How has the forex market performed around different US Presidential terms? Read on to discover what history can tell us about the Forex market and the President.

(1) The US Dollar and the President’s Party

At first, many traders are surprised to learn that there is rarely a direct, straightforward relationship between the President and forex market performance. But considering that the President represents just one branch of the US government, every currency pair involves (at least) an entire other country’s government, and that many of the most important market developments (cough COVID-19 cough) are entirely outside the control of a single politician, it starts to make more sense that the President is just one of many important factors to consider.

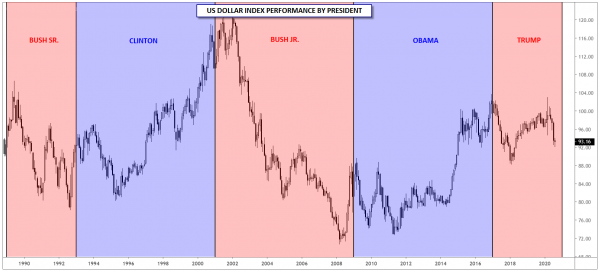

All of that said, there has been a consistent pattern of the US dollar strengthening under Democratic Presidents and generally weakening under Republicans dating back to the 1980s. As the chart below shows, Democrats Bill Clinton and Barack Obama presided over periods where the US dollar index generally rose, whereas George H.W. Bush, George W. Bush, and Donald Trump have all seen the greenback move lower under their leadership:

Source: TradingView, GAIN Capital

Viewed this way, a chart spanning over 30 years with seemingly obvious takeaways for the global reserve currency (buy/hold USD under Democratic Presidents and sell/short it under Republican Presidents) is impressive, but we would caution traders against reading too much into it. After all, holding a single trade for 4-8 years based on just one indicator would test most readers’ patience. More importantly, this entire sample size covers just 5 unique Presidents, so it may not be as significant as it initially appears. At a minimum, longer-term traders should keep this possible relationship in mind as one factor informing their outlook toward the greenback.

(2) Polls and Policies

Despite taking one on the proverbial chin four years ago, polls are still one of the best tools to use to handicap the likely results in November (or at a minimum for insight into what the market is expecting). As of writing in mid-August, Joe Biden holds a meaningful 8-point lead across an average of major polls, though there’s still plenty of time for the race to tighten, as we saw four years ago:

Source: RealClearPolitics

As of writing in mid-August, both major Presidential candidates’ campaigns have been light on concrete economic policy proposals as they focus on their rival’s fitness for office and COVID-19 responses, but we would expect more relevant policy details to emerge in the coming months. Of particularly interest to forex traders will be the ultimate winner’s attitude toward the trade relationship between the US and China, the world’s two largest economies, as well as the outlook toward international trade more generally. When it comes to the greenback, forex traders will also keep a close eye on the candidates’ fiscal policy stances; of late, neither party has even paid much in the way of lip service to reducing the federal deficit, which has grown rapidly in recent years and shows no signs of receding any time soon.

(3) Election 2020: What happens next?

Looking ahead, forex traders must navigate many unknowns, from the path the COVID-19 pandemic carves out to the identity of the world’s most powerful politician come January 2021. While there is some historical evidence that a Democratic victory on Election Day could provide a tailwind to the US dollar, readers are encouraged to maintain a flexible mindset and avoid allowing their personal political leanings to impact their trading.

We’ve seen many elections across the globe in our 20+ year history, so no matter what November brings, you can trust that we will continue to offer the tools, support, and insights to help you navigate the markets in the months to come and put you in the best position to find success.

If you have any questions about how we can help you in your trading, please reach out today!

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals