INDICES

Friday, European stocks were broadly lower. The Stoxx Europe 600 Index slid 1.3%, Germany’s DAX 30 sank 1.7%, France’s CAC 40 and U.K.’s FTSE 100 were down 0.9%.

EUROPE ADVANCE/DECLINE

70% of STOXX 600 constituents traded lower or unchanged Friday.

29% of the shares trade above their 20D MA vs 41% Thursday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 52% Thursday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 2.7pts to 31.71, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Autos

3mths relative low: none

Europe Best 3 sectors

banks, basic resources, automobiles & parts

Europe worst 3 sectors

real estate, technology, utilities

INTEREST RATE

The 10yr Bund yield fell 2bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -23bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Jul Industrial Production MoM, exp.: 8.9%

UK 08:30: Aug Halifax House Price Idx YoY, exp.: 3.8%

UK 08:30: Aug Halifax House Price Idx MoM, exp.: 1.6%

FR 14:00: 12-Mth BTF auction, exp.: -0.57%

FR 14:00: 6-Mth BTF auction, exp.: -0.58%

FR 14:00: 3-Mth BTF auction, exp.: -0.57%

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1835 while GBP/USD slipped to 1.3239. USD/JPY was steady at 106.28.

Spot gold climbed to $1,938 an ounce.

#UK – IRELAND#

Associated British Foods, a food processing and retailing company, posted a 4Q trading update: “Trading in the fourth quarter in both our food businesses and Primark exceeded our expectations. (…) All Primark stores reopened in May, June and July. Since reopening we have traded strongly, attracting customers with our value-for-money offering and a welcoming and safe store environment. Cumulative sales since reopening to the year-end are expected to be £2bn and our adjusted operating profit on an IFRS16 basis for the year, before exceptional items, is now expected to be at least at the top end of the previously advised £300-350m range.”

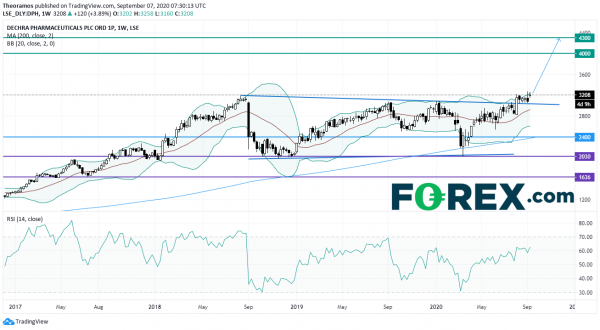

Dechra Pharmaceuticals, a veterinary pharmaceuticals company, released full-year results: “Dechra delivered consolidated revenue of £515.1 million, representing an increase of 6.8% on the prior year. (…) Consolidated underlying operating profit of £128.3 million represents a 0.4% increase on the prior year. (…) Underlying diluted EPS grew by 1.7% to 92.19 pence. (…) The Board is proposing a final dividend of 24.00 pence per share (2019: 22.10 pence per share). Added to the interim dividend of 10.29 pence per share (2019: 9.50 pence per share), this brings the total dividend for the financial year ended 30 June 2020 to 34.29 pence per share (2019: 31.60 pence per share), representing 8.5% growth over the previous year.”

From a weekly point of view, the share has broken above a symmetrical triangle following a consolidation area of 2 years. Furthermore, the 200WMA plays a support role. Above the 200WMA at 2400p look for 4000p and 4300p in extension.

Informa, a business intelligence group, was downgraded to “neutral” from “buy” at Goldman Sachs.

#GERMANY#

Volkswagen’s, an automobile group, Traton is planning to make a fresh bid for U.S. heavy-truck company Navistar International, which it previously offered 2.9 billion dollars, reported Bloomberg citing people familiar with the matter.

Continental, automotive parts manufacturer, was upgraded to “neutral” from “underweight” at JPMorgan.

Hannover Re, a reinsurance group, was upgraded to “overweight” from “underweight” at JPMorgan.

Hapag-Lloyd, a shipping and container transportation company, was upgraded to “hold” from “reduce” at HSBC.

#FRANCE#

Suez’s, an utility company, CEO Bertrand Camus in an interview with French newspaper Le Figaro that “the proposed deal by Veolia is an aberration and destructive for France”. He added that the company’s share price has been hurt by the coronavirus pandemic, the offer undervalues Suez’s assets and is opportunistic.

Sanofi, a pharmaceutical group, will launch an IPO for its drug-ingredients division in the coming months, according to the company’s chief in France Olivier Bogillot cited by France Inter radio.

Scor, a reinsurance company, was downgraded to “neutral” from “overweight” at JPMorgan.

#SPAIN#

Mapfre, a Spanish insurance company, was downgraded to “underweight” from “neutral” at JPMorgan.

#BENELUX#

Ageas, a Belgian insurance company, confirmed that it was approached recently by BE Group with “an indicative and highly conditional offer” on the company. The company added that “the Ageas Board of Directors assessed the indicative proposal but considered it not realistic and has decided not to engage”.

#SWITZERLAND#

Swiss Life, an insurance group, was upgraded to “neutral” from “underweight” at JPMorgan.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals