Key Highlights

- GBP/USD failed to clear the 1.3000 resistance and declined below 1.2900.

- EUR/USD also struggled to continue above 1.1850 and declined sharply.

- Gold price is sliding and it could even break the $1,900 support zone.

- The US Existing Home Sales might increase 2.4% in August 2020 (MoM).

GBP/USD Technical Analysis

This past week, the British Pound made a couple of attempts to clear the 1.3000 resistance against the US Dollar. GBP/USD failed to gain momentum, and declined sharply below 1.2950 and 1.2920.

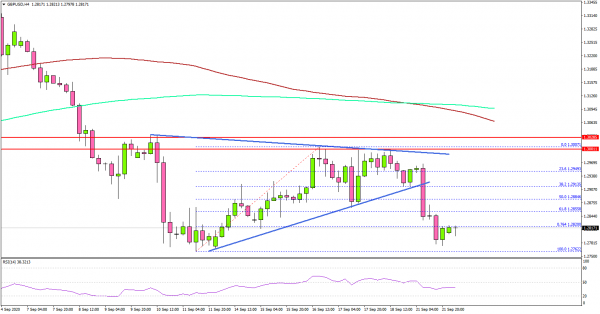

Looking at the 4-hours chart, the pair topped near the 1.3007 level before starting a fresh decline. There was a break below a key contracting triangle with support near 1.2910.

It opened the doors for more losses below 1.2900, and the pair settled well below the 200 simple moving average (green, 4-hours) and the 100 simple moving average (red, 4-hours). The pair traded below the 61.8% Fib retracement level of the upward move from the 1.2762 low to 1.3007 high.

It seems like the pair is under a lot of selling pressure and it could continue to move down below 1.2780. Any further losses might lead the pair towards the 1.2650 level.

On the upside, an initial resistance is near the 1.2880 level. The next major resistance is near the broken trend line and 1.2920. The main resistance is still near 1.3000, above which the pair could turn positive.

Looking at EUR/USD, the pair struggled to clear the 1.1850 resistance (as discussed yesterday) and started a strong decline. Similarly, there were bearish moves in gold price and USD/JPY.

Upcoming Economic Releases

- US Existing Home Sales for August 2020 (MoM) – Forecast +2.4%, versus +24.7% previous.

- Fed’s Chair Powell speech.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals