The company Siemens (SIEG) is in a strong uptrend like many other stocks. But the price action in August was calm and sideways. Reversal chart patterns also started to appear. What is the next expected price swing based on the price patterns?

Price Charts and Technical Analysis

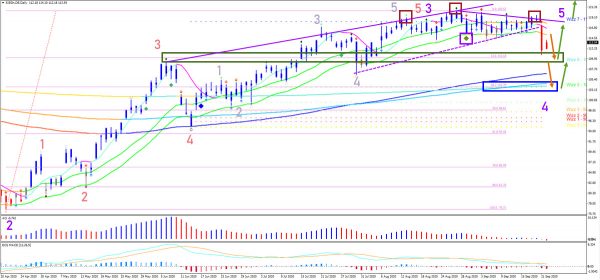

Siemens is starting a bearish retracement according to our Elliott Wave indicator (red candle). This occurred after price action showed chart patterns such as a rising wedge (purple trend lines) and a head and shoulders pattern (dark red boxes). But the long-term trend remains very bullish due to the gap between price and the 21 ema zone versus the long-term moving averages (144,233,610 emas). And also the momentum on the weekly chart has recently been confirmed (green diamond in purple box). Price is expected to retrace deeper but not much before support stops price from falling. The main support levels are at the 23.6% Fibonacci retracement level and the previous top (dark green box). Or at the confluence of long-term MAs and the 38.2% Fib (blue box). This would confirm the usual retracement level for a wave 4 (purple).

The 4 hour chart (see below) seems to be indicating a pullback via an ABC wave pattern (purple). Price is moving below the 21 ema zone so if price retests that same zone, it could turn into resistance. And price could bounce and aim for the Fibonacci targets and Wizz levels. Only a break, pullback, and bounce above the 21 ema zone would indicate an immediate uptrend without a deeper bearish pullback. Earnings date is November 5, 2020.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals