The S&P 500 Futures are extending Tuesday rebound when the Dow Jones Industrial Average rose 140 points (+0.52%) to 27288, the S&P 500 climbed 34 points (+1.05%) to 3315, and the Nasdaq 100 jumped 206 points (+1.88%) to 11186.

Later today, the Federal Housing Finance Agency will post its house price index for July (+0.5% on month expected) and Research firm Markit will publish preliminary readings of September U.S. Manufacturing PMI (53.5 expected) and Services PMI (54.6 expected).

European indices are rising more than 1% on average. On the statistical front, in the euro zone, the manufacturing PMI index rose to 53.7 in September as a first estimate, against 51.7 in August and 51.9 expected. Yet, the PMI services index unexpectedly declined to 47.6 in the initial estimate for September, compared with 50.5 the previous month and 50.6 expected. This is the first time since June the index fell below the 50 key thresholds highlighting a contraction of the sector. The composite PMI index stood at 50.1 in first reading, compared to 51.9 in August. Economists anticipated stability. In the U.K., all PMIs declined. The manufacturing PMI index came out at 54.3, compared with 55.2 in August and 54.0 expected, Services declined to 55.1 from 58.8 and 55.9 expected. The composite PMI index stood declined from 59.1 to 55.7 and 56.1 expected by economists.

Asian indices slightly recovered except the Australian ASX 200 which jumped 2.42%. Japan Nikkei closed its first trading session of the week with a slight 0.06% decline.

WTI Crude Oil futures are drawing a consolidation. BofA Global Research said the global oil market is expected to be in a 4.9 million b/d deficit in the fourth quarter and sees crude prices staying range-bound in the mid-$40s, until fuel demand recovers to more normal levels in the next few months. The American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 691,000 barrels in the week ending September 18 (-2.26 million barrels expected). Later today, the U.S. Energy Information Administration (EIA) will release official crude oil inventories data for the same period.

Gold fell 9.73 dollars (-0.51%) to 1890.48 dollars as the US dollar remains strong at 93.988, on coronavirus worries.

U.S. Equity Snapshot

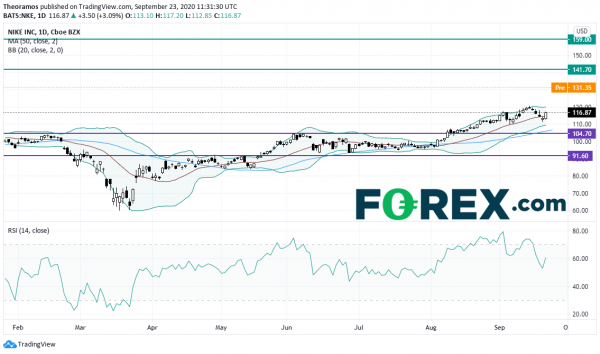

Nike (NKE), the sportswear company, soared after hours after reporting first quarter EPS of 0.95 dollar, significantly beating estimates, up from 0.86 dollar a year ago, on revenue of 10.6 billion dollars, above the consensus, slightly down from 10.7 billion dollars last year. Digital sales jumped 82%.

Tesla (TSLA), an electric vehicle and clean energy company, is expected to lose ground as the company’s “Battery Day” presentation disappointed investors.

Twitter (TWTR), the social network, was upgraded to “buy” from “hold” at Pivotal Research.

General Mills (GIS), a packaged food company, is expected to jump at the open after posting better than expected quarterly earnings and boosting quarterly dividend.

KKR & Co (KKR), an investment firm, is in advanced talks to buy contact lens retailer 1-800 Contacts for more than 3 billion dollars, according to Bloomberg.

KB Home (KBH), the homebuilder, gained ground in extended trading after posting quarterly earnings that beat estimates.

HP (HPQ), a provider of computers, printers and printer supplies, was upgraded to “buy” from “neutral” at UBS.

Lululemon Athletica (LULU), a designer of athletic accessories and apparel, said it is restarting its stock buyback program.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals