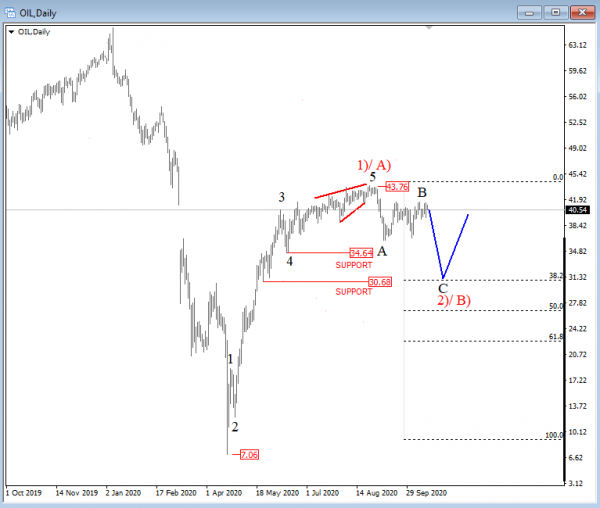

It appears that crude oil prices stabilized after that sharp drop at the start of September. Then energy was able to recover close to $42 but move is not that strong, rather slower and choppier; very undecided direction due to increase of corona-virus cases and potential second lock-down. However, I don’t think we will see the repeat of a March and April decline, since I doubt we will see the same hard 2nd lockdown, especially not in the US under Trump administration. But fear remains in eyes of investors so new dip may not be surprise before real price stabilization occurs.

From an Elliott Wave perspective, I see nice ongoing corrective drop from $44 area that will ideally unfold as an A-B-C correction. In zigzag you will typically see price retracement back to the area of a former wave four, which in our case was near $34.64. The next support I would keep an eye is around $30.00, which is psychological level that comes in around 38.2% Fib. retracement compared to previous five wave rise. Regarding timing for this wave 2)/B), it may finish as we approach the year end.

If I am on the right track then I think there can be nice opportunity on the long side in 2021, after that dip. But if it goes straight up from here, then it’s better to wait and see if bulls are going to be early, or is something else going on for a complex wave 2)/B).

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals