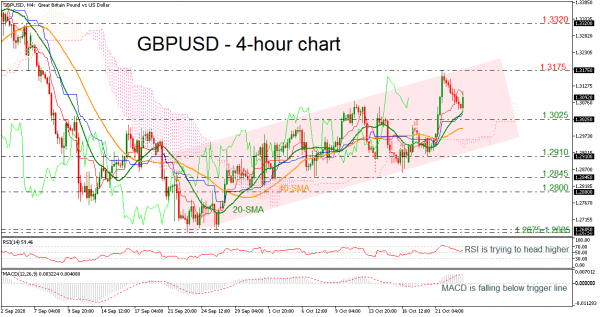

GBPUSD is pairing some losses that were posted in the preceding nine consecutive red candles in the 4-hour chart. Over the last month, the price has been developing within an ascending channel and the latest bullish action is being confirmed by the RSI, which is sloping slightly up in the positive region. However, above the zero level the MACD oscillator is still holding beneath its trigger and the red Tenkan-sen line is pointing down.

If the price continues to gain momentum the next immediate resistance could come from the 1.3175 barrier ahead of the 1.3320 barrier, taken from the peak on September 4.

Alternatively, a decline below the 20-period simple moving average (SMA) could open the door for the 40-period SMA currently at 1.3000 ahead of the upper surface of the Ichimoku cloud at 1.2970. A break below the upward sloping channel could meet support at the 1.2910 barrier and the 1.2800-1.2845 crucial zone.

In brief, GBPUSD is looking positive in the short-term as it is still developing in an ascending channel, despite the several sessions of losses.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals