The world, at least the financial markets part, is in euphoria today on news that tens of millions doses of coronavirus vaccine are ready this year, to pull it out of the coronavirus pandemic that took away over 1.2 millions lives. DOW future is in massive rally, up around 1500 pts of writing while European indices are all up 5-6%. Yen selling finally takes off even against the weak Dollar. Australian Dollar leads other commodity currencies higher.

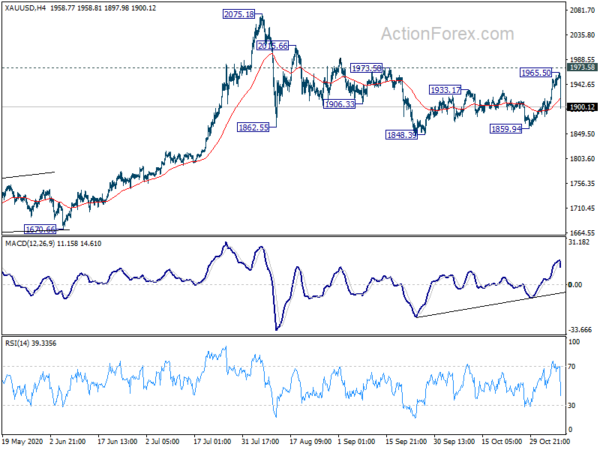

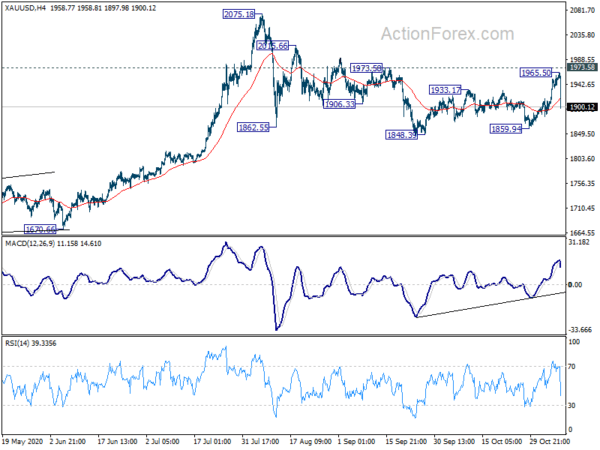

Technically, one thing to note is that Gold suffers steep selloff after rejection below 1973.58 resistance. The development keeps gold in the corrective pattern from 2075.18. That is, a break below 1848.39 support is now back in radar. At least, the development argues that selling focus is no longer solely on Dollar for now.

In Europe, currently, FTSE is up 5.10%, DAX is up 5.39%. CAC is up 6.73%. German 10-year yield is up 0.067 at -0.549. Earlier in Asia, Nikkei rose 2.12%. Hong Kong HSI rose 1.18%. China Shanghai SSE rose 1.86%. Singapore Strait Times rose 1.19%. Japan 10-yaer JGB yield dropped -0.0026 to 0.019.

Pfizer and BioNTech said vaccine is now over 90% effective

Sentiments are given a massive boost after Pfizer and BioNTech said today that their COVID-19 vaccine is now over 90% effective. The companies have began manufacturing the vaccine already, before knowing whether it would be effect, to save time to help fighting the pandemic that has plagued the world since February. They expect to produce up to 50 million doses to protect 25 million people this year. 1.3 billion doses of the vaccine are expected in 2021.

Eurozone Sentix dropped to -10, coronavirus containment has negative impacts on recovery

Eurozone Sentix Investor Confidence dropped to -10.0 in November, down from -8.3, but beat expectation of -14.0. Current Situation Index, ticked down from -32.0 to -32.3. But Expectations Index dropped form 18.8 to 15.3, hitting the lowest since May.

Sentix said, the coronavirus containment measures taken by European governments are “not only a human burden for citizens”, but also have a “negative impact on the economic recovery process”. The so-called “lockdown light” has so far had little effect on investors’ assessment of the situation. The decline in expectation could be worst if not for better international situation. Also, ECB’s further easing may also had a positive effect on inventors.

Also released in European session, Germany trade surplus widened to EUR 17.8B in September, above expectation of EUR 17.2B. Swiss unemployment rate dropped to 3.3% in October, down from 3.4%.

Bank of France estimate -4% GDP loss in Oct, -12% in Oct on pandemic restrictions

Bank of France said the outlook for November is “on the whole oriented clearly downwards”, but in a more differentiated and limited way than during the first round of coronavirus restrictions earlier this year.

The loss of GDP in October, comparing to normal pre-pandemic level is estimated at around -4%, just slight deterioration from September’s -3.5%. For November, GDP loss is estimated to be around -12%. The figures were much better than the -31% loss in GDP recorded in April.

BoJ members concerned with prolonged fight against coronavirus

In the Summary of Opinions at BoJ’s October 28/29 monetary policy meeting, it’s noted that “the fight against COVID-19 may be prolonged”. The central bank “should avoid brining a premature end to its current monetary policy responses”. BoJ should “exercise utmost vigilance against the possibility of a sudden change in financial markets and make policy responses flexibly when necessary”

Additionally, one member warned that “if economic recovery is delayed, credit risk might materialize, leading to a risk on the financial system side.” It’s “top priority” to ensure corporate financing and sustain employment”. Also, BoJ should “further look for ways to enhance the sustainability” of ETFs and J-REITs purchases.

“If COVID-19 spreads again and economic activity is pushed down, the CPI could stay in negative territory for a protracted period and deflation might take hold.”

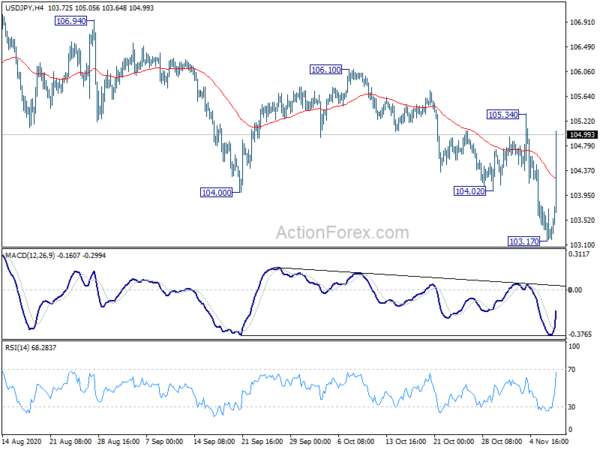

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.11; (P) 103.44; (R1) 103.69; More…

USD/JPY’s strong rally today suggests short term bottoming at 103.17. Intraday bias is back on the upside for 105.34 resistance. Firm break there, and sustained trading above 55 day EMA, will be the first sign of near term bullish reversal. Stronger rally would be seen to 106.10 resistance to confirm the completion of whole fall from 111.71. Though, this bullish view will be neutralized if USD/JPY falls back below 4 hour 55 EMA.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance will suggest that the decline from 111.71 has completed. Focus will then be back to this resistance to signal medium term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 5:00 | JPY | Leading Economic Index Sep P | 9.29 | 92.9 | 88.4 | |

| 6:45 | CHF | Unemployment Rate Oct | 3.30% | 3.40% | 3.30% | 3.40% |

| 7:00 | EUR | Germany Trade Balance Sep | 17.8B | 17.2B | 15.7B | 15.4B |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Nov | -10 | -14 | -8.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals