IG Client Sentiment (IGCS) is an extremely valuable tool that reveals where IG clients are positioned across key markets, whether long or short. While IGCS provides helpful insights into all the markets it’s offered on, there are some nuances across asset types that traders need to be aware of to get the most out of IG Client Sentiment.

IG Client Sentiment: FX Majors

Sentiment data derived from FX majors are most likely to represent a strong consensus among retail traders due to their high trading volumes – representing a large sample of individual opinions on a single market.

The reason FX majors may provide more robust indications of retail client sentiment is statistical. Viewers of client sentiment are able to make more well-informed inferences regarding future possible price paths when the number of traders essentially ‘casting their vote’ is large. This is why IG Client Sentiment can be regarded as a leading indicator.

Therefore, traders are able to deduce more from client sentiment data on frequently traded markets and the FX majors are certainly one of the more popular markets traded with IG.

Recommended by Richard Snow

Download our guide to learn more about sentiment trading

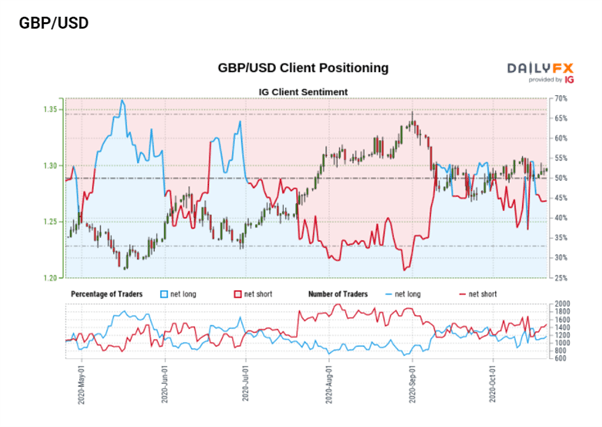

Major Forex Pair Example:

The GBP/USD pair below shows how clearly the contrarian signals produced by IGCS can be observed in frequently traded markets. Net positioning (blue and red continuous line) is superimposed onto a price chart, revealing that sentiment and price moved in opposite directions.

IG Client Sentiment: Equities/Indices

Individual shares, apart from heavy hitters like the ‘FAANGs’ stocks for example, can be susceptible to lower than optimal retail trading volumes which may not present the most accurate representation of retail sentiment.

One solution to this problem is to observe client sentiment on equity indices. Equity indices serve as a benchmark for their local equity markets and tend to have a significant weighting towards the frequently traded, larger market cap stocks if the index is calculated according to market capitalization.

Recommended by Richard Snow

Find out what’s in store for equity markets this quarter

Popular market cap weighted indices include:

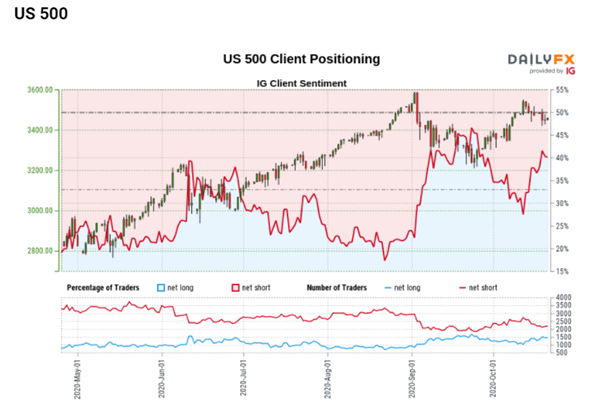

US 500 Index example:

The contrarian approach to IG Client Sentiment is once more observed in the upward trending US 500 example below. Net shorts increase as the underlying index marches higher.

Learn stock market basics, types of stocks and how the stock market affects the economy in our comprehensive stock market basics section of our education section

IG Client Sentiment: Commodities

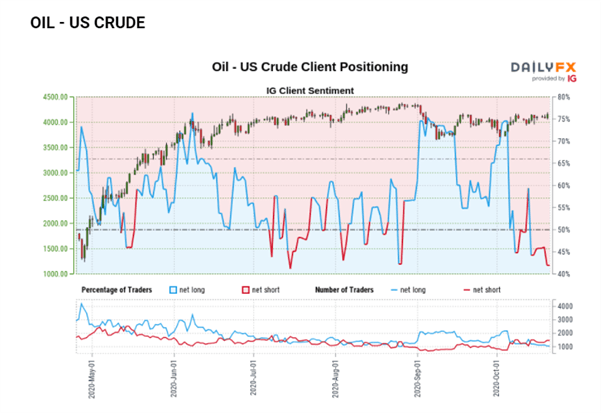

IG provides comprehensive sentiment data on oil US crude, gold and silver. Oil sentiment tends to fluctuate between net long and net short in a similar manner to most other markets.

Typical oil US crude sentiment chart:

Gold and silver however, exhibit an inherent, long-term, bullish bias as the precious metals are viewed favourably in terms of their perceived value and potential price appreciation. Gold is often viewed as a hedge against inflation and a store of value which also contributes to the elevated (long) sentiment figures over long periods.

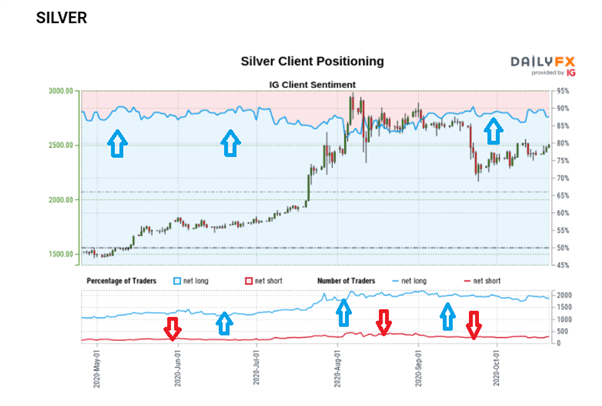

Inherent ‘long’ bias observed in gold and silver

In both the gold and silver charts there is a noticeable imbalance in sentiment towards long trades as shown by the blue line superimposed on both charts.

The same thing can be observed below the price chart where the actual number of net-short and net-long positions are shown over time. The two lines very rarely intersect – revealing that long traders tend to outweigh short traders the majority of the time.

Gold sentiment chart:

Recommended by Richard Snow

What does gold have in store? See our quarterly forecast

Silver sentiment chart:

Therefore, the traditional contrarian approach to client sentiment may not be as relevant for gold and silver. A more appropriate approach may be to observe the daily and weekly changes in sentiment for insight into possible trend reversals or pull backs that present attractive entry levels in the direction of the trend.

IG Client Sentiment: Commodity Currencies

In addition to major FX markets and commodity markets, DailyFX also provides timely sentiment data on commodity currency pairs: USD/CAD, AUD/USD, NZD/USD. Sentiment data compiled on commodity currencies may shed insight into not only the relevant FX markets but also the commodity/commodities exported from the country in question.

Commodity currency example:

The chart below compares the Western Texas Intermediate (WTI) oil price with the USD/CAD exchange rate. It can be seen that for long periods of time that the two lines tend to move in the opposite direction which makes sense. Canada exports a significant amount of oil to the US which results in the exchange of US dollars for Canadian dollars.

When the price of oil (black line) rises over time there is also a tendency for lower prices in USD/CAD as more US dollars are being exchanged for Canadian dollars. Likewise, when oil prices fall, USD/CAD rises because fewer dollars are needed to be exchanged into Canadian dollars. However, it is crucial to note that there are many other factors that contribute to FX rates, and correlations with commodities that should be considered, such as: economic growth (GDP), interest rates, monetary policy, sovereign debt levels, inflation etc.

Created with TradingView

Looking to trade in a simulated environment to better learn strategies, tactics and approach? Click here to request a free demo with IG group.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals