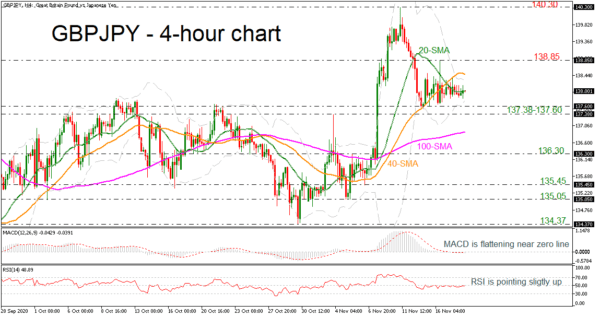

GBPJPY has been moving in a horizontal trajectory over the last week, failing to improve the rebound on the 137.60 support level. The Bollinger band is squeezing, suggesting a neutral bias, and the momentum indicators are flattening. The MACD is holding near the zero level, while the RSI is standing around the 50 threshold.

A successful climb above the 40-period simple moving average (SMA) at 138.50 could take the pair towards the 138.85 barrier. More gains could lead the bulls until the next strong resistance at 140.30, identified by the peak on November 11.

In case the price falls underneath the 137.38-137.60 support, the next barrier could come at the 100-period SMA at 136.90. Below that, the 136.30 level could step into the spotlight ahead of the 135.45 and 135.05 lows.

Overall, GBPJPY seems to be flat in the very short-term timeframe. However, over the last two months, the market looks positive.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals