U.S. Highlights

- Financial markets were more upbeat this week as investors cheered encouraging vaccine news and the start of the presidential transition. The S&P 500 is on track to end the week with a 2.3% gain from last week’s close.

- The impact of the current wave of infections continues to weigh on economic data. Consumer confidence pulled back in November, and initial jobless claims increased for the second straight week.

- Personal income contracted by 0.7% in October, reflecting the fading boost from federal aid programs. Meanwhile, personal spending increased by 0.5%, the slowest pace of monthly gains since May.

Canadian Highlights

- The second wave continues to run rampant across Canada. Provinces are responding by tightening restrictions and in some cases introducing regional lockdowns.

- Small business optimism for the year-ahead posted a surprise uptick, on the back of encouraging vaccine news. However, the near-term outlook remains weak, reflecting the difficulties small businesses face amid renewed restrictions.

- The domestic approval process for vaccines has already started, but given Canada’s lack of domestic production capability, other countries may get priority.

U.S. – Pandemic Dampens Holiday Cheer

Market sentiment was upbeat this week as investors cheered encouraging developments on the vaccine front and the official start of the presidential transition. As of writing, the S&P 500 is on track to end the week with a 2.3% gain from last week’s close.

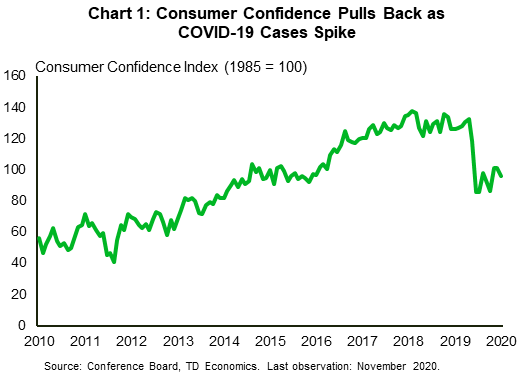

With reports that an effective vaccine is likely on the horizon, the prospect of an earlier-than-anticipated end to the pandemic is gaining traction. Until then, however, the balance of risks appears tilted to the downside. Indeed, the virus is continuing to spread at an unprecedented rate in many states, prompting the introduction of a fresh round of restrictions. Already, the impact on the economic recovery is unravelling in high-frequency data. Following three consecutive months of increases, consumer confidence pulled back in November (Chart 1), illustrating the perception that growth will likely slow heading into 2021.

Likewise, initial jobless claims increased for the second straight week to 778,000, the highest level since mid-October. The recent increases suggest that the current wave of infections is slowing the labor market rebound. Should this trend continue and with the impact from previous fiscal support quickly loosing steam, many American households are at risk of facing additional duress as we approach the festive season. What is more, leftover supports from the CARES Act are set to expire at the end of the year. Notably, these programs continue to provide benefits and support to gig workers and the self-employed, whom state unemployment insurance programs do not cover.

Bringing credence to the above was personal income and spending data for the month of October. Incomes contracted by 0.7% on the month, reflecting the fading boost from federal aid programs. In comparison, spending continued to increase (+0.5%), albeit at the slowest pace since the recovery began. Meanwhile, the personal saving rate edged lower to 13.6% (Chart 2). Households saved a considerable share of their income when the pandemic hit, pushing the saving rate to an all-time high of 33.7% in April. It has since come down, but it remains elevated by historical standards.

Other economic data released this week included the second estimate of real GDP for the third quarter. The report had little in the way of surprises with only minor revisions to the GDP components, confirming the strong 33.1% (annualized) rebound in economic growth last quarter. Released alongside the report were corporate profits, which jumped by 27.1% (non-annualized) in the third quarter from a quarter prior thanks largely to support provided by the Paycheck Protection Program.

Looking ahead, last quarter’s pace of growth is unlikely to be repeated. In fact, minutes from the November 4-5 Federal Open Market Committee meeting showed that members were bracing for a near-term slowdown in activity. Importantly, Fed officials continued to view the economic outlook as clouded with high uncertainty, and emphasized the importance of additional fiscal support. The prospects of a new stimulus bill, however, have dimmed considerably over the last few weeks. Without additional help, we anticipate economic growth to slow materially this quarter and next.

Canada – Pandemic Runs Rampant, But Vaccines Keep Hope Alive

Financial markets had a solid showing this week. The S&P/TSX Composite gained 2% on the week (as of writing) on the back of gains in the technology, metals and mining sectors. The index has now made positive gains for the fourth straight week, climbing 11% so far in November. Elsewhere, oil markets rallied to an eight-month high amid recent breakthroughs on a COVID-19 vaccine, a weakening dollar and a surprise drawdown of U.S. crude supplies. As of writing, oil prices stand at $45.2, more than 7% higher compared to last week.

In terms of economic data, the CFIB Business Barometer, a measure of small business confidence in the next 12 months, rose by 2.4 points to 55.7 – the first improvement since July (Chart 1). The improvement captures hopes of an earlier-than-expected vaccine. Meanwhile, near-term confidence remained weak, reflecting the difficulties small businesses are facing amid surging cases and subsequent restrictions. Since these data were collected prior to the latest restrictions imposed in Toronto and other regions, the near-term outlook will likely deteriorate in the coming weeks, accelerating business closures.

On the pandemic front, the second wave continues to run rampant across Canada (Chart 2). The rising second wave is already bigger and geographically more widespread compared to the first wave. Western Canada – which had handled the virus relatively well previously – is seeing a surge this time round. Meanwhile, the Atlantic provinces, which had so far kept the pandemic at bay, are seeing their ‘Atlantic Bubble’ burst as cases rise. If this trend continues, hospitals across the country will soon reach capacity.

As a result, provinces have continued to toughen up restrictions; Alberta added new restrictions prohibiting all indoor social gatherings, British Columbia ordered temporary closures of indoor fitness activities; and Toronto entered a lockdown. New restrictions were also imposed in Atlantic provinces. These measures are bound to weigh on economic activity, as reflected in latest mobility and restaurant bookings data. However, the more targeted nature of these measures will limit the economic damage relative to the spring.

Against this bleak winter backdrop, vaccines provide hope. Canada has begun the domestic approval of Pfizer, Moderna and AstraZeneca. Still, it is likely that countries where these vaccines are based will get first preference. The Prime Minister has acknowledged that Canada is at a disadvantage because it “no longer has any domestic production capability” to make its own vaccines and must rely on other nations. This could be the reason why Canada – to hedge its risks – has ordered the most vaccines (per person) compared to any other country.

Meanwhile, the Bank of Canada’s Governor, Tiff Macklem, said that the economy could recover faster than expected if consumer spending jumps in the wake of successful vaccine efforts. The Governor also said that there is room for interest rates to go a bit lower and reassured markets that “borrowing costs are going to remain very low for a long time.”

U.S: Upcoming Key Economic Releases

U.S. Employment – November*

Release Date: December 4th, 2020

Previous: NFP 638k; UE rate 6.9%; AHE 0.1% m/m, 4.5% y/y

TD Forecast: NFP 200k; UE rate 6.9%; AHE 0.0% m/m, 4.1% y/y

Consensus: NFP 500k, UE rate 6.8%; AHE 0.1% m/m, 4.2% y/y

Payrolls have been rising rapidly by pre-COVID standards, but the pace has been slowing, and the level is still down by more than 10 million since February. The pace probably slowed again in November. Related indicators have sent mixed signals, but new COVID restrictions appear to be taking a toll. Downward momentum will probably continue; we see a high likelihood of contraction in the December report. We expect the downtrend in the unemployment rate to at least stall in the next few months before vaccines help turn momentum in employment positive again during the course of 2021.

U.S. ISM Manufacturing Index – November*

Release Date: December 1st, 2020

Previous: 59.3

TD Forecast: 57.3

Consensus: 57.6

Regional Fed manufacturing surveys already reported for November have signaled some slowing, in contrast to the Markit data, but with readings still signaling fairly healthy growth. Our ISM forecast put more weight on the regional data. We expect more slowing in December, although new COVID restrictions are likely to affect services more than manufacturing.

U.S. ISM Services Index – November*

Release Date: December 3rd, 2020

Previous: 56.6

TD Forecast: 56.1

Consensus: 56.0

As with manufacturing, the initial November surveys have been mixed for services, with strengthening in the Markit data but weakening in regional Fed data. Our ISM forecast puts more weight on the regional Fed data. We expect more slowing in December, with new COVID restrictions likely to affect services more than manufacturing..

Canada: Upcoming Key Economic Releases

Canadian Real GDP – Q3 & September*

Release Date: December 1st, 2020

Previous: -38.7% q/q, 1.2% m/m

TD Forecast: 46.4% q/q, 1.0% m/m

Consensus: NA

Following an unprecedented decline in the second quarter, the Canadian economy is poised for record-breaking growth in the third quarter. We expect GDP to expand by 46.4% (annualized) as provinces lifted restrictions and unleashed pent-up demand during the summer months. Every component of GDP will likely see strong rebounds, with residential investment leading the pack. Household consumption and business investment are also slated to record incredible growth for the quarter, due in part to the extraordinary support provided by fiscal and monetary policy. Nonetheless, the economy is still likely to fall short of a full recovery. We expect the level of GDP to be around 5% below where it was at the end of 2019. It will likely be several more quarters before activity gets back to pre-pandemic levels, especially as the recent surge in cases and renewed restrictions weigh on activity.

Looking to September, the Canadian economy continues to demonstrate resilience with industry-level GDP forecast to rise by 1.0% m/m, which if realized would mark the 5th consecutive month that GDP growth has outpaced flash estimates. Stronger energy production will support growth in the goods-producing sector along with a solid increase in manufacturing shipments, while services will receive a tailwind from the return to in-classroom learning and further recovery in food services/recreation. Real GDP growth of 1.0% m/m would provide a strong handoff from Q3 and provide some buffer against the risk of a Q4 contraction, even if new COVID restrictions weigh on monthly output in Nov/Dec.

Canadian Employment – November*

Release Date: December 4th, 2020

Previous: 83.6k, unemployment rate: 8.9%

TD Forecast: -25k, unemployment rate: 9.0%

Consensus: NA

TD looks for the labour market recovery to stumble in November with the loss of 25k jobs as the renewed surge in COVID infections and subsequent public health measures take their toll. Job losses will be felt primarily across services, with accommodation/food services and recreational services (gyms, cinemas, etc) hardest hit, while retail trade could be weighed down by seasonal adjustment ahead of the holiday season along with regional COVID measures. Manitoba should underperform on a relative basis after locking down ahead of the reference week, and job losses would be even greater if the reference week did not preclude a return to (modified) lockdown in Toronto. A 25k decline would see the unemployment rate drift higher to 9.0%, while hours worked should continue to receive attention for insight into growth conditions for November.

Canadian International Merchandise Trade – October*

Release Date: December 4th, 2020

Previous: -$3.25bn

TD Forecast: -$3.50bn

Consensus: NA

TD looks for the international merchandise trade deficit to edge wider to $3.50bn in October from $3.25bn, as both exports and imports continue to grind higher. Export strength should originate outside the automotive sector; motor vehicle production was unchanged in October and auto exports had already exceeded pre-COVID levels by September. However, other categories will benefit from stronger industrial production south of the border, with manufacturing PMI holding near recent highs in October.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals