Key Highlights

- EUR/USD extended its rise above the 1.1900 and 1.1920 resistance levels.

- A major bullish trend line is forming with support near 1.1905 on the 4-hours chart.

- GBP/USD retreated lower after it failed to clear 1.3400, gold price broke the key $1,800 support.

- The German CPI (to be released today) could decline 0.2% in Nov 2020 (YoY) (Prelim).

EUR/USD Technical Analysis

The Euro remained well supported near 1.1850 against the US Dollar. As a result, EUR/USD gained bullish momentum and cleared the key 1.1900 resistance zone.

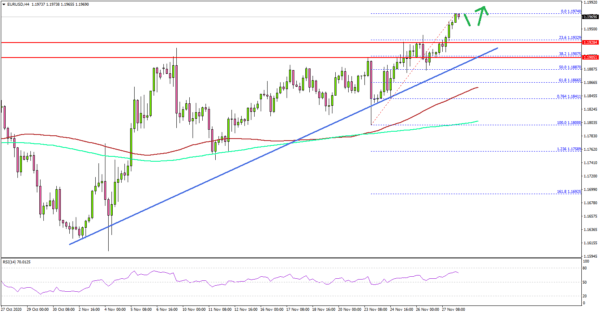

Looking at the 4-hours chart, the pair settled above the 1.1900 level, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

The upward move was such that the pair broke the last swing high and surpassed the 1.1940 resistance. A new monthly high was formed near 1.1975 and the pair is currently trading well above many important supports.

On the downside, the previous resistance near 1.1920 and 1.1900 could act as a strong support. There is also a major bullish trend line forming with support near 1.1905 on the same chart.

If EUR/USD fails to stay above the 1.1900 support level, it could revisit the 1.1850 support. Conversely, the pair could continue to rise above the 1.1965 and 1.1980 resistance levels. The next major resistance sits near 1.2000.

Looking at GBP/USD, the pair failed to clear the 1.3385 and 1.3400 resistance levels, and started a fresh decline. More importantly, gold price declined further below the key $1,800 support level. The next major support could be $1,765.

Upcoming Economic Releases

- US Pending Home Sales for Oct 2020 (YoY) – Forecast +1.0%, versus -2.2% previous.

- German Consumer Price Index for Nov 2020 (YoY) (Prelim) – Forecast -0.2%, versus -0.2% previous.

- German Consumer Price Index for Nov 2020 (MoM) (Prelim) – Forecast -0.7%, versus +0.1% previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals