Canadian Dollar is trading generally higher in Asian session, with support from upside break out in oil prices. But Aussie and Kiwi are soft. Dollar is taking a breather in Asian session after yesterday’s selloff, as focus turns to non-farm payrolls report. For the week, Dollar and Yen remain the worst performing ones. European majors are the strongest as led by Swiss Franc.

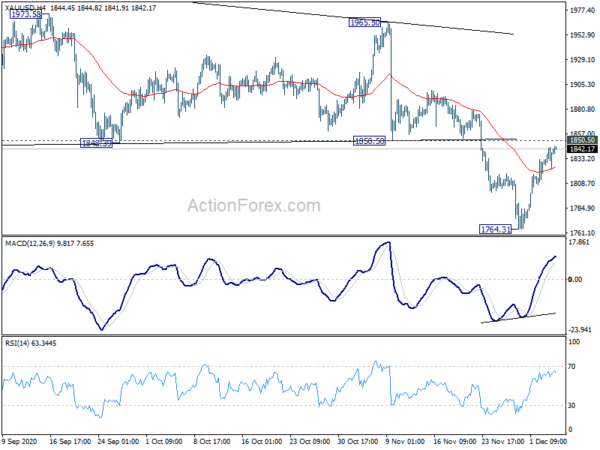

Technically, 103.65 support in USD/JPY is a focus after yesterday’s steep decline. Break will put focus on 103.17 support, for confirming medium term down trend resumption. Gold is also eyeing 1850.50 support turned resistance. Sustained break there should confirm completion of medium term correction from 2075.18 record high. Both developments, if happen, would seal the case of Dollar’s medium term weakness, probably prompt more downside acceleration.

In Asia, currently, Nikkei is down -0.41%. Hong Kong HSI is down -0.19%. China Shanghai SSE is down -0.35%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is down -0.0040 at 0.023. Overnight, DOW rose 0.29%. S&P 500 dropped -0.06%. NASDAQ rose 0.23%. 10-year yield dropped -0.028 to 0.920.

WTI upside breakout as OPEC+ eases production cut by 500k bpd

OPEC and Russia agreed to ease their oil output cut by 500k barrels per day starting January. That is, OPEC_ will cut production by only -7.2m bpd, or -7% of global demand, comparing to current cuts of -7.7m bpd. Additionally, the group will meet every month to review the output policies beyond January, with monthly increases in production not exceeding 500k bpd.

WTI crude oil broke out of near term range on the news and hit as high as 46.43 so far. Near term outlook will now remain bullish as long as 43.78 support holds. 50 psychological level is the next hurdle. Reaction from there would decide whether the rise from March’s spike low would develop into a sustainable long term up trend.

Dollar index to take on 90 with focus on non-farm payrolls

US non-farm payroll is a major focus for today. Markets are expecting 520k job growth in November. Unemployment rate is expected to edge down by 0.1% to 6.8%. Looking at related indicators, ISM manufacturing employment dropped back into contraction at 48.4. But ISM services employment improved from 50.1 to 51.5. ADP private employment grew only 307k, missed expectations. Four-week moving average of initial jobless claims dropped from 787k to 740k. Overall, the set of data pointed to continuous growth in US employment, but the momentum could disappoint.

Dollar index’s medium term down trend resumed this week and accelerated to as low as 90.51 so far. It’s now close to a key support level at around 90 psychological level. That coincides with 38.2% projection of 102.99 to 91.74 from 94.30 at 90.00. Decisive break there would prompt further downside acceleration to 61.8% projection at 87.34, and solidify medium term downside momentum.

Australia retail sales rose 1.4% in Oct, Victoria led on reopening

Australia retail sales rose 1.4% mom to AUD 29.6B in October, above expectation of 0.5% mom. Comparing to October 2019, sales rose 7.1% yoy.

Victoria (5.1%) led state and territory rises, and there were also rises for New South Wales (0.7%), Western Australia (1.0 %), and South Australia (0.6%). Queensland (-0.5%), Tasmania (-1.4%), the Northern Territory (-0.6%) fell, while the Australian Capital Territory (-0.1%) was relatively unchanged.

Looking ahead

Germany factory orders, Italy retail sales and UK construction PMI will be released in European session. US will release non-farm payrolls, trade balance and factory orders. Canada will also release job data and trade balance.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2832; (P) 1.2886; (R1) 1.2921; More….

USD/CAD’s down trend extends to as low as 1.2852 so far. 61.8% projection of 1.3389 to 1.2928 from 1.3172 at 1.2887 is already met but there is no sign of bottoming yet. Intraday bias stays on the downside for 100% projection at 1.2711 next. On the upside, above 1.2941 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Rejection by 55 week EMA is keeping outlook bearish. Such decline should now target 1.2061 (2017 low). In any case, break of 1.3389 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Oct | 1.40% | 0.50% | 1.60% | |

| 07:00 | EUR | Germany Factory Orders M/M Oct | 1.40% | 0.50% | ||

| 09:00 | Italy | Retail Sales M/M Oct | -0.20% | -0.80% | ||

| 09:30 | GBP | Construction PMI Nov | 52.3 | 53.1 | ||

| 13:30 | USD | Nonfarm Payrolls Nov | 520K | 638K | ||

| 13:30 | USD | Unemployment Rate Nov | 6.80% | 6.90% | ||

| 13:30 | USD | Average Hourly Earnings M/M Nov | 0.10% | 0.10% | ||

| 13:30 | USD | Trade Balance (USD) Oct | -64.7B | -63.9B | ||

| 13:30 | CAD | Net Change in Employment Nov | 22.0K | 83.6K | ||

| 13:30 | CAD | Unemployment Rate Nov | 8.90% | 8.90% | ||

| 13:30 | CAD | International Merchandise Trade (CAD) Oct | -3.2B | -3.3B | ||

| 15:00 | USD | Factory Orders M/M Oct | 1.00% | 1.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals