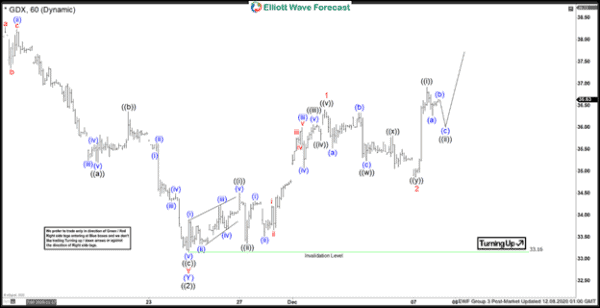

Elliott Wave view in $GDX suggests that the Gold Miner Index ended cycle from March low in wave ((2)) at 33.16. The Index has turned higher again in wave ((3)) with the internal unfolding as an impulse Elliott Wave structure. Gold Miners still need to break above previous wave ((1)) high on August 5 at 45.78 to avoid a double correction. Up from wave ((2)) low at 33.16, wave ((i)) ended at 34.5 and wave ((ii)) pullback ended at 33.35. Gold Miners then extended higher again in wave ((iii)) towards 36.07, and pullback in wave ((iv)) ended at 35.7. Final leg higher in wave ((v)) ended at 36.4 and this completed wave 1 in higher degree.

The Index then corrected cycle from November 24 low and ended wave 2 at 34.87. Internal of wave 2 unfolded as a double three structure where wave ((w)) ended at 35.23, wave ((x)) ended at 35.81, and wave ((y)) ended at 34.87. Up from wave 2 low, wave ((i)) ended at 36.92. Expect wave ((ii)) pullback to stay above wave 2 at 34.87, but more importantly above 33.16. As far as pivot at 33.16 low stays intact, expect dips to find support in 3, 7, or 11 swing for more upside. Potential short term target higher is 100% – 123.6% Fibonacci extension from November 24 low at 38.09 – 38.86.

$GDX 60 Minutes Elliott Wave Chart

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals