Growth data out of the United Kingdom will kick off Thursday’s European session at 07:00 GMT when traders are likely to wake up to fresh Brexit headlines. Prime Minister Boris Johnson is due to travel to Brussels later today to try and salvage a post-Brexit trade agreement with the European Union, with only three weeks to go until the end of the transition period. He is expected to hold talks with European Commission President Ursula von der Leyen over dinner at 19:00 GMT. But with neither side seemingly backing down on their red lines, hopes for a deal have started to fade somewhat. In the meantime, sluggish growth figures could add to sterling’s misery tomorrow if a no-deal Brexit is indeed the outcome of tonight’s talks.

GDP growth probably slowed again in October

The British economy grew by a record 15.5% in the third quarter. But when taking into account the steep slump of the first half when the nationwide lockdown shaved about a fifth off GDP, output stood nearly 10% below pre-pandemic levels, indicating the recovery has a long way to go still. With the virus re-escalating in the Autumn, the fourth quarter is not expected to have gotten off to a good start.

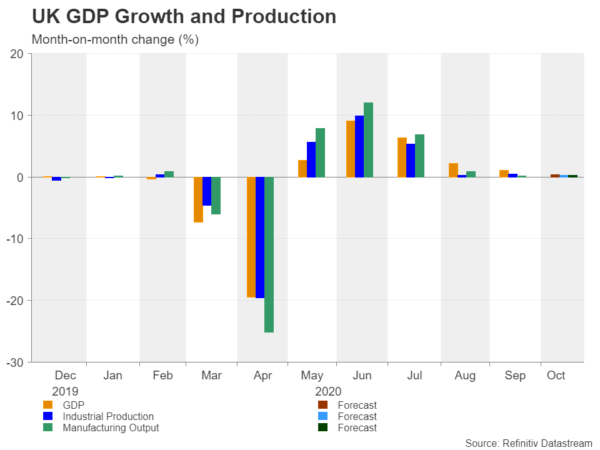

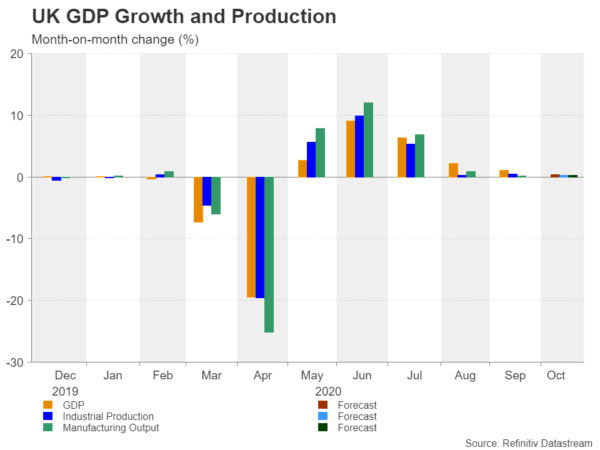

GDP is forecast to have increased by just 0.4% month-on-month in October, narrowing the annual decline slightly to -8.3%. Industrial and manufacturing growth are expected to have been equally subdued. Both manufacturing and overall industrial output are projected to have expanded by 0.3% m/m in October.

UK to lag in global recovery

The Organisation for Economic Co-operation and Development (OECD) recently warned that the UK’s recovery will likely be one of the slowest among its members. The disproportionately greater impact of the virus restrictions and shutdowns on service industries than other sectors is the main reason why the UK economy has been hit harder by the pandemic than other advanced economies and the OECD thinks Brexit will worsen the pain in 2021.

Brexit talks on ‘knife edge’

However, the threat of Brexit deepening the virus-induced economic crisis doesn’t appear to be a major concern for Boris Johnson as he seems adamant to protect the UK’s sovereignty over closer economic ties with the EU. As Johnson and von der Leyen head for crunch talks, it’s the same old issues of fishing rights, governance and a level playing field that are holding back a deal. Although a level playing field – or competition rules – is now reportedly the biggest thorn in the negotiations.

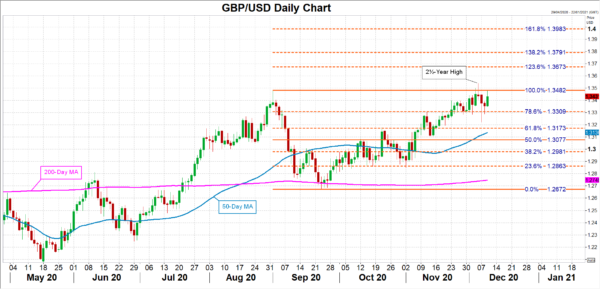

Weeks of intense talks have failed to bridge the gap on the three remaining sticking points and as the negotiations stretch into the 11th hour, it’s looking increasingly likely that those divergences could scupper a deal. Yet, there’s no sense of panic in the markets from the talks being on knife edge. The pound is back above the $1.34 level today, moving towards Friday’s 2½-year high of $1.3539.

Pound poised to skyrocket if deal is struck

Should tonight’s last-ditch effort to secure an agreement end with success, cable could easily rally towards the 123.6% Fibonacci extension of the September downleg at 1.3673. The pair might even reach the 138.2% Fibonacci of 1.3791 if the announced trade pact is a comprehensive one, though longer-term gains that could potentially target the 161.8% Fibonacci of 1.3983 would likely depend on the speed of Britain’s economic recovery from the Covid slump.

However, with the markets possibly underestimating the risk of a chaotic Brexit, the pound is susceptible to a sharp downside correction if the negotiations in the coming hours and days go nowhere. The 78.6% Fibonacci retracement of 1.3309 could provide initial support in case of a negative reversal, followed by the 61.8% Fibonacci of 1.3173. Further down, the 38.2% Fibonacci of 1.2981 could be the only thing standing in the way between the bears and the 200-day moving average, currently at 1.2748.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals