Sterling opens broadly higher as Brexit trade negotiation is extending through the Sunday deadline. The Pound is taking Euro and Swiss Franc slightly higher today. Nevertheless, it should be noted that no important resistance level is broken by Sterling. Traders are just lighting their shorts. Markets are rather mixed elsewhere, with weakness seen in Dollar. But overall trading is subdued, with most pairs bounded inside Friday’s range.

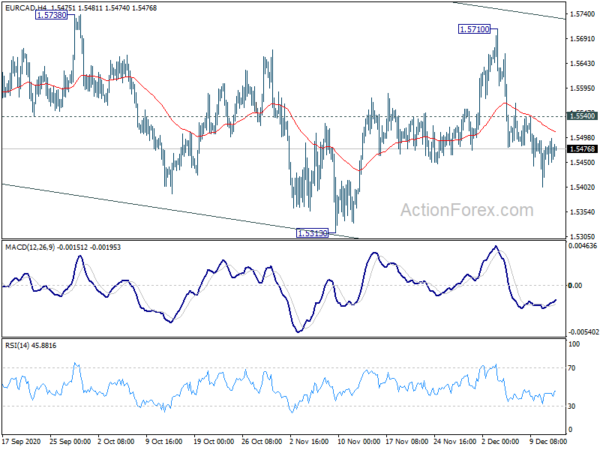

Technically, other than Sterling pairs, Euro is worth a watch this week too. Both EUR/USD and EUR/JPY are holding in tight range below 1.2177 and 126.74 temporary tops. Outlook stay bullish in both pairs and upside breakout could be imminent, considering the time spent on the consolidations. However, Euro is at the same time capped by weakness against commodity currencies. EUR/AUD is pressing 1.6033 low and firm break there could prompt downside acceleration. Such development could also drag EUR/CAD further lower to retest 1.5313 low. We could see which way it goes later in the week.

In Asia, currently, Nikkei is up 0.64%. Hong Kong HSI is down -0.04%. China Shanghai SSE is up 0.39%. Singapore Strait Times is up 1.39%. Japan 10-year JGB yield is up 0.004 at 0.017.

UK and EU to go the extra mile in Brexit talks, GBP/CHF and EUR/GBP gapped but range bound

UK Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed to “go the extra mile” and extend the Brexit trade negotiations beyond Sunday’s deadline. “Despite the exhaustion after almost a year of negotiations, despite the fact that deadlines have been missed over and over, we think it is responsible at this point to go the extra mile,” they said in a joint statement. “We have accordingly mandated our negotiators to continue the talks and to see whether an agreement can even at this late stage be reached,” they added. UK delegation are expected to stay in Brussels until at least Tuesday.

GBP/CHF opens notably higher today but it’s kept well below 55 day EMA, staying on the lower half of the medium term range. Bias is turned neutral for now. We’d maintain that firm break of 1.2203 resistance is needed to confirm underlying bullish development in the cross. Meanwhile, firm break of 1.1598 support is needed to confirm bearish development, probably due to confirmation of no-deal Brexit. Otherwise, we’ll just wait-and see what’s next.

Similarly, EUR/GBP opens lower but it’s held well above 55 day EMA, in the upper side of recent range. Break of 0.8861 support is needed to confirm completion of the choppy rebound from 0.8670. Otherwise, another rise through 0.9229 and 0.9291 resistance zone is expected, at a later stage.

Japan tankan large manufacturing rose to -10, non-manufacturing rose to -5

Japan Tankan large manufacturing index rose 17 points from -27 to -10 in Q4, above expectation of -15. Outlook also improvement to -8, up from -17, and beat expectation of -11. Non-manufacturing index rose 7 pts from -12 to -5, slightly above expectation of -6. Non-manufacturing outlook rose from -11 to -6, above expectation of -7. However, all industry capex dropped -1.2%, much worse than expectation of -0.1%.

The set of data would affirm BoJ’s decision to stand pat on interest rate and QE program later in the week. Though, extensions of the emergence lending programs would be extended, as Japan is currently in a “relatively” serious third wave of coronavirus infections.

Four central banks to meet, in a busy pre-holiday week

Fed, SNB, BoE and BoJ will meet this week. No major change in interest rates nor QE is expected from the central banks. Though, there could be extension to some emergence lending facilities. BoE, however, would provide some extra talking points, in their responses to the results of Brexit trade negotiations. RBA will also release meeting minutes.

The economic calendar is also extremely busy, ahead of the Christmas and New Year holiday weeks. PMIs from Eurozone, UK and US, as well as Germany Ifo, should provide further evidence that this round of lockdowns are having much less severe impacts than that in Spring. Meanwhile, data from China should indicate the sustainability of its recovery from the pandemic, which started in Wuhan. Here are some highlights for the week:

- Monday: Japan Tankan survey, tertiary industry index; Eurozone industrial production.

- Tuesday: New Zealand Westpac consumer sentiment; RBA minutes; China industrial production, retail sales, fixed asset investment; UK employment; Swiss CPI, SECO economic forecasts; Italy trade balance; Canada housing starts, manufacturing sales; US Empire State manufacturing, import prices, industrial production.

- Wednesday: New Zealand current account; Australia PMIs, leading indicator; Japan trade balance, PMI manufacturing; UK CPI, PPI, PMIs; Eurozone PMIs, trade balance; Canada CPI, foreign securities purchases, wholesale sales; US retail sales, PMIs, business inventories, NAHB housing index; FOMC rate decision.

- Thursday: New Zealand GDP; Australia employment; Swiss trade balance, SNB rate decision; Eurozone CPI final; BoE rate decision; Canada ADP employment; US Philly Fed survey, jobless claims, housing starts and building permits.

- Friday: New Zealand trade balance, ANZ business confidence; BoJ rate decision; UK Gfk consumer confidence, retail sales; Germany PPI, Ifo business climate; Eurozone current account; Canada retail sales, new housing price index; US current account.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3134; (P) 1.3230; (R1) 1.3324; More…

GBP/USD rebounds strongly today but it’s held well below 1.3529 resistance. Intraday bias is turned neutral first and another fall remains mildly in favor. On the downside, sustained break of 1.3134 should confirm another rejection by 1.3514 key resistance. Deeper decline would be seen back to 1.2675 support next. Nevertheless sustained break of 1.3539 would resume whole rise form 1.1409 and carry larger bullish implications.

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3308). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | -10 | -15 | -27 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q4 | -8 | -11 | -17 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q4 | -5 | -6 | -12 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q4 | -6 | -7 | -11 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | -1.20% | -0.10% | 1.40% | |

| 00:01 | GBP | Rightmove House Price Index M/M Dec | -0.60% | -0.50% | ||

| 04:30 | JPY | Tertiary Industry Index M/M Oct | 1.30% | 1.80% | ||

| 04:30 | JPY | Industrial Production M/M Oct F | 3.80% | 3.80% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | 2.00% | -0.40% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals