Dollar trades generally lower today as Asian markets ex-Japan open the year on strong footing. Investors are generally riding on optimism of vaccine rollouts and an eventual sustainable global recovery. Though, for the short term, Japan is facing risk of more lookdowns while coronavirus infections in the US could still surge again. The forex markets are mixed elsewhere, with Aussie and Kiwi paring some recent gains. Euro and Swiss Franc are struggling in consolidations.

Technically, 1.2688 support in USD/CAD is a level to watch today. Break will confirm resumption of larger down trend from 1.4677. Break of 102.87 support in USD/JPY will also resume larger down trend. At the same time, firm break of 126.04 minor support in EUR/JPY could invalidate prior upside break out and bring deeper pullback.

In Asia, currently, Nikkei is down -0.62%. Hong Kong HSI is up 0.71%. China Shanghai SSE is up 0.96%. Singapore Strait Times is up 0.30%. Japan 10-year JGB yield is up 0.0007 at 0.026.

Japan considers state of emergency for Greater Tokyo

While Asian markets rise broadly today, Nikkei is lagging with mild loss on fear of further showdowns. Prime Minister Yoshihide Suga warned that the government would consider declaring state of emergency for the Greater Tokyo metropolitan area, as coronavirus cases surged.

“Even during the three days of the New Year’s holidays, cases didn’t go down in the greater Tokyo area,” Suga said. “We felt that a stronger message was needed.” He added that in some regions like Osaka Prefecture and Hokkaido, shortening restaurant hours helped stem the rise in infections.

Japan PMI Manufacturing finalized at 50, stabilization at the end of a tumultuous year

Japan PMI Manufacturing was finalized at 50.0 in December, up from November’s 49.0. Markit said output stabilized after 23 consecutive monthly falls. Also, employment rose for the first time since February.

Usamah Bhatti, Economist at IHS Markit, said:

“Japanese manufacturers signalled a broad stabilisation in operating conditions at the end of a tumultuous year, as the headline PMI registered at the 50.0 no-change threshold in December. This pushed the PMI to the highest level since April 2018 and ended a sequence of 19 straight declines – the longest in the survey history.

“The overall health of the Japanese manufacturing sector was boosted by output levels steadying following nearly two years of consistent declines. Although new orders reduced in the latest survey period, the fall was the softest recorded in the current sequence dating back to January 2019.

“Buoyed by improved operating conditions, Japanese manufacturing firms increased employment levels for the first time since February, albeit only fractionally. Nevertheless, ongoing issues of an ageing population have continued to hold back Japanese manufacturing employment, as firms report continued to report retirements.

“Businesses reported a sustained increase in optimism, with a third of respondents predicting a rise in output over the coming 12 months. This is in line with the IHS Markit forecast for industrial production to grow 7.3% in 2021.”

China Caixin PMI manufacturing dropped to 53.0, negative impact of pandemic further subsided

China Caixin PMI Manufacturing dropped to 53.0 in December, down from 54.9, missed expectation of 54.9. Markit said that output and new work expanded at slower, but still marked, rates. Staffing levels stagnated, despite further uptick in backlogs of work. Input costs increased at quickest rate for three years.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In December, the negative impact of the pandemic on the domestic economy further subsided and the manufacturing industry continued to recover. Both the supply and demand sides continued to improve. Overseas demand also steadily increased. In terms of the trend, we expect the economic recovery in the post-epidemic era to continue for several months, and macroeconomic indicators will be stronger in the next six months, taking into account the low bases in the first half of 2020.

“Meanwhile, we need to pay attention to the mounting pressure on costs brought by the increase in raw material prices and its adverse impact on employment, which is particularly important for the design of the exit from stimulus policies implemented during the epidemic.”

Fed and ECB minutes, US ISMs and NFP to highlight a week in full gear

The economic calendar is back in full gear this week. Fed and ECB minutes will catch some attention. Focuses will also be on ISMs and NFP from the US, Eurozone CPI, Germany production, Canada employment, and China PMIs. Here are some highlights for the week:

- Monday: China Caixin PMI manufacturing; Japan PMI manufacturing final; Swiss PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final, M4 money supply, mortgage approvals; Canada PMI manufacturing: US PMI manufacturing final, construction spending.

- Tuesday: Japan monetary base; Germany retail sales, unemployment; Swiss CPI; Eurozone M3 money supply; Canada IPPI and RMPI; US ISM manufacturing.

- Wednesday: China Caixin PMI services; Japan consumer confidence; Eurozone PMI services final, PPI; UK PMI services final; US ADP employment, PMI services final; factory orders, FOMC minutes.

- Thursday: Japan average cash earnings; Australia building approvals, trade balance; Swiss unemployment rate, retail sales; Germany factory orders; ECB monthly bulletin, monetary policy meeting accounts, Eurozone CPI flash, retail sales; UK PMI construction. Canada trade balance, Ivey PMI; US jobless claims, trade balance, ISM services.

- Friday: Japan leading indicators; Germany industrial production, trade balance; France industrial production, trade balance; Swiss foreign currency reserves. Eurozone unemployment rate; Canada employment; US non-farm payrolls.

AUD/USD Daily Report

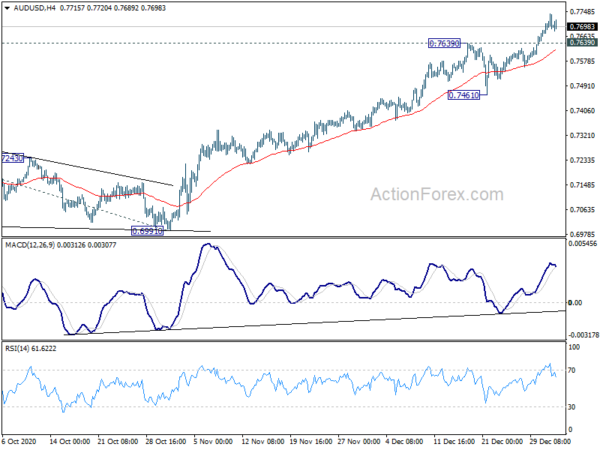

Daily Pivots: (S1) 0.7662; (P) 0.7691; (R1) 0.7729; More…

Intraday bias in AUD/USD remains on the upside at this point. Current up trend should target 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170 next. On the downside, below 0.7639 resistance turned support will turn intraday bias neutral first. But retreat should be contained above 0.7461 support to bring another rally.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise form 0.5506 could either the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:45 | JPY | Manufacturing PMI Dec F | 50.0 | 49.7 | 49.7 | |

| 01:45 | CNY | Caixin Manufacturing PMI Dec | 53.0 | 54.9 | 54.9 | |

| 08:45 | EUR | Italy Manufacturing PMI Dec | 53.6 | 51.5 | ||

| 08:50 | EUR | France Manufacturing PMI Dec F | 51.1 | 51.1 | ||

| 08:55 | EUR | Germany Manufacturing PMI Dec F | 58.6 | 58.6 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Dec F | 55.5 | 55.5 | ||

| 09:30 | GBP | Manufacturing PMI Dec F | 57.3 | 57.3 | ||

| 09:30 | GBP | Mortgage Approvals Nov | 82K | 98K | ||

| 09:30 | GBP | M4 Money Supply M/M Nov | 0.40% | 0.60% | ||

| 14:30 | CAD | Manufacturing PMI Dec | 55.8 | |||

| 14:45 | USD | Manufacturing PMI Dec F | 56.5 | 56.5 | ||

| 15:00 | USD | Construction Spending M/M Nov | 0.90% | 1.30% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals