Cable is consolidating after Monday’s 0.62% drop, as bulls were deflated after cracking 1.37 barrier and hitting new 2 ½ year high.

Despite bullish expectations, investors were cautious at the start of the year, considering risk of exploding new coronavirus cases and negative impact on economic recovery that deflated risk sentiment on the first trading day of the year 2021.

New lockdown in the UK started today and will last until mid-February at least that would increase pressure on sterling.

Traders are also concerned about potential BoE rate cut below zero during the third national lockdown that could drive pound lower and hurt larger longs.

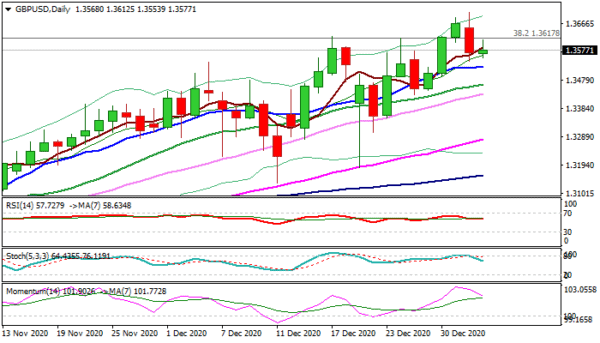

Daily studies show loss of bullish momentum that contributes to fears of deeper pullback, however, near-term action is expected to remain biased higher while holding above rising daily Tenkan-sen (1.3503).

Caution on break below daily Kijun-sen (1.3419) that would put bulls on hold and signal stronger correction.

Res: 1.3612; 1.3624; 1.3686; 1.3703.

Sup: 1.3541; 1.3503; 1.3461; 1.3419.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals