Euro recovers mildly today but stays as one the weakest, along with Dollar, Yen and Swiss Franc. Strong risk-on sentiments pushed major US indices to new records overnight. Commodity currencies are generally strong on the sentiments. Canadian Dollar was additionally lifted by the not-so-dovish BoC statement, but it’s awaiting upside breakout in oil price to give it another lift. Sterling is mixed for now, hesitating to push up further, even against Euro.

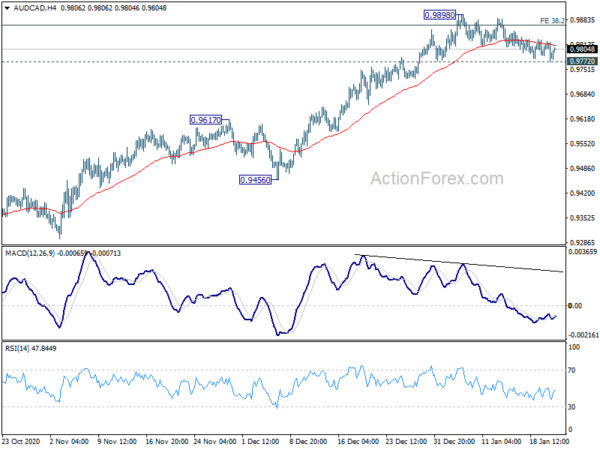

Technically, Euro will be a focus today. So far, EUR/USD is holding above 1.2052 support, EUR/JPY above 125.07 support, EUR/CHF above 1.0737 support. These three pairs are somewhat capping Euro’s downside elsewhere. But break of these levels could prompt more broad based selloff. Separately, USD/JPY’s break of 103.51 support revives that case that rebound from 102.58 has completed after rejection by channel resistance. Retest of 102.58 could be seen and that could drag the greenback lower elsewhere. AUD/CAD will remain an interesting one to watch, as traders are still undecided on which one to bet more on.

In Asia, Nikkei closed up 0.82%. Hong Kong HSI is up 0.05%. China Shanghai SSE is up 1.34%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is down -0.0077 at 0.032. Overnight, DOW rose 0.83%. S&P 500 rose 1.39%. NASDAQ rose 1.97%. All were record highs. 10-year yield dropped -0.02 to 1.090.

BoJ kept policy unchanged, raised growth fiscal 2021, 2022 growth forecasts

BoJ left monetary policy unchanged today as widely expected,. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. The central bank will continue to purchase unlimited amount of JGBs to keep 10-year yield at around 0%, with some fluctuations allowed. Goushi Kataoka dissented again in a 7-1 vote, pushing for further strengthening monetary easing.

In the Outlook for Economic Activity and Prices, BoJ raised fiscal 2021 growth forecasts to 3.3-4.0% (median at 3.9%), up from October’s projection of 3.0-3.8% (median at 3.6%). Fiscal 2022 growth forecasts was also raised to 1.5-2.0% (median at 1.8%), from 1.5-1.8% (median at 1.6%).

Core CPI forecasts for fiscal 2021 was revised to 0.3-0.5% (median at 0.5%), from 0.2-0.6% (median at 0.4%). Fiscal 2022 core CPI was projected at 0.7-0.8% (media 0.7%), from 0.4-0.7% (median at 0.7%).

Japan posted first annual export growth since 2018

In non seasonally adjusted terms, Japan’s exports rose 2.0% yoy in December to JPY 6.71T, slightly below expectation of 2.4% yoy rise. But that’s still the first annual growth since November 2018. Imports dropped -11.6% yoy to JPY 5.96T, above expectation of -14.0% yoy. Trade came in at JPY 751B, small than expectation of JPY 943B.

In seasonally adjusted terms, exports dropped -0.1% mom to JPY 5.98T. Imports rose 1.3% mom to 5.50T. Trade surplus narrowed to JPY 477B, below expectation off JPY 760B.

Australia employment grew 50k in Dec, unemployment rate dropped to 6.6%

Australia employment grew 50k in December, or 0.4% to 12.9m, matched expectations. Full time employment rose 35.6k to 8.76m. Part-time employment rose 14.3k to 4.15m. Over the year to December 2020, employment dropped by -0.5% or -63.9k. Unemployment rate dropped to 6.6%, down from 6.8%, better than expectation of 6.7%. Participation rate rose 0.1% to 66.2%.

Bjorn Jarvis, head of labour statistics at the ABS, said, “Although employment has recovered 90 per cent of the fall from March to May, the recovery in part-time employment has outpaced full-time employment. While part-time employment was higher than March, full-time employment was 1.3 per cent below March.”

Also released, consumer inflation expectations dropped to 3.4% in Dec.

ECB in focus; EUR/AUD to break 1.5591 support

ECB meeting is a focus today but it’s likely to be non-eventful. Monetary policy should be left unchanged. Following the recalibration in December, ECB would leave the size of the Pandemic Emergency Purchase Program (PEPP) at EUR 1850B and that of the Asset Purchase Program (APP), its traditional QE program, EUR 20B per month. The deposit rate will also stay unchanged at -0.5%. Some attention will be on policymakers’ view on recent Euro strength, discussions on QE tapering and economic impacts of renewed lockdown.

Here are some previews:

Euro is under some pressure this week along with Dollar, Yen and Swiss Franc. It’s clearly overwhelmed by the power in commodity currencies, on broad based risk-on sentiment. EUR/CAD has taken out 1.5313 support yesterday to resume the decline from 1.5978. EUR/AUD is a focus today, on when (more than whether) it would break through 1.5591 support to resume the down trend from 1.9799. Next near term target is 161.8% projection of 1.6827 to 1.6144 from 1.6420 at 1.5315.

Elsewhere

Canada will release new housing price index. US will release housing starts and building permits, jobless claims, and Philly Fed survey.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2069; (P) 1.2114; (R1) 1.2150; More…

Intraday bias EUR/USD is turned neutral at it retreat sharply after failing 4 hour 55 EMA. Another rise still mildly in favor. Break of 1.2157 will turn bias to the upside for retesting 1.2348 high. However, decisive break of 1.2052 will resume the correction from 1.2348. Intraday bias will be turned to the downside for 61.8% retracement of 1.1602 to 1.2348 at 1.1887.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Dec | 0.48T | 0.76T | 0.57T | 0.55T |

| 0:00 | AUD | Consumer Inflation Expectations Jan | 3.40% | 3.50% | ||

| 0:30 | AUD | Employment Change Dec | 50K | 50K | 90K | |

| 0:30 | AUD | Unemployment Rate Dec | 6.60% | 6.70% | 6.80% | |

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | |||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.60% | |||

| 13:30 | USD | Building Permits Dec | 1.60M | 1.64M | ||

| 13:30 | USD | Housing Starts Dec | 1.56M | 1.55M | ||

| 13:30 | USD | Initial Jobless Claims (Jan 15) | 860K | 965K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | 12.2 | 11.1 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Jan P | -15 | -14 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals