Markets are generally staying in consolidative mode for now, except that Sterling appears to be the stronger one. There is no follow through selling in Dollar so far, as traders await some guidance from FOMC statement and press conference today. Australian Dollar has little reaction to stronger than expected consumer inflation and business conditions data. Crude oil price and gold are both stuck in familiar range. Asia stocks are also treading water.

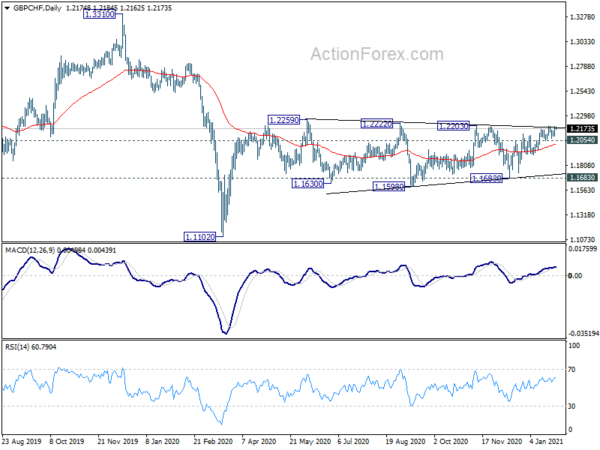

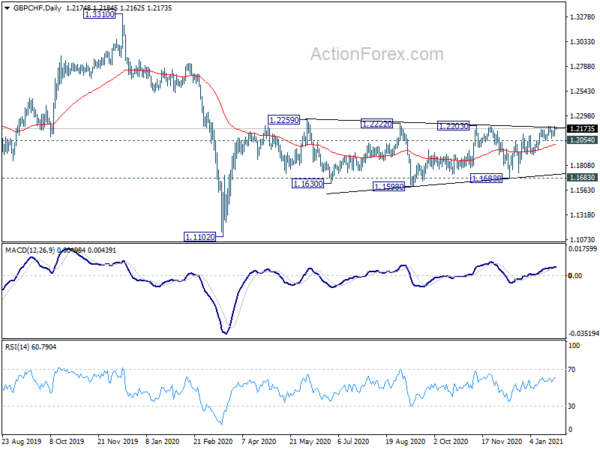

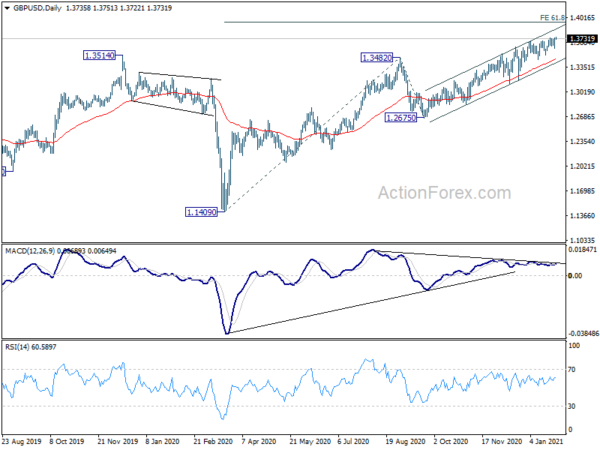

Technically, GBP/USD’s breach of 1.3745 resistance, and GBP/JPY’s break of 142.30 resistance suggest that buying in the Pound is back. A focus will be on 0.8828 temporary low in EUR/GBP. Decisive break there could pave the way back to 0.8670 support. GBP/CHF is also back pressing 1.2203/2259 resistance zone. Sustained break there would resume medium rebound from 1.1102.

In Asia, currently, Nikkei is up 0.21%. Hong Kong HSI is up 0.25%. China Shanghai SSE is up 0.07%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is up 0.0044 at 0.039. Overnight, DOW dropped -0.07%. S&P 500 dropped -0.15%. NASDAQ dropped -0.07%. 10-year yield closed flat at 1.040.

Australia CPI rose 0.9% qoq in Q4, driven by tobacco and childcare

Australia CPI rose 0.9% qoq in Q4, above expectation of 0.7% qoq. Annually, CPI accelerated from 0.7% yoy to 0.9% yoy, above expectation of 0.7% yoy. RBA trimmed mean CPI came in at 0.4% qoq, 1.2% yoy. Weighted mean CPI was at 0.5% qoq, 1.4% yoy.

Head of Prices Statistics at the ABS, Michelle Marquardt said: “The December quarter CPI was primarily impacted by an increase in tobacco excise and the introduction, continuation and conclusion of a number of government schemes, including childcare fee subsidies and home building grants.”

Australia NAB business conditions rose to 14, employment turned positive

Australia NAB Business Conditions rose to 14 in December, up from 7. That’s the fourth consecutive month of improvement, and highest level since late 2018. Looking at some details, Employment improved notably from -4 to 9, first positive reading since the start of the coronavirus pandemic. Trading conditions rose from 15 to 20, but profitability dropped from 13 to 11.

Business Confidence dropped to 4 in December, down from 13, as confidence pulled back in New South Wales, Victoria and Queensland, partly reflecting the outbreak in Sydney through December.

ECB Villeroy: Monetary policy also about quality of transmission

ECB Governing Council member Francois Villeroy de Galhau said yesterday, “ensuring favorable financing conditions are the conditions for the full transmission of this accommodative monetary stance”.

“Monetary policy is not only about quantities, it is also about the quality of its transmission. And it is not limited to one single indicator or one automatic rule like yield curve control, it incorporates judgment and discretion,” he added.

Villeroy also reiterated that ECB remains committed to the inflation target of below, but close to 2%. “Our goal is and remains inflation.”

Separately, Governing Council member Pablo Hernandez de Cos said, some downward risks from the fourth quarter could still continue in the first quarter.” Recovery in Eurozone is still uncertain and uneven.

Dollar index staying bearish, FOMC previews

Fed is widely expected to keep monetary policy unchanged today. Despite recent resurgence in coronavirus infections and the economic impact, roll-out of more fiscal stimulus and positive vaccination progress would keep policy makers in a wait-and-see mode. Federal funds rate will be held at 0-0.25% while asset purchase will continue at current pace of USD 120B per month. Chair Jerome Powell would likely re-emphasize that Fed is in no position to even start discussing tapering of quantitative easing yet.

Here are some suggested readings:

Dollar Index is staying in range trading for now, reflecting the consolidation in most Dollar pairs. DXY is held below falling 55 day EMA, as well as 91.01 near term resistance, keeping outlook bearish. The down trend from 102.99 would more likely extend lower than not. Though, downside momentum has been clearly diminishing as seen in daily MACD. Hence, we’d expect strong support from 61.8% projection of 102.99 to 91.74 from 94.74 at 87.88 to contain downside and bring sustainable rebound, even in case of another down move.

Looking ahead

Germany will release Gfk consumer confidence in European session. US will release durable goods orders and crude oil inventories.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3649; (P) 1.3697; (R1) 1.3783; More….

GBP/USD’s breach of 1.3745 temporary top suggests rise resumption. Intraday bias is back on the upside. Current up trend from 1.1409 should target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside, however, break of 1.3608 support will now suggest short term topping, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned back to the downside for deeper pull back.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.10% | 0.50% | 0.70% | |

| 00:30 | AUD | NAB Business Conditions Dec | 14 | 9 | 7 | |

| 00:30 | AUD | NAB Business Confidence Dec | 4 | 12 | 13 | |

| 00:30 | AUD | CPI Q/Q Q4 | 0.90% | 0.70% | 1.60% | |

| 00:30 | AUD | CPI Y/Y Q4 | 0.90% | 0.70% | 0.70% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 0.40% | 0.40% | 0.40% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 1.20% | 1.20% | 1.20% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Feb | -7.8 | -7.3 | ||

| 13:30 | USD | Durable Goods Orders Dec | 1.00% | 1.00% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Dec | 0.50% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 1.6M | 4.4M | ||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals