Firmer US data overnight helped propel the dollar and further confound bears who remain positioned for a deeper macro sell-off.

The Dollar Continues to Squeeze Bears with Firmer US Data

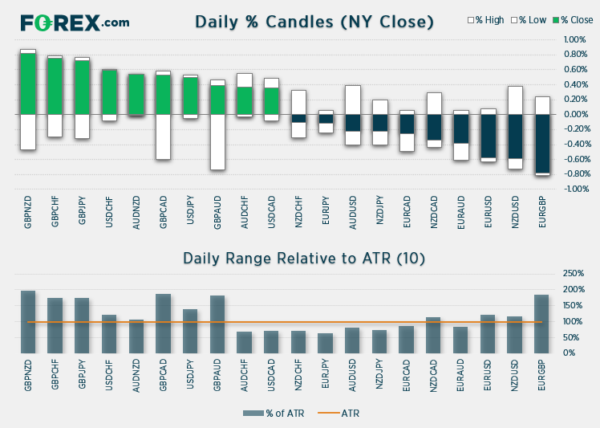

- GBP and USD were strongest majors overnight, CHF and JPY were the weakest majors overnight.

- Firmer US data strengthen the dollar, weighed on gold (which is back below 1800) and saw EUR/USD close beneath 1.2000.

- Higher yields undescrore strength of the reflation trade

- Oil prices extended their bullish runs, with WTI and Brent at their highest levels since January and February respectively

- Global indices remained anchored at (or near) record highs

- BOE held rates ad their appetite for negative rates appears almost non-existent

- NFP is the main economic event today (with Canadian reemployment released alongside it)

Firmer US data overnight helped propel the dollar and further confound bears who remain positioned for a deeper macro sell-off. ADP private payrolls rebounded in January more than expected, up 174k versus -123k prior, paving the way for a better-than-expected NFP payroll later today. ISM manufacturing continued to point towards a broader recovery for the US economy.

ISM non-manufacturing rose to a near 2-year high of 58.7 in January, up from 57.7 in December and way above 56.8 consensus. Most notably the employment index expanded (above 50) at 55.2 versus 48.7 prior, new orders hit a healthy 61.8 and prices paid (inflation proxy) remains elevated at 64.2, although down from 64.4.

The basic fact is that as US data continues to outperform Europe, and relative growth expectations paint a rosier picture for the US, EUR/USD could be facing a deeper correction than some would like to believe.

The Rising Dollar Continues to Squeeze Bears

The US dollar index (DXY) extended its lead to a 9-week high overnight and gained 0.4% as the dollar momentarily breaks its inverted correlation with rising equity markets. EUR/USD sliced through 1.2000 support with apparent ease and USD/CHF held above 0.9000 to trade to its highest level since 1st December.

However, the positive correlation between DXY and the US10-2 year yield spread appears to have returned so far this year. The 10-2 spread rose to 1.0240 overnight to a 4-year high and, with no immediate signs of a top in site, could pave the way for a higher dollar still.

Signs of an overcrowded dollar-short trade are not new, and a squeeze was almost inevitable given the extreme bearish poisoning in recent weeks. Net-short positioning on DXY (US dollar index) has been its most bearish since 2011 recently, which coincided when DXY last traded around 72 and pinpointed a multi-year bullish rally.

Since EUR/USD topped out in January, momentum has clearly favoured bears with the majority of volatile candles pointing to the downside. Yesterday’s firm bearish close beneath 1.2000 almost certainly triggered some bullish stops, and a strong bearish trend is now forming on the four-hour chart with all eMA’s pointing lower.

- The bias remains bearish below 1.2000, with minor rallies likely to temp further bearish interest.

- Next major support is around 1.1922, making is a viable target for bears

- A break above 1.2000 invalidates the near-term bearish bias. But, given the overcrowded short trade on USD, we expect to see EUR/USD lower from current levels

BOE Curb Their Enthusiasm on Negative Rates

The Bank of England (BOE) held policy unchanged overnight and warned it could be six months for banks to prepare for negative rates. Yet with MPC voting 9-0 in favour of standing pat, BOE conceding that going to zero would be easier, and taken in context alongside positive growth forecasts, the BOE’s appetite for negative rates seems almost non-existent. So, whilst negative rates remain on the table, they appear to be an unlikely scenario at this stage.

The British pound was firmer overnight following the inadvertently hawkish BOE meeting. In particular it, GBP made further gains against safe-haven currencies CHF and JPY with GBP/CHF hitting a fresh 10-month high and GBP/JPY an 11-month high. EUR/GBP also rallied into the close to reach its highest level since April. There was little reaction from the UK’s FTSE 100 which remains anchored around 6,500.

Today’s NFP report is the main event tonight. Take note that Canadian employment is also released at the same time which places USD/CAD nicely into the crosshair of volatility.

Australian retail sales will also warrant a look but, with NFP just around the corner, we could find trade relatively restricted as is usually the case, ahead of such events.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals