Australian Dollar strengthens mildly in Asian session today, as supported by another set of solid job data. But overall, trading in the forex markets is subdued. Dollar is taking a breather as FOMC minutes provided no special inspirations. The greenback is, nonetheless, staying as the strongest one for the week, together with Sterling. Yen, Swiss Franc and Euro are the worst performing ones. Bigger moves are seen in oil prices, with WTI resuming recent rise on supply disruptions.

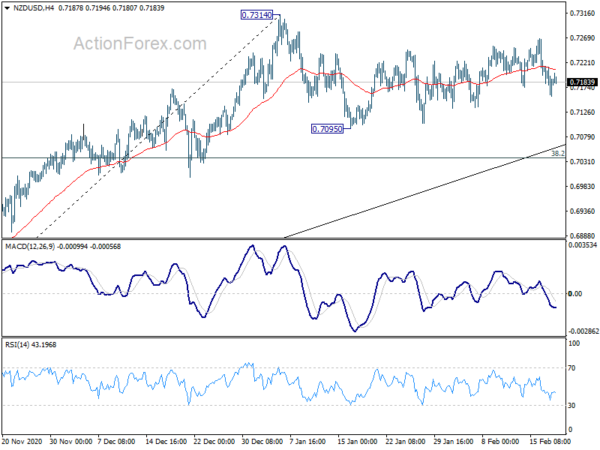

Technically, the rebound in Dollar remains relatively unconvincing against Sterling, and commodity currencies. GBP/USD is holding above 1.3758 resistance turned support. AUD/USD is staying above 0.7717 minor support. USD/CAD is held below 1.2762 minor resistance. NZD/USD is also just kept at around mid-point of 0.7095/7314 range. Let’s see if there would be another round of buying to push Dollar through these levels before the weekend.

In Asia, currently, Nikkei is up 0.17%. Hong Kong HSI is down -1.10%. China Shanghai SSE is up 0.39%. Singapore Strait Times is down -0.28%. Japan 10-year yield is down -0.012 at 0.086, backing off from 0.1% handle. Overnight, DOW rose 0.29%. S&P 500 dropped -0.03%. NASDAQ dropped -0.58%. 10-year yield rose 0.0002 to 1.301, after hitting as high as 1.331.

WTI oil closing 62.38 projection level on Texas production drop

WTI crude oil extends to as high as 62.23 so far this week The unusual cold storm and deep freeze in Texas is still hampering crude output, which would extend for days or even weeks. It’s estimated that roughly 1m bpd of production is shut.

WTI is now close to 100% projection of 47.24 to 53.92 from 51.58 at 62.38, and there is no sign of topping yet. Further rise would remain in favor as long as 59.34 support holds. Firm break of 62.38 will pave the way to 65.43 structural resistance next. We’d pay attention to loss of upside momentum as it approaches this 65.43 level. On the downside, break of 59.34 will now indicate short term topping and bring deeper pull back.

FOMC Minutes: Economic projection implied a considerably stronger activity outlook in 2021

Minutes of January 26-27 FOMC meeting noted that economic projection prepared by the staff for implied a “considerably stronger outlook for activity in 2021 relative to the December forecast”, incorporating the impact of additional fiscal support. Real GDP growth would “outpace that of potential over this period, leading to a considerable further decline in the unemployment rate”.

Also, “participants remarked that the prospect of an effective vaccine program, the recently enacted fiscal support, and the potential for additional fiscal actions had led them to judge that the medium-term outlook had improved”.

Nevertheless, “the economy remained far from the Committee’s longer-run goals and that the path ahead remained highly uncertain”. “It was likely to take some time for substantial further progress to be achieved.”

On inflation, “many participants stressed the importance of distinguishing between such one-time changes in relative prices and changes in the underlying trend for inflation,” the minutes said. Such moves “could temporarily raise measured inflation but would be unlikely to have a lasting effect.”

BoJ Kuroda: Exports recovered to pre-pandemic levels

BoJ Governor Haruhiko Kuroda told reporters today that Japan’s exports have recovered to levels before COVID-19 struck. Output was making similar moves while consumption was picking up as a whole. However, services spending remains weak.

Kuroda also Prime Minister Yoshihide Suga today, and “explained how the global economy was picking up, and how the BOJ needed to conduct the review to continue its ultra-loose monetary policy.” He said that Suga didn’t comment on the review, and there was no discussion regarding the Tokyo Olympic games.

Australia employment grew 29.1k in Jan, unemployment rate dropped to 6.4%

Australia employment grew 29.1k to 12.9m in January, slightly below expectation of 30.2k. That’s also the fourth consecutive monthly growth in jobs. Full time employment rose 59k to 8.82m. Part-time employment dropped -29.8k to 4.12m.

Unemployment rate dropped to 6.4%, down from 6.6%, better than expectation of 6.5%. But that was still 1.1% higher than a year ago. Participation rate dropped -0.1% to 66.1%. Monthly hours worked dropped -4.9%, or -86m hours, to 1667m.

Looking ahead

Swiss trade balance and ECB monetary policy meeting accounts will be featured in European session. Later in the day, Canada will release ADP employment and new housing price index. US will release building permits and housing starts, jobless claims, import price, Philly Fed survey.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5498; (P) 1.5568; (R1) 1.5604; More…

EUR/AUD’s down trend continues today and intraday bias stays on the downside for 61.8% projection of 1.6409 to 1.5591 from 1.5945 at 1.5439. Firm break there will target 100% projection at 1.5127. On the upside, break of 1.5634 minor resistance will turn bias neutral and bring consolidations first. But outlook will stay bearish as long as 1.5945 resistance holds.

In the bigger picture, price actions from 1.9799 are developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6827 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Employment Change Jan | 29.1K | 30.2K | 50.0K | |

| 00:30 | AUD | Unemployment Rate Jan | 6.40% | 6.50% | 6.60% | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 3.32B | 2.88B | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | CAD | ADP Employment Change Jan | -28.8K | |||

| 13:30 | CAD | New Housing Price Index M/M Jan | 0.50% | 0.30% | ||

| 13:30 | USD | Building Permits Jan | 1.67M | 1.70M | ||

| 13:30 | USD | Housing Starts Jan | 1.66M | 1.67M | ||

| 13:30 | USD | Initial Jobless Claims (Feb 12) | 775K | 793K | ||

| 13:30 | USD | Import Price Index M/M Jan | 1.00% | 0.90% | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | 20 | 26.5 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Feb P | -15 | -16 | ||

| 15:30 | USD | Natural Gas Storage | -250B | -171B | ||

| 16:00 | USD | Crude Oil Inventories | -2.1M | -6.6M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals