We have a few topics that will drive the markets this week. First is coming from Turkey after Erdogan has fired the central bank governor after they increased rates on Thursday. TRY lost 15% against the USD. Second important topic is all about vaccine and covid cases which are again increasing in EU, and this will probably lead to new lockdowns and restrictions early this week, so crude can see another dip or sideways price action.

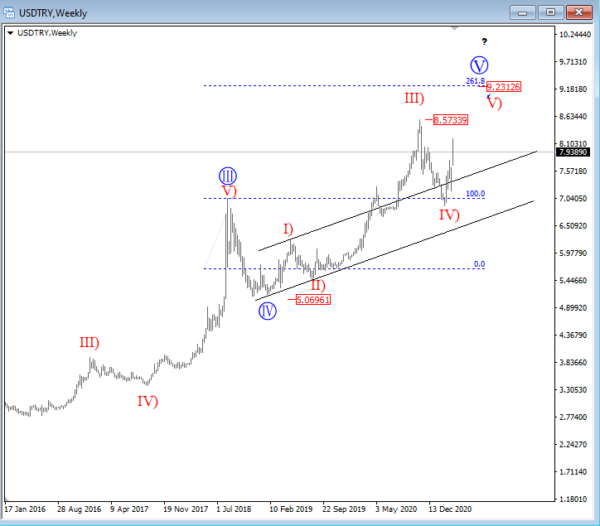

From an Elliott Wave perspective the USDTRY is still seen in long-term uptrend that appears incomplete when looking at the weekly chart. Keep in mind that even if leg from 5.06 is final in a sequnce we need five subwaves up within wave five which is not the case yet, so we think that even more upside can be seen in upcoming months, especially on specualtions that Central Bank of the Republic of Turkey may cut interest rates after recent Erdogan’s ection.

Also, keep an eye on USD and CNH this week after Russia’s top diplomat starts China visit with call to reduce US dollar use. US will respond to that for sure so we may see some volatility on USDCNH pair which may leave AUDUSD in a sideways mode where I am observing incomplete fourth wave correction.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals