Asian markets closed in deep red earlier today while European stocks dived in initial trading. Yet, the markets were saved by much stronger than expected PMI data out of Eurozone and UK. Overall sentiments recovered notably, with US futures pointing to a rebound at open. In the currency markets, Canadian Dollar, Dollar and Aussie are currently the stronger ones. Sterling and Kiwi are the worst at the time of writing. Yen has pared back some earlier gains.

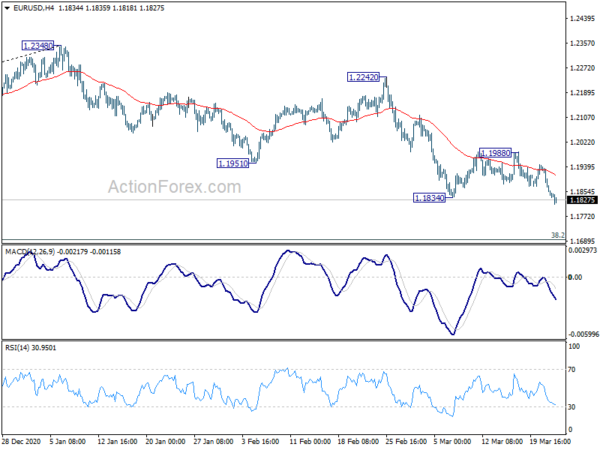

Technically, EUR/USD’s break of 1.1834 support suggests that corrective fall from 1.2348 has resumed. This is inline with the developments in both GBP/USD and AUD/USD. One focus is now on whether USD/CHF would break through 0.9374 resistance to resume the larger rise from 0.8756. Another focus is whether USD/JPY would defend 108.33 support well, to set the base for upside breakout. Or, it would break through this 108.33 to bring deeper near term correction.

In Europe, currently, FTSE is down -0.29%. DAX is down -0.60%. CAC is down -0.28%. Germany 10-year yield is down -0.006 at -0.343. Earlier in Asia, Nikkei dropped -2.04%. Hong Kong HSI dropped -2.03%. China Shanghai SSE dropped -1.30%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield dropped -0.0124 to 0.068.

Fed Bostic: 2023 is the time for liftoff

In a WSJ interview, Atlanta Fed President Raphael Bostic said “2023 is the time we’re going to start to be in the liftoff range” on monetary policy.

Fed will need to see “strong and robust” inflation for a sustained period before raising interest rates. Bostic added, “I just don’t have a lot of certainty that we’re going to see that very quickly.”

Though, he’s still seeing strong 6% growth in the US economy this year. Inflation would also overshoot Fed’s 2% target.

US durable goods orders dropped -1.1% in Feb, ex-transport orders down -0.9%

US durable goods orders dropped -1.1% mom to USD 254.0B in February, much worse than expectation of 1.0% mom rise. That’s also the first decrease following nine months of growth. Ex-transport orders dropped -0.9% mom, versus expectation of 0.5% mom. Ex-defense orders dropped -0.8% mom. Transportation equipment, down following month months of increase, dropped -1.6% mom.

Eurozone PMI manufacturing surged to record high, but outlook deteriorated on rising infection rates

Eurozone PMI Manufacturing rose to 62.4 in March, up from 57.9, well above expectation of 57.9. That’s a record high since June 1997. PMI Services improved to 48.8, up from 45.7, beat expectation of 46.1, a 7-month high. PMI Composite rose to 52.5, up from 48.8, an8-month high.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone economy beat expectations in March, showing a much better than anticipated expansion thanks mainly to a record surge in manufacturing output… The outlook has deteriorated, however, amid rising COVID-19 infection rates and new lockdown measures. This two-speed nature of the economy will therefore likely persist for some time to come, as manufacturers benefit from a recovery in global demand but consumer-facing service companies remain constrained by social distancing restrictions.

Germany PMI Manufacturing surged to 66.6 in March, up from 60.7, well above expectation of 60.9. That’s also a record high since April 1996. PMI Services rose to 50.8, up from 45.7, well above expectation of 46.3. PMI Composite rose to 56.8, up from 51.1, a 37-month high.

France PMI Manufacturing rose to 58.8 in march, up from 56.1, above expectation of 56.1. That’s also the highest level in 39 months. PMI Services rose to 47.8, up from 45.6, above expectation of 45.5. PMI Composite rose to 49.5, up from 47.0.

UK PMI manufacturing rose to 40-mth high, worries persist though

UK PMI Manufacturing rose to 57.9 in March, up from 55.1, above expectation of 55.0. That’s also the highest level in 40 months. PMI services rose to 56.8, up from 49.5, above expectation of 51.0, a 7-month high. PMI Composite rose to 56.6, up from 49.6, also a 7-month high.

Chris Williamson, Chief Business Economist at IHS Markit, said: “The surge in business activity is far stronger than any economists expected, according to Reuters polls, and hints at only a modest contraction of GDP during the first quarter, adding to evidence that the economy has shown far greater resilience in the third lockdown compared to the first..

“Worries persist though, especially in relation to near-record supply chain delays, a continued fall in exports and sharply rising prices, all of which are making life difficult for many companies. Many consumer facing companies meanwhile remain constrained by COVID-19 restrictions, which are likely to curb the overall pace of economic growth for some time to come, especially if we see a third wave of infections.”

UK CPI slowed sharply to 0.4% yoy in Feb, core CPI down to 0.9% yoy

UK CPI slowed sharply to 0.4% yoy in February, down from 0.7% yoy, missed expectation of 0.8% yoy. Core CPI also dropped to 0.9% yoy, down from 1.4% yoy, missed expectation of 1.4% yoy. RPI was unchanged at 1.4% yoy, matched expectations.

PPI input came in at 0.6% mom, 2.6% yoy, versus expectation of 0.5% mom, 0.6% yoy. PPI output was at 0.6% mom, 0.9% yoy, versus expectation of 0.2% mom, -0.4% yoy. PPI core output was at 0.1% mom, 1.4% yoy, versus expectation of 0.0% mom, 1.4% yoy.

Japan PMI composite ticked up to 48.3, subdued business but strong employment

Japan PMI Manufacturing rose slightly to 52.0 in march, up from 51.4, above expectation of 51.3. PMI services improved slightly to 46.5, up from 46.3. PMI Composite edged up to 48.3, from 48.2.

Usamah Bhatti, Economist at IHS Markit, said: “Activity at Japanese private sector businesses remained subdued… one positive note was private sector firms in Japan recording the strongest increase in employment levels since January 2020… private sector companies were optimistic that business conditions would improve in the year ahead… Positive sentiment stemmed from the expectation that the lifting of state of emergency measures and broader restrictions as vaccinations roll out would trigger a recovery in demand in both domestic and external markets.”

Australia PMI composite rose to 56.2, rounds off a strong quarter, but inflation a concern

Australia PMI Manufacturing rose slightly to 57.0 in March, up from 56.9. PMI Services jumped to 56.2, up from 53.4. PMI Composite also rose to 56.2, up from 53.7.

Pollyanna De Lima, Economics Associate Director at IHS Markit, said: “The latest results rounded off a strong quarter for the private sector, the best since the second quarter of 2017… Inflation remains an area of concern, with March data showing the strongest rise in input costs in the survey history…. Supply-chain disruption was cited by panellists as the main driver of inflation, a factor that also restricted business optimism towards growth prospects.”

New Zealand goods exports dropped -8.5% yoy in Feb, imports down -1.1% yoy

New Zealand goods exports dropped -8.5% yoy in February to NZD 4.5B. Imports dropped -1.1% yoy to NZD 4.3B. Monthly trade surplus came in at NZD 181m, turned from January’s NZD -647m deficit, largely matched expectations.

Exports to China was up NZD 369m, but down to other major trading partners including US, EU, Australia and japan. Imports from China, Australia and Japan were up, but down from EU and US.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1813; (P) 1.1877; (R1) 1.1912; More….

EUR/USD’s correction from 1.2348 resumed by taking out 1.1834 and hits as low as 1.1811 so far. Intraday bias is back on the downside for 38.2% retracement of 1.0635 to 1.2348 at 1.1694 and possibly mildly below. But we’d expect strong support from 1.1062 to contain downside to complete the correction. Though, break of 1.1988 resistance is needed to indicate short term bottoming. Otherwise, risk will stay on the downside even in case of recovery.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | 181M | 180M | -626M | -647M |

| 22:00 | AUD | CBA Manufacturing PMI Mar P | 57 | 56.9 | ||

| 22:00 | AUD | CBA Services PMI Mar P | 56.2 | 53.4 | ||

| 23:50 | JPY | BoJ Minutes | ||||

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | -0.10% | -0.50% | -0.50% | -0.40% |

| 00:30 | JPY | Manufacturing PMI Mar P | 52 | 51.3 | 51.4 | |

| 07:00 | GBP | CPI M/M Feb | 0.10% | 0.50% | -0.20% | |

| 07:00 | GBP | CPI Y/Y Feb | 0.40% | 0.80% | 0.70% | |

| 07:00 | GBP | Core CPI Y/Y Feb | 0.90% | 1.40% | 1.40% | |

| 07:00 | GBP | RPI M/M Feb | 0.50% | 0.50% | -0.30% | |

| 07:00 | GBP | RPI Y/Y Feb | 1.40% | 1.40% | 1.40% | |

| 07:00 | GBP | PPI Input M/M Feb | 0.60% | 0.50% | 0.70% | 1.00% |

| 07:00 | GBP | PPI Input Y/Y Feb | 2.60% | 0.60% | 1.30% | 1.60% |

| 07:00 | GBP | PPI Output M/M Feb | 0.60% | 0.20% | 0.40% | 0.80% |

| 07:00 | GBP | PPI Output Y/Y Feb | 0.90% | -0.40% | -0.20% | 0.10% |

| 07:00 | GBP | PPI Core Output M/M Feb | 0.10% | 0.00% | 0.30% | 0.50% |

| 07:00 | GBP | PPI Core Output Y/Y Feb | 1.40% | 1.40% | 1.40% | 1.50% |

| 08:15 | EUR | France Manufacturing PMI Mar P | 58.8 | 56.1 | 56.1 | |

| 08:15 | EUR | France Services PMI Mar P | 47.8 | 45.5 | 45.6 | |

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 66.6 | 60.9 | 60.7 | |

| 08:30 | EUR | Germany Services PMI Mar P | 50.8 | 46.3 | 45.7 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 62.4 | 57.9 | 57.9 | |

| 09:00 | EUR | Eurozone Services PMI Mar P | 48.8 | 46.1 | 45.7 | |

| 09:30 | GBP | Manufacturing PMI Mar P | 57.9 | 55 | 55.1 | |

| 09:30 | GBP | Services PMI Mar P | 56.8 | 51 | 49.5 | |

| 09:30 | GBP | DCLG House Price Index Y/Y Jan | 7.50% | 8.10% | 8.50% | |

| 12:30 | USD | Durable Goods Orders Feb | -1.10% | 1.00% | 3.40% | 3.50% |

| 12:30 | USD | Durable Goods Orders ex Transportation Feb | -0.90% | 0.50% | 1.30% | |

| 13:45 | USD | Manufacturing PMI Mar P | 59.4 | 58.6 | ||

| 13:45 | USD | Services PMI Mar P | 60.2 | 59.8 | ||

| 14:00 | USD | Fed’s Chair Powell testifies | ||||

| 14:30 | USD | Crude Oil Inventories | 1.4M | 2.4M | ||

| 15:00 | EUR | Eurozone Consumer Confidence Mar P | -15 | -15 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals