Whilst the refloating of the large cargo has weighed on oil prices overnight, it remains unclear how quickly the Suez Canal will be reopened and fully operational.

Asian Indices:

- Australia’s ASX 200 index fell by -8.2 points (-0.12%) to close at 6,816.00

- Japan’s Nikkei 225 index has risen by 342.62 points (1.17%) and currently trades at 29,519.32

- Hong Kong’s Hang Seng index has risen by 94.92 points (0.33%) and currently trades at 28,431.35

UK and Europe:

- UK’s FTSE 100 futures are currently down -5 points (-0.07%), the cash market is currently estimated to open at 6,735.59

- Euro STOXX 50 futures are currently up 9 points (0.24%), the cash market is currently estimated to open at 3,875.68

- Germany’s DAX futures are currently up 26 points (0.18%), the cash market is currently estimated to open at 14,774.94

Friday US Close:

- The Dow Jones Industrial rose 453.38 points (1.39%) to close at 33,072.88

- The S&P 500 index rose 65.02 points (1.67%) to close at 3,974.54

- The Nasdaq 100 index rose 198.62 points (1.55%) to close at 12,979.12

Indices across US and Europe close the week on a high

It was a strong close on Wall Street and across European bourses on Friday. The S&P 500 squeaked its way to a new record high (by around 0.02 points) and led higher by energy and information technology sectors. Communication services was the only broad sector to close lower.

The Dow Jones also hit a record high and closed back above 33,000 for its second time in history. The Russell 2,000 was the strongest performer in the US although, like the Nasdaq 100, are nowhere near their record highs.

It was also a positive finish across Europe as well with the STOXX 50 and German DAX closing just beneath record highs. Our bias remains bullish and for trend continuation. Check out today’s video for a closer look. Asian share markets were slightly higher overnight led by China’s SSEC (+0.79%) and CSI300 (+0.78%).

FTSE 100 bulls have 6800 within site

As we noted last week, the FTSE 100 has remained above its 50-day eMA despite several attempts to break lower. That the daily chart produced lower wicks (or ‘buying tails’) every day last week, before rebounding higher later in the session, can be taken as a sign of strength.

Friday also closed at its weekly high and formed a bullish hammer. However, the 200-week eMA sits overhead at 6750.

- A break above 6750 (its 200-week eMA) assumes bullish continuation.

- The bias remains bullish above 6674.80 if a bullish breakout occurs.

- The target is around the 6,800 highs.

Forex: Large speculators trim net-long exposure to GBP futures

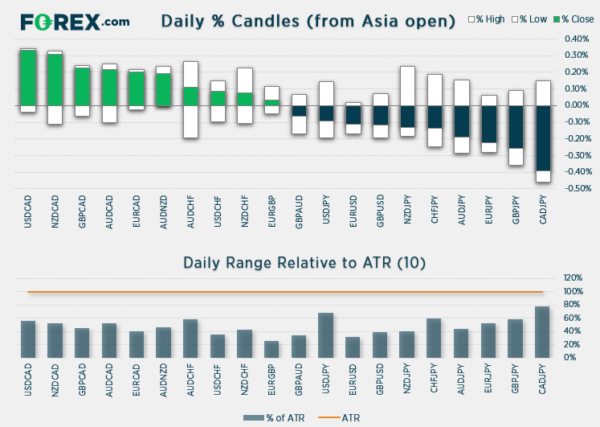

The Canadian dollar is the weakest major overnight, weighed down by oil price whilst the Japanese yen is the strongest. The US dollar index remains just above its 200-day eMA and trades in a tight range around 92.82.

Traders remained net-long the British pound yet reduced exposure for a third consecutive week, taking bullish exposure to a 6-week low. Yet the move has mostly come from a closure of gross longs as opposed to an increase of short (which have only ticked up marginally).

- After two bullish days to finish last week, GBP/USD’s upside has been capped by the 50-day eMA. Until prices break above 1.3800 then the odds favour a minor retracement against Thursday and Friday’s gains.

- EUR/GBP closed to a at a 1-week low on Friday but remains supported by the February low at 0.8540. Given the elongated bearish candle on Thursday and series of selling tails during its downtrend, the bias is for an eventual break beneath support.

- GBP/AUD tried but failed to break above the February high and produced a bearish engulfing candle on Friday, which closed back beneath its 200-day eMA. Given the choppy nature of price action we remain neutral on the pair.

- 1.3000 remains untested on GBP/CHF despite several attempts to touch it. The longer it caps as resistance the greater the odds of a deeper correction against its strong bullish trend.

- GBP/JPY trades just beneath Friday’s 4-day high after posting strong gains on Thursday and Friday. The near-term bias remains bullish above Friday’s low.

Commodities: Refloated cargo weighs on oil prices

The (in)famous cargo ship, Ever Given has been successfully refloated overnight which has weighed on oil prices. Yet it still remains unclear just how quickly the Suez Canal will be reopened and fully operational.

Brent and WTI are -1.3% and -1.7% respectively, although volatility is relatively tame compared with daily whipsaws seen last week. Yet despite the turbulence prices have remained above their 50-day eMA. So if volatility continues to subside, then we’d seek a break above $65 to suggest bulls were back in control. See today’s video for a look at brent futures.

Palladium closed to a six-day high last week and above 2657.50 resistance, which suggests it may have completed its correction from March’s high. Technically the trend on the daily chart remains bullish above the 2564.50 low, although Friday’s low at 2618.50 could also be used to fine tune risk management. Palladium has recently broken out of a multi-month sideways range and its measured move from the range places an initial target around 2807.

Copper closed back above $4.00 on Friday but traders slightly lower for the session today, yet still above $4.00. The daily chart is showing the potential to form a triangle pattern, but if prices break lower then we would see if prices can find support around the September 2012 high at 3.84, or its bullish trendline projected form its October low.

Up Next (Times in GMT)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals