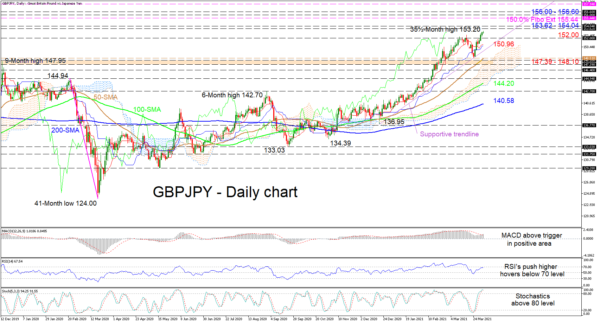

GBPJPY is sustaining its upward trajectory reaching a 35½-month high of 153.20, and bearish powers seem to be incapable of overthrowing the uptrend. The soaring simple moving averages (SMA) are safeguarding the positive structure, while the rising Ichimoku lines are indicating a rekindling in positive momentum.

The short-term oscillators are reflecting the pause in the pair’s climb but are favouring the improving picture. The MACD, north of the zero mark, has returned back above its red trigger line, while the RSI is floating beneath the 70 level. The stochastic lines are in overbought territory, endorsing positive momentum and have yet to signal any clear waning in bullish price performance.

If buying interest persists, initial constraints could arise from the nearby resistance band of 153.62-154.04, formed back in February-April 2018. However, surpassing this barrier may bolster upwards efforts, pushing the pair towards the 155.44 obstacle, which happens to be the 150.0% Fibonacci retracement of the down leg from 144.94 to 124.00. Another leg higher could then challenge the resistance section of 156.00-156.60, moulded between the end of January and early February 2018.

If sellers resurface and steer the price down, preliminary support may come from the 152.00 handle. Piloting lower, the pair may encounter downside friction from the Ichimoku lines around 150.96, before the price hits the supportive trend line drawn from the 136.95 trough. Should the price sink further below this mark, sellers may then target the cloud and 50-day SMA at 148.51. In the event this trough fails to offer some footing for buyers, the support zone of 147.39-148.10 underneath, may attempt to annul the price decline.

Summarizing, GBPJPY sellers seem unable to dethrone the upward pattern and the more than three-month ascent remains intact above the trend line and the 148.51 trough.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals