Dollar remains generally pressured in Asian session, as selling appeared to have taken off overnight. J&J’s vaccine saga is raising some concerns that it would take longer for US to achieve herd immunity. Or, at least, it’s not brightening the outlook. On the other hand, New Zealand Dollar jumps broadly after RBNZ rate decision, taking Australian Dollar higher today. The trans-Tasman travel bubble between the two countries to start on April 19 provides some optimism to both consumers and service industries.

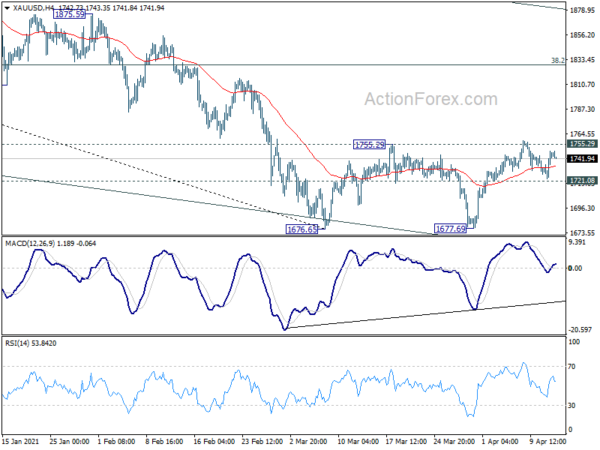

Technically, Dollar’s decline is gathering momentum. A major focus is on 1.1988 resistance in EUR/USD. Firm break there will affirm the case that correction from 1.2348 has completed at 1.1703. Break of 0.7676 minor resistance in AUD/USD will resume the rebound from 0.7530 and align the outlook with EUR/USD too. We’d also have a look at 1755.29 resistance in Gold. Break of the level will indicate near term bullish reversal in Gold, and double confirm Dollar’s weakness.

In Asia, currently, Nikkei is down -0.22%. Hong Kong HSI is up 1.23%. China Shanghai SSE is up 0.09%. Singapore Strait Times is down -0.34%. Japan 10-year JGB yield is down -0.0112 at 0.092. Overnight, DOW dropped -0.2%. S&P 500 rose 0.33% to 4141.59, new record. NASDAQ rose 1.05%. 10-year yield dropped -0.052 to 1.623.

RBNZ stands pat, outlook remains highly uncertain

RBNZ left stimulatory monetary policy unchanged as widely expected, with OCR at 0.25% and Large Scale Asset Purchase and Funding for Lending program unchanged. It maintained that to meet the requirements of sustainable 2% inflation and maximum employment will “necessitate considerable time and patience”. The committee is also “prepared to lower the OCR if required”.

The medium-term growth outlook was “similar” to the scenario presented in the February statement. Outlook remains “highly uncertain, determined in large part by both health-related restrictions, and business and consumer confidence.” The would be some temporary factors for near-term price pressures, including global supply chain disruptions and higher oil prices. But medium-term inflation and employment will “likely remain below its remit targets in the absence of prolonged monetary stimulus.”

NZD/USD jumps after RBNZ, to test 0.7098 resistance

NZD/USD trades notably higher today after RBNZ rate decision, as rebound from 0.6942 resumes. Break of the trend line resistance argues that corrective fall from 0.7463 has completed with three waves down to 0.6942. Sustained break of 0.7098 support turned resistance should add more credence to this case. Stronger rebound would then be seen to 0.7268 cluster resistance (61.8% retracement of 0.7463 to 0.6942 at 0.7264) next. Though, rejection by 0.7098 will turn focus back to 0.6942 low immediately.

Developments in AUD/NZD suggests that NZD might be having some strength of its own. Focus remains on 1.0798 support. Break there will indicate near term bearish reversal. That would extend the decline from 1.0944 to 1.0637 support and possibly below. Nevertheless, rebound from the current level would suggests that larger rise is not completed, and turn focus back to 1.0944 high.

Australia Westpac consumer sentiment rose to 118.8, highest since 2010

Australia Westpac consumer sentiment rose 6.2% to 118.8 in April, up from 111.8. it’s the highest level since August 2010, “when the Australia’s post-GFC rebound and mining boom were in full swing”. The survey continues to signal that “consumer will be the key driver of above-trend growth in 2021”.

Westpac expects RBA to maintain currency policy settings on May 4. Markets will focus on the new economic projections to be released with the SoMP on May 7. Overall, the forecasts would be consistent with the policy guidance that, “it will still be some time – 2024 at the earliest – before the Bank expects to achieve its full employment and inflation targets.”

Fed Harker: No reason to withdraw support yet

Philadelphia Fed Bank President Patrick Harker said, “Fed policy is going to hold steady”. He added, “while the economic situation is improving, recovery is still in its early stages, and there’s no reason to withdraw support yet.” He also noted that “we’re not seeing inflation running out of control.” Instead, he’d be more concerned with inflation that is too low.

Boston Fed President Eric Rosengren told WSJ that he’s expecting a “very strong economy over the course of this year”, and unemployment to “get quite low by the end of the year.” But he’s not giving a specific forecast about where the rate liftoff to be, as there’s no such foresight in the only post-war pandemic. “I think we’re two years away from when that likely is going to become a much more important question,” he said.

Elsewhere

Japan machinery orders dropped -8.5% mom in February, much worse than expectation of 2.8% mom rise. That’s also the second straight month of decline, and worst since April 2020. The data raised concerns that business investment was brought to an abrupt halt in Q1. Though, recovery is still expected in Q2 and onwards.

Looking ahead, Eurozone will release industrial production today. US will release import price index, crude oil inventories, and Fed’s Beige Book economic report.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1899; (P) 1.1928; (R1) 1.1977; More….

Intraday bias in EUR/USD remains on the upside for 1.1988 resistance. Firm break there should affirm the case that correction from 1.2348 has completed at 1.1703. Further rally should then be seen to 1.2242 key resistance for confirmation. On the downside, below 1.1876 minor support will dampen the bullish case, and turn bias back to the downside for 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Feb | -8.50% | 2.80% | -4.50% | |

| 0:30 | AUD | Westpac Consumer Confidence Apr | 6.20% | 2.60% | ||

| 1:00 | NZD | RBNZ Rate Decision | 0.25% | 0.25% | 0.25% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Feb | 0.50% | 0.80% | ||

| 12:30 | USD | Import Price Index M/M Mar | 0.90% | 1.30% | ||

| 14:30 | USD | Crude Oil Inventories | -3.5M | |||

| 18:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals