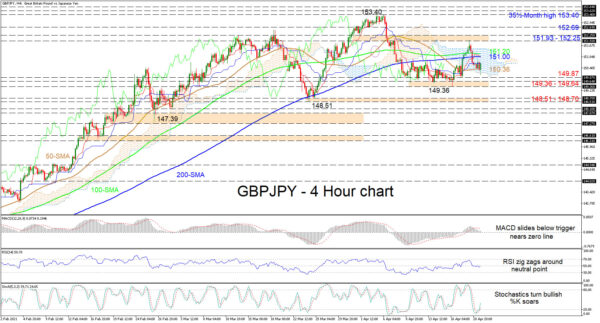

GBPJPY is edging across the 50-period simple moving average (SMA) and price action appears to have become confined to the vicinity between the 50- and 200-period SMAs. All SMAs have adopted a horizontal demeanour and are endorsing the neutral price action in the pair.

The Ichimoku lines are not signalling any definitive price direction, while the short-term oscillators are transmitting conflicting signals in directional sentiment. The MACD, in the positive region, is below its red trigger line and has approached the zero border, while the recent bullish charge in the stochastic oscillator is suggesting price improvements. Nonetheless, the RSI is flirting with its neutral threshold, promoting the net absence of directional impetus.

If sellers push under the 50-period SMA at 150.36 and the cloud’s lower band, initial support could develop from the 149.87 obstacle before the bears challenge the floor of 149.36-149.64 of the sideways pattern. Plunging past this may then turn traders’ focus to the region of 148.51-148.70.

Otherwise, if buyers manage to drive the price over a cluster of resistance from the blue Kijun-sen line up to the 100-period SMA at 151.20, the cloud’s ceiling could then try to neutralise buyers’ efforts to improve. That said, for the positive picture to regain confidence, the bulls would need to endure and then surpass the resistance boundary of 151.93-152.25. Succeeding, next upside friction could evolve from the 152.69 mark.

Concluding, GBPJPY retains a neutral bias and a break either above 152.25 or below 149.36 will reveal a clearer price direction in the short-term timeframe.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals