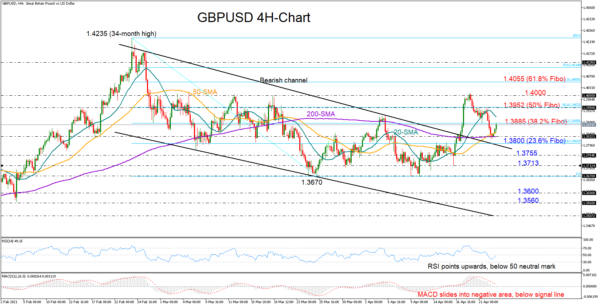

GBPUSD returned most of its weekly wins, but the bullish breakout above the descending channel remains valid, with the pair currently pushing for a rebound near the 200-period simple moving average (SMA) on the four-hour chart.

The recent golden cross between the 50- and 200-period SMAs is an encouraging trend signal, though in terms of momentum, the picture is still muddy as the MACD is stepping into negative waters and the RSI has yet to cross above its 50 neutral mark.

For the bears to take full control, the price should deep back into the channel, breaching the 1.3800 level, where the 23.6% Fibonacci of the 1.4235 – 1.3670 down leg happens to be. In this case, the 1.3755 number could quickly add some footing ahead of the 1.3713 support. Beneath the latter, the floor of 1.3670 may be the last opportunity for an upside reversal before a more aggressive sell-off extends the downtrend towards the 1.3600 – 1.3560 region, switching the outlook back to bearish.

Should the bulls dominate above the 38.2% Fibonacci of 1.3885, the 50% Fibonacci of 1.3952 could be the first obstacle to tackle followed by the crucial 1.4000 resistance. Beyond the latter, the next target could be the 61.8% Fibonacci of 1.4055.

Summing up, GBPUSD is currently attempting to recoup some lost ground, but the upside correction could be fragile. A rally above 1.4000 could bring new buyers into the market, while a close below 1.3800 could raise selling interest.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals