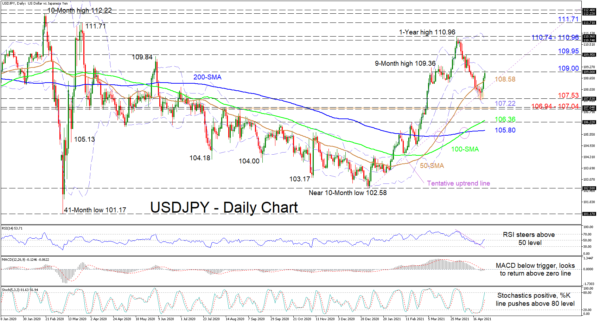

USDJPY is struggling to overcome the 109.00 hurdle, where the mid-Bollinger band also resides, after recovering some lost ground from a deep price correction from the 1-year high of 110.96. The soaring 50- and 100-day simple moving averages are endorsing the positive structure.

It is apparent that positive momentum has picked up after the pair plotted a false break of the diagonal line, simultaneously bouncing off the lower Bollinger band, which overlapped the 107.53 support barrier. The short-term oscillators are reflecting growing positive sentiment within the pair. The MACD is slightly in the negative territory but looks set to reclaim positive ground with a push over its red trigger and zero lines, while the rising RSI is fighting to maintain its step above the 50 level. The positively charged stochastic oscillator is backing positive price action.

If buyers manage to surpass the 109.00 border coupled with the mid-Bollinger band, this could bolster upside impetus to shoot the price towards the 109.95 high. Surpassing this too may then underpin confidence to encourage buyers to challenge the resistance zone existing between the 110.74 and 110.96 peaks. Successfully piloting above the upper Bollinger band could enhance the positive structure, steering the price towards the 111.71 obstacle.

To the downside, initial support could come from the 50-day SMA at 108.58 before the pair retests the soundness of the tentative uptrend line drawn from the low of 102.58. Breaking below the ascending line, the pair may then aim again for the 107.53 support level. Sinking under this, the price may hit the lower Bollinger band at 107.22 before meeting the support belt of 106.94-107.04.

Summarizing, USDJPY’s short-term bias may sustain its bullish demeanour should the contested uptrend line remain valid and the 107.53 support endure.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals