RBNZ to Leave Expansionary Policy Unchanged as Growth Momentum Eases

Economic developments have been mixed since the February RBNZ meeting. Inter-meeting data show deceleration in the growth momentum, while inflation expectations have soared. Government’s measures to curb property prices would be another factors easing the growth outlook, while the Trans-Tasman...

Data Flurry to Inspire a Range Break?

Last week’s narrow AUD/USD trading range of 0.7588 to 0.7677 was the first sub-1 cent weekly range since November 2020. This week’s busy Australian data calendar could inspire clearer direction for the Aussie.Data flurry to inspire a range break? Last...

Powell says it’s ‘highly unlikely’ the Fed will raise rates this year, despite stronger economy

Federal Reserve Chairman Jerome Powell Kevin Lamarque | Reuters Despite what he sees as a rapidly recovering economy, Federal Reserve Chairman Jerome Powell on Sunday reaffirmed the central bank’s commitment to keep loose monetary policy on place. That includes a...

Fed Chair Powell says economy about to grow much quicker due to vaccinations and fiscal support

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee hearing on “The Quarterly CARES Act Report to Congress” on Capitol Hill in Washington, December 1, 2020. Susan Walsh | Pool | Reuters The U.S. economy is at a...

Euro Reversed Course on Less Pessimistic European Outlook, Commodity Currencies Ignored Risk Rallies

Swiss Franc and Euro ended as the strongest ones last week, as investors reversed their short positions accumulated in Q1. In particular, such reversals pushed Sterling to be the worst performing one, suffering heavy pressure against both Euro and Franc....

Weekly Economic & Financial Commentary: Reopening Boom, while Supplies Last

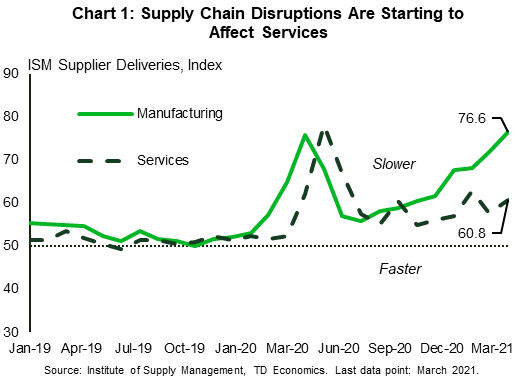

U.S. Review: Reopening Boom, while Supplies Last This week’s economic data kicked off with a bang. The ISM Services Index jumped to 63.7, signaling the fastest pace of expansion in the index’s 24-year history. The strong report came with some...

The Weekly Bottom Line: A Few Dark Spots in Bright Economic Growth Prospects

U.S. Highlights U.S. equities jumped early this week and continued to move higher over the course of it despite the prospect of higher corporate taxes announced by the Biden administration. A few dark spots in the short-term outlook are supply...

Week Ahead: Lockdowns and “Re-Openings”, Big Data Dump, and Earnings Season Begins!

The talk last week was all about the expectation of an upcoming economic boom into the spring and over the summer months. Although there are current lockdowns spread throughout Europe and Canada, traders are forward-looking. With vaccines rolling out non-stop...

Week Ahead: Fed’s Inflation Calm About to Get Tested

The Fed has clearly signaled they are not worried about inflation and that should worry financial markets. The Fed has repeated that inflation will be transitory, but financial markets have never seen this record amount of stimulus get pumped into...

Stocks making the biggest moves midday: Levi Strauss, FuboTV, Honeywell and more

A man wears Levis Strauss & Co. clothing during the company’s initial public offering (IPO) at the New York Stock Exchange (NYSE) in New York, U.S., on Thursday, March 21, 2019. Jeenah Moon | Bloomberg | Getty Images Check out...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals