Summary

U.S. Review: U.S. Recovery Is Well on Its Way

- The U.S. economy expanded at a rapid clip in the first quarter and incoming data continue to paint a picture of an economic recovery gaining momentum. The public health situation continues to rapidly improve on a national scale with increased vaccinations leading to lower new daily cases, deaths and hospitalizations. The improving health position is giving way to a pickup in activity and an improvement in joblessness.

International Review: A Divergent Global Recovery Persists

- The international economic news was varied this week. Canadian activity data were robust, including a surge in retail sales and a gain in overall GDP in February. There were hints of a brief pause in China where April PMI data softened and in Mexico where Q1 GDP fell slightly, although the growth outlook for full-year 2021 remains encouraging. The weakest outcome was from the Eurozone where Q1 GDP fell 0.6% quarter-over-quarter, a second straight quarterly decline.

- Among next week’s events, we expect Brazil’s central bank to raise interest rates, while we expect the Bank of England to hold monetary policy steady. In Canada, given some uptick in COVID cases and some restrictions, there may be a brief pause in the labor market recovery in April.

Interest Rate Watch: A Brighter Fed Outlook but No Taper without “Substantial Further Progress”

- The FOMC meeting this week struck a more optimistic tone but did nothing to dissuade expectations that the current stance is set in stone…for now. The FOMC left its forward guidance around the fed funds rate and asset purchases unchanged.

Topic of the Week: American Families Plan Unveiled

- In a speech before Congress Wednesday night, President Joe Biden laid out the case for his “American Families Plan,” which includes $1.8 trillion in spending and tax cuts on a variety of social welfare issues, partially paid for with higher taxes on high-income individuals.

U.S. Review

U.S. Recovery Is Well on Its Way

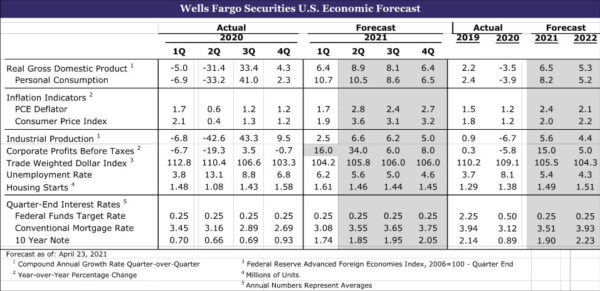

Data released this week showed the U.S. economy expanded at a rapid 6.4% annualized rate in the first quarter. The gain in output leaves the level of real GDP just a stone’s throw below its pre-COVID Q4-2019 level (see chart). We project the level of output to eclipse its pre-COVID position in the second quarter and for the remaining output gap to close by the end of the year. Most major areas of the economy expanded in the first quarter, but a considerable boost came from stimulus-fueled consumers.

U.S. households are flush with cash. Many households received their third, considerably larger stimulus check in March, which caused personal income to surge a record 21.1% during the month. In fact, many households received two stimulus checks during the first quarter, and even with the double-digit annualized gain in real personal consumption expenditures (+10.7%), the large influx of stimulus boosted the personal saving rate to 21% from 13% in the fourth quarter. In total, we estimate consumers are sitting on $2.2 trillion in “excess savings” through March, which is a considerable amount of dry powder at their disposal to fuel what is shaping up to be a consumer-led recovery.

In addition to cash-bloated consumers, the rapidly improving public health situation leaves us fairly optimistic on growth prospects this year. Through April 29, about 38% of U.S. adults are fully vaccinated and 55% of adults have received at least one does of a vaccine, according to the CDC. National daily case counts have fallen back below 60K, while deaths and hospitalizations have also moved lower. The improving virus situation is boosting confidence and leading to an ease of restrictions across the country.

New York City and Chicago both announced an easing of restrictions this week and NYC plans to move to a full reopening on July 1. That said, virus outbreaks in key areas of the country like Michigan and Oregon are stark reminders that even with an increasing portion of the population becoming vaccinated, the virus is not yet behind us and the economic recovery still depends on the trajectory of the virus.

The national improvement on the virus front to date has boosted optimism. Consumers report being the most optimistic since the start of the pandemic. Both the Conference Board’s consumer confidence index and the University of Michigan’s consumer sentiment index shot higher to fresh pandemic-era highs in April (see chart). As more Americans get vaccinated and warmer weather begins to spread across the United States, life is gradually returning to some semblance of normal and confidence is improving. Increased optimism bodes well for continued consumption as does an improvement in high-frequency mobility measurements, such as visits to retail locations, OpenTable seated diners and the number of people passing through TSA check points. Even with further progress to be made regarding the virus, consumers continue to become more comfortable venturing out, and perhaps, are learning to live with the virus.

The pickup in activity is also leading to a recovery in employment. We will get the official employment report for April next week, but the number of workers who filed an initial claim for unemployment has slid the past three weeks to a pandemic-era low. That said, continuing claims in the most recent week totaled 16.6 million workers across all programs and points to unemployment insurance remaining a substantial source of household income (see chart). At the same time, there are increasing reports of difficulty finding skilled labor despite the large number of workers still unemployed. As the economy continues to reopen, labor shortages should also dissipate as possible risks of high-contact jobs subsides. Regardless, stubbornly high claims demonstrate that the labor market is far from fully healed, despite most labor market measures moving in the right direction.

While acknowledging the economy’s more recent progress, the FOMC reiterated it is looking for “substantial further progress” toward its employment and inflation goals before it removes policy accommodation at the conclusion of its policy meeting this week. For a full analysis of the meeting and Chair Powell’s press conference, please see Interest Rate Watch. On the fiscal front, President Biden delivered his first address to Congress on Wednesday where he presented the details of his $1.8 trillion “American Families Plan.” We unpack the details of the plan and our expectations for fiscal policy in Topic of the Week.

U.S. Outlook

Construction Spending • Monday

Total construction spending fell 0.8% during February, as residential and nonresidential both registered monthly declines. Severe winter weather in many parts of the country clearly dampened construction activity during the month. However, some pullback in residential spending had been expected, given supply shortages and skyrocketing building material prices. Residential expenditures should bounce back in March, as housing starts rebounded strongly during the month. Meanwhile, nonresidential spending continues to be bogged down by the pandemic, a trend we expect to continue over the next few months. Overall, we anticipate a solid 1.6% rise in total construction spending for March.

Previous: -0.8%; Wells Fargo: 1.6%; Consensus: 1.8%

ISM Manufacturing • Monday

The ISM manufacturing index soared to a 64.7 reading in March, the highest since 1983. Most sub-indices improved sharply during the month, notably the production and new orders components. Sentiment in the factory sector has been boosted by robust consumer demand generated by multiple rounds of fiscal stimulus. That said, ongoing supply chain constraints remain a significant challenge for many producers, who are still working through delays caused by February’s adverse weather and the recent blockage of the Suez Canal. Manufacturing firms also continue to report fast-rising raw material prices as well as shortages of labor due to health concerns and childcare issues. Still, most regional surveys of manufacturing activity bested expectations during the month, which points to another solid rise in the ISM manufacturing index for April.

Previous: 64.7; Wells Fargo: 66.5; Consensus: 65.0

ISM Services • Wednesday

The beleaguered services sector appears to be getting back on track as more of the population receives vaccinations and ventures back out into the economy. The ISM services index skyrocketed more than eight points to 63.7 during March. The index on current business activity rebounded from last month’s weather-related disruptions and shot up to a record high of 69.4. What’s more, both the new orders and employment sub-indexes soared during the month, which indicates that service sector activity should continue to ramp up in the months ahead. Many service providers, however, also appear to be tied down somewhat by supply-side constraints, namely lengthening supplier delivery times. Despite these limitations, the services sector appears poised to advance further alongside subsiding COVID risks and coming surge in services spending.

Previous: 63.7; Wells Fargo: 64.5; Consensus: 64.2

Employment • Friday

Employers added 916,000 net new jobs during March. The unemployment rate slipped to 6.0% from 6.2% in February, while the labor force participation rate ticked higher. April should bring even more robust gains, as the public health environment continued to improve and more restrictions on businesses were relaxed during the month. On top of that, the latest round of fiscal support has been a boon for consumer optimism and spending, which is lifting business confidence. The employment components of both the ISM indexes shot up in March, which portends well for hiring in April. The NFIB Small Business Optimism Index showed a similar upshift in staffing plans. What’s more, initial jobless claims fell to the lowest level of the pandemic during April, meaning fewer layoffs are taking place. We look for an above-consensus 1,200K increase in nonfarm payrolls for the month. Furthermore, we expect the unemployment rate declined to 5.8%.

Previous: 916K; Wells Fargo: 1,200K; Consensus: 950K

International Review

Eurozone GDP Contracts Again in the First Quarter

The initial estimate of Eurozone first quarter GDP indicated the Eurozone economy contracted for a second straight quarter. Q1 GDP fell 0.6% quarter-over-quarter, a smaller-than-expected decline, while GDP was down 1.8% compared to Q1 2020. While full details are not available with this initial release, there are enough details to offer some insights. With respect to the Eurozone region’s largest economies, the weakest GDP outcome was in Germany (down 1.7% quarter-over-quarter). Italy’s GDP fell 0.4% and Spain’s fell 0.5%, while France actually managed a Q1 gain of 0.4%. Qualitatively, noted weakness in consumer spending in particular, while in terms of more precise estimates, Spain’s Q1 consumer spending fell 1.0% quarter-over-quarter, but French consumer spending eked out a 0.3% gain.

For April, Eurozone economic confidence jumped to 110.3 from 100.9 in March. While the direction of that move seems reasonable, the magnitude of the increase appears large, given that restrictions were still in place in many Eurozone countries during April. We continue to forecast only modest Eurozone GDP growth of 3.2% for full-year 2021. With inflation trends also benign, including for example just a 0.8% year-over-year increase in the April core CPI, we expect the European Central Bank to maintain its accommodative monetary policy stance for an extended period of time.

A Pause in China and Mexico

This past week has seen some notable data releases from a couple of notable emerging economies. In China, the economy has started 2021 on a solid enough note, although a bit up and down at times, as a mild uptick in COVID cases has had some impact on activity. While China’s Q1 GDP grew a moderate 0.6% quarter-over-quarter, a strong rise in the manufacturing and services PMIs in March pointed to improving momentum toward the end of the quarter. For April, it appears the economy’s momentum has continued, albeit plateauing to some extent. The April manufacturing PMI fell to 51.1, while the April services PMI fell to 54.9. We recently revised our full-year 2021 GDP growth forecast for China down modestly, but still expect a sturdy 9% gain this year.

In Mexico, the economy also saw a pause during the first quarter. After large GDP gains in both Q3 and Q4 of 2020, Mexico’s GDP rose a modest 0.4% quarter-over-quarter in Q1-2021. Activity in the tertiary sector (which includes services) rose 0.7%, while activity in the secondary sector (which includes manufacturing) was flat for the quarter. Activity in the primary sector was soft, with a decline of 1.3%. Despite the modest Q1 outcome, we expect Mexican GDP growth to gain some momentum as 2021 progresses, helped in part by the strength of the U.S. economy.

Canada’s Forward Momentum Continues

It was another week of good news for the Canadian economy and the data released in recent days showed activity remaining relatively firm in the early part of 2021. The February retail sales report showed a robust gain in sales of 4.8% month-over-month, while revised sales for January were flat on the month compared to the previously reported 1.1% decline. Adjusting for inflation, the February gain in real retail sales was also impressive at 4.3%. Finally, with respect to nominal retail sales, the flash estimate from Statistics Canada is for a further increase in sales in March of 2.3%.

The news on the broader economy was also favorable overall. February real GDP rose 0.4% month-over-month, a touch below the consensus forecast for a 0.5% increase. Activity in the services sector rose 0.6% in February, but industrial output fell 1.2%. Looking ahead, Statistics Canada’s flash estimate is for March GDP to rise 0.9% month-over-month. That would equate to a Q1 GDP increase of 1.6% quarter-over-quarter (not annualized), which would be a bit softer than our current forecast for a Q1 GDP gain of 1.9%.

International Outlook

Brazil Monetary Policy Announcement • Wednesday

Brazil’s central bank announces its monetary policy decision next week and, given a recent acceleration in CPI inflation, is expected to raise interest rates for the second time during the current cycle. With the rise in commodity prices and a Brazilian currency that has been softer on balance since the start of 2021, CPI inflation quickened to 6.1% year-over-year in March. In response, the central bank kicked off its tightening cycle with a 75-bp rate hike in March. With inflation pressures still elevated, the consensus forecast is for the central bank to raise its policy rate another 75 bps at its May meeting to 3.50%, though we expect a slightly larger increase of 100 bps. Moreover, May is unlikely to represent the end of Brazil’s tightening cycle, with at least some further increase in interest rates anticipated in the months ahead. Separately, next week also brings the release of April manufacturing and services PMI data as well as retail sales for March.

Previous: 2.75%; Wells Fargo: 3.75%; Consensus: 3.50% (Selic Rate)

Bank of England Policy Announcement • Thursday

The Bank of England also has its monetary policy decision next week and, given signs of an improving economy, we expect the U.K. central bank to make no change to its policy stance. After the economy struggled at the start of this year amid a renewed spread of COVID and associated restrictions, activity has shown encouraging trends as the economy has started to reopen. Among the highlights have been the rise in the April manufacturing and services PMIs to 60.7 and 60.1, respectively, and a larger-than-expected 5.4% month-over-month jump in March retail sales.

It is against this backdrop that we expect the Bank of England to keep its policy rate at 0.10%, and maintain its asset purchase target at £895 billion, with little need seen for additional monetary policy support at the current juncture. At the same time and despite the improvement in growth so far, we think it is too early for the central bank to send any tightening signals. There will, however, be interest in the May Monetary Policy Report that is also published next week. The Bank of England’s GDP growth forecasts should be revised perceptibly higher, while the central bank’s CPI inflation forecasts will also be closely scrutinized.

Previous: 0.10%; £895 Billion; Wells Fargo: 0.10%; £895 Billion; Consensus: 0.10%; £895 Billion (Policy Rate; Asset Purchase Target)

Canada Employment Report • Friday

Canadian activity data have been generally encouraging at the beginning of 2021, although that trend may see a brief pause in April given some uptick in COVID cases and restrictions put in place. The March labor market report was a blowout, as employment surged by 303,100, with large gains in full-time jobs. However, after surging employment in both February and March, April could see some moderate payback with restrictions in place across some provinces, including in Ontario, Canada’s most populous province. As a result we forecast employment to fall by 50,000 in April, and also see the unemployment rate edging higher to 7.6%.

Among next week’s other releases is the April manufacturing PMI. Much like other areas of the economy, the manufacturing sector has also shown noticeable improvement over the past several months, including a rise in the manufacturing PMI to 72.9 in March.

Previous: 303,100; 7.5%; Wells Fargo: -50,000; 7.6% (Monthly Employment Change; Unemployment Rate)

Interest Rate Watch

Have to Admit It’s Getting Better

No change. That was what was expected. The FOMC unanimously voted to keep the fed funds rate target unchanged at a range between 0.00%-0.25%, while asset purchases will continue at their current pace of $80 billion in Treasury securities and $40 billion in mortgage-backed securities.

Remembering the lessons from the taper tantrum in 2013, Fed policymakers carefully wrote a statement that acknowledged the rapidly improving economy, while remaining dovish on policy guidance. Specifically, the FOMC noted that, “amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened.”

The top-of-mind issue for financial markets is in inflation and on that front, the committee’s updated assessment reflects that inflation by some measures has moved back above 2% (PCE inflation released earlier today came in at 2.3% through March). However, the FOMC indicated that it expects the pickup in inflation currently under way will likely prove temporary and explicitly stated in the post-meeting statement that the recent pickup in inflation “largely reflects transitory factors.”

That message is received skeptically by some financial market participants, but its inclusion in the statement signals it is widely held among members and underscores that the FOMC is prepared to look through the near-term rise in inflation.

Labor Market Likely to Take Longer than Inflation to Reach Target

No tapering of asset purchases yet. The Fed reiterated that purchases would continue at their current pace “until substantial further progress” has been made on its employment and inflation goals. Chair Powell appeared ready for that as he responded to the first question of the press conference. He noted that, “it will take some time before we see substantial further progress” toward the FOMC’s employment and inflation goals, and he reinforced the idea that it is not yet time to have a conversation about tapering.

The job market is recovering, but with 8.4 million fewer jobs since the pandemic began, there remains a good deal of ground to cover before reaching maximum employment.

With risks to the outlook remaining, the meeting statement again indicated that the FOMC will need to see outcomes consistent with its goals, not just forecasts. That will keep the Fed in a holding pattern for months to come.

Topic of the Week

American Families Plan Unveiled

In a speech before Congress Wednesday night, President Joe Biden laid out the case for his “American Families Plan” (AFP). The AFP calls for $1.8 trillion in spending and tax cuts on a variety of social welfare issues, partially paid for with higher taxes on high-income individuals.

On the spending side, perhaps the biggest ticket item is actually a tax cut. The AFP would extend the enhanced Child Tax Credit, which was passed for 2021 only in the American Rescue Plan, through 2025. In addition, Biden’s plan proposes $225 billion for child care funding and tax credits, and $225 billion for a national paid family and medical leave program. On health care, the AFP calls for $200 billion to fund an expansion of the tax credits households use to buy health insurance through the Affordable Care Act. The plan also includes $200 billion for free universal pre-school, $109 billion for two years of tuition-free community college, an $80 billion investment in Pell Grants and $45 billion to improve the health of K-12 school meal programs and provide food during summer breaks.

Biden also called for a series of tax increases to fund the new spending. The AFP would restore the top marginal income tax rate to 39.6%, up from 37%, for singles making about $450,000 or more and joint filers making over $500,000. On capital gains, Biden proposed increasing the tax rate from 20% to 39.6% for those earning $1 million or more, while also eliminating the “step-up in basis” that currently allows heirs to use the market value of assets at the time of inheritance rather than the actual purchase price when determining the cost basis for capital gains. Finally, the AFP eliminates the carried interest tax break and includes more funding for the IRS to ensure owed taxes are being paid. The White House plan claims these changes would raise about $1.5 trillion over the decade, or $800 billion without the White House’s assumptions about improved IRS tax collection rates.

Where Do Things Go from Here?

The AFP comes on the heels of the infrastructure-oriented “American Jobs Plan” released last month. In total, the two plans propose more than $4 trillion in spending over a decade alongside roughly $3 trillion-$3.5 trillion in tax increases over the same time horizon. If enacted in full, the two plans would represent some of the most sweeping fiscal policy changes in recent memory.

However, we are highly skeptical the two plans will be enacted in full. Ultimately, if something does come to pass, we believe it will be the result of combining the two proposals and significantly scaling some parts back. With so many different moving pieces on both the tax and spending sides, however, there is tremendous uncertainty about what may or may not be included. This is made further complicated by the Democrats’ razor-thin majorities in the House and Senate as well as the complicated rules surrounding budget reconciliation, the likely legislative vehicle. We would certainly take the under on $4 trillion in spending and $3 trillion in tax increases, but some form of economic policy change does appear to be brewing. We will continue to keep our readers updated on our thoughts about new developments and possible economic implications.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals