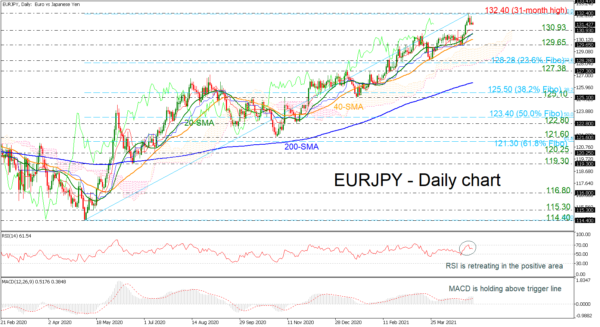

EURJPY is strongly positive as it reached a fresh 31-month peak at 132.40 on April 29. The MACD is standing beyond the trigger and zero lines, though, the RSI is losing ground above the 50 level. The short-term simple moving averages (SMAs) are heading north, approaching the current market price.

The short-run risk is looking neutral-to-positive at the moment and another retest of the 132.40 high is likely. Particularly, a decisive close above the aforementioned level might what the bulls are eagerly waiting for to rally towards the 133.47 level, registered in April 2018. Higher, the price may initially stall around the 137.50 mark, taken from the high in January 2018.

To the downside, the 130.93 nearby support area may add some footing to the market, but a violation at this point may not attract much attention unless the price slumps below the 129.65 support. Negative momentum could further strengthen if the 23.6% Fibonacci retracement level of the upleg from 114.40 to 132.40 at 128.28 is breached as well, with the 127.38 obstacle appearing next in the radar.

In brief, EURJPY has been in an upside move since May 2020 and only a decline below the 200-day SMA around 126.26 may change this view.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals