Swiss Franc and Euro jump in overall mixed markets. There were little reaction to better than expected job data from the US. BoE’s slowing of asset purchases, and surprising voting prompted brief rally in the Pound, but there is no follow through momentum. Australian Dollar quickly pared back the losses on increasing tension with China. European indices are hovering between gains an losses while US futures are mixed too. Traders might need to wait for tomorrow’s non-farm payroll data before taking a firmer stance.

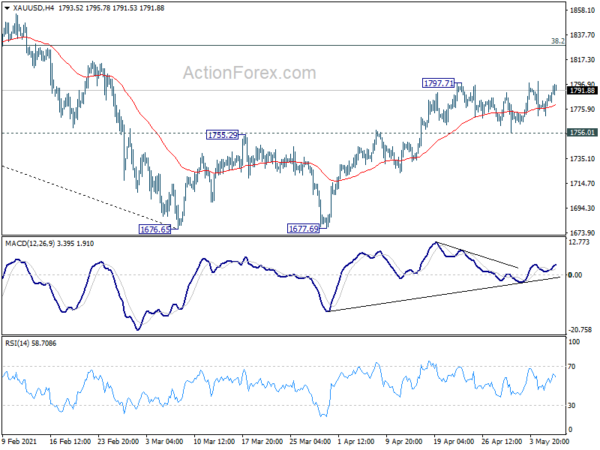

Technically, though, Dollar is looking vulnerable against Euro and Swiss Franc. With today’s recovery, focus will firstly be on 1.2075 minor resistance in EUR/USD. Break will suggest that correction from 1.2149 has completed, and larger up trend is ready to resume. USD/CHF is also pressing 0.9079 temporary low too. Break will resume larger down trend. We’d also watch is gold could finally break through 1800 handle to resume the rise from 1677.69.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is down -0.07%. CAC is up 0.06%. Germany 10-year yield is up 0.008 to -0.217. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 0.77%. China Shanghai SSE dropped -0.16%. Singapore Strait Times rose 0.62%. Japan 10-year JGB yield dropped -0.0054 to 0.090.

US initial jobless claims dropped to 498k, lowest since March 14, 2020

US initial jobless claims dropped -92k to 498k in the week ending May 1, below expectation of 540k. That’s also the lowest level since March 14, 2020. Four-week moving average of initial claims dropped -61k to 560k, lowest since March 13, 2020 too.

Continuing claims rose 37k to 3690k in the week end April 24. Four-week moving average of continuing claims dropped -6.8k to 3676k, lowest since March 28, 2020.

BoE stands pat, but Haldane voted to cut asset purchases

BoE kept monetary policy unchanged as widely expected. Bank rate is held at 0.10% on unanimous vote. Asset purchase target was kept at GBP 895B in total. Chief economist Andy Haldane surprisingly dissented, “preferring to continue with the existing programme of UK government bond purchases but to reduce the target for the stock of these purchases from £875 billion to £825 billion.”

The MPC will “continue to monitor the situation closely” and taken whatever action is necessary”. Also, “the Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”

The central bank said economic activity is expected to “rise sharply” in Q2 and GDP would recovery to pre-Covid level “over the remainder of this year”, in absence of most restrictions.

In the economic projections conditioned on constant interest rate at 0.10%, 2021 GDP growth growth is upgrade to 7.25% (from 5.0%). But 2022 projection was lowed to 5.75% (down from 7.25%). Growth is expected to slow back to 1.25% in 2023.

CPI inflation forecast was raised to 2.50% in 2021 (from 2%), lowered to 2% in 2022 (from 2.25%), and kept unchanged at 2.0% (2023).

Suggested reading on BoE: Bank of England Eases Foot Off Monetary Policy Accelerator

UK PMI services finalized at 61.0, surge of pent up demand started to flow through

UK PMI Services was finalized at 61.0 in April, up from March’s 56.3. That’s also the highest reading since October 2013. Job created accelerated to five-and-a half year high. Input cost inflation also intensified. PMI Composite was finalized at 60.7, up from March’s 56.4, a seven-and-a-half year high.

Tim Moore, Economics Director at IHS Markit: “April data illustrates that a surge of pent up demand has started to flow through the UK economy following the loosening of pandemic restrictions, which lifted private sector growth to its highest since October 2013. The roadmap for reopening leisure, hospitality and other customer-facing activities resulted in a sharp increase in forward bookings and new project starts across the service sector. If the rebound in order books continues along its recent trajectory during the rest of the second quarter, then service sector output growth looks very likely to surpass the survey-record high seen back in April 1997.”

New Zealand ANZ business confidence rose to 7, inflation expectations surged

Preliminary reading of New Zealand ANZ business confidence improved to 7.0 in May, up from -2.0. Own activity outlook also rose to 32.3, up from 22.2. Export intentions rose to 14.9, from 9.1. Investment intentions rose to 20.8, from 17.1. Employment intentions rose to 22.1, from 16.4. Pricing intentions rose to 57.6, from 55.8. Inflation expectations surged to 2.17, from 1.97.

ANZ said: “Any ECON 101 student or business person can tell you that strong demand and hampered supply is a sure-fire recipe for inflation. The RBNZ can ignore it only as long as inflation expectations remain well-anchored. So far so good; but it’s a lagging, not leading, indicator.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1985; (P) 1.2006; (R1) 1.2026; More….

Focus is now on 1.2075 minor resistance in EUR/USD with today’s recovery. Break there will indicate that pull back from 1.2149 has completed and bring retest of this resistance. Break there will resume rise from 1.1703 to 1.2242/2348 resistance zone. In case of another fall, we’d continue to expect strong support from 38.2% retracement of 1.1703 to 1.2149 at 1.1979 to bring rebound. However, firm break of 1.1979 will bring deeper fall to 61.8% retracement at 1.1873.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | 17.90% | -18.20% | -19.30% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 01:00 | NZD | ANZ Business Confidence May P | 7 | -8.4 | -2 | |

| 06:00 | EUR | Germany Factory Orders M/M Mar | 3.00% | 1.90% | 1.20% | 1.40% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:30 | GBP | Services PMI Apr F | 61 | 60.1 | 60.1 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | 2.70% | 1.40% | 3.00% | |

| 11:00 | GBP | BoE Rate Decision | 0.10% | 0.10% | 0.10% | |

| 11:00 | GBP | BoE Asset Purchase Facility | 895B | 875B | 895B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–1–8 | 0–0–9 | 0–0–9 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Apr | -96.60% | -86.20% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 30) | 498K | 540K | 553K | 590K |

| 12:30 | USD | Nonfarm Productivity Q1 P | 5.40% | 3.50% | -4.20% | |

| 12:30 | USD | Unit Labor Costs Q1 P | -0.30% | -0.70% | 6.00% | |

| 14:30 | USD | Natural Gas Storage | 68B | 15B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals