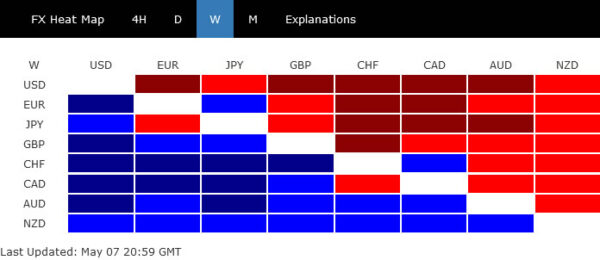

Dollar dropped broadly last week and ended sharply lower, as the huge non-farm payroll miss gave a strong node to Fed’s patient approach. Progress could only be consider substantial as seen in realized economic data, rather than projected outlook. It’s right that Fed is not even in a position to consider tapering. The expectation that ultra loose monetary policy is here to stay for longer boosted US stocks to new record high too. Meanwhile, despite a post NFP spike, treasury yield showed much resilient by late rebound.

Back in the currency markets, Yen and Euro followed Dollar as the next weakest. New Zealand Dollar lead other commodity currencies as the strongest ones. Australian Dollar was troubled briefly by increasing trade diplomatic tension with China. The Loonie’s rally was put to a halt after job data miss too. Looking ahead, as risk-on markets are set to continue, we’d expect Dollar to stay pressured in general.

DOW and S&P 500 closed at new record highs

DOW surged to close at another record high at 34777.76 last week, with some pickup in upside momentum. Up trend from 18213.65 (2020 low) is on healthy track. Further rally should be seen to 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47 next. Outlook will remain bullish as long as 33687.01 support holds, in case of retreat.

Similarly, S&P 500, while lagged behind DOW a bit, also closed at new recod high at 4323.60. Current up trend from 2191.86 is on track to 100% projection of 2191.86 to 3588.11 from 3233.94 at 4630.19. Outlook will remain bullish as long as 4128.59 support holds, in case of retreat.

10-year yield got strong support from 1.467 fibnacci level

10-year yield spiked lower to 1.471 as initial reaction to poor NFP. But TNX quickly recovered to close at 1.577. The development showed strong support from 23.6% retracement of 0.504 to 1.765 at 1.467. Consollidation from 1.765 high would extend for a while, until fruther developments in the economy. But the range for consolidation should pretty much be set. And upside break out is envisaged at a later stage.

FTSE has 8000 handle on medium term radar

Talking about strength in equities, UK FTSE 100 is worth as mention with a strong close at 7129.71, as up trend form 4898.79 (2020 low) extended. Near term outlook will stay bullish as long as 6857.06 support holds. Sustained break of 100% projection of 4898.79 to 6511.83 from 5525.52 at 7138.56 will pave the way to 161.8% projection at 8135.41. This projection level is sligthly higher than 7903.50 record high, and 8000 psychological level. This resistance zone will be the key hurdle for FTSE to overcome in the latter half of the year.

Nikkei extended sideway trading, maintains bullsiness

Japanese Nikkei’s price actions were relatively much more sluggish, as is still bounded in sideway trading below 30714.52, established since Fberuary. Though, medium term bullsiness is maintained with 38.2 retracement of 22948.47 to 30714.52 at 27747.88 well defended. It’s also now close to medium term channel support. Thus, we’d probably see an up trend resumption soon, probably even within May.

Dollar index extending decline to retest 89.20 low

Dollar index’s recovery attempt last week was limited by 55 day EMA. Subsequent sharp fall resumed the decline from 93.43. Further fall is still expected to 89.20 low. Firm break there will resume larger down trend from 102.99. We’d maitain then DXY could be in the third leg of the long term corrective pattern from 103.82. Hence while break of 89.20 is likely, strong support might be seen from 88.25 and 100% projection of 103.82 to 88.25 from 102.99 at 84.72. We’ll see how things go from there.

Gold to take on channel resistance, to confirm underlying bullishness

Gold’s strong rally last week was a sign that double confirm Dollar’s weakness. 38.2% retracement of 2075.18 to 1676.65 at 1828.88 was taken out as the hold rebound from 1676.65 extended. Focus is now on medium term channel resisntace (now at 1865.70). Sustained break that will affirm our bullish view, that correction from 2075.18 has completed with three waves down to 1676.65. Further rise should then be seen through 1959.16 to retest 2075.18 high. this will remain the favored case now as long as 1756.01 support holds.

AUD/USD’s rebound from 0.7530 resumed last week by breaking through 0.7815 resistance. The development affirmed out bullish view that correction from 0.8006 has completed with three waves down to 0.7530. Initial bias stays on the upside for retesting 0.8006 high next. For now, near term outlook will remain cautiously bullish as long a s0.7673 support holds, in case of retreat.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

In the longer term picture, 0.5506 is a long term bottom, on bullish convergence condition in monthly MACD. Focus is now back on 0.8135 structural resistance. Decisive break there will raise the chance that rise from 0.5506 is an impulsive up trend. Next target should be 61.8% retracement at 0.8950 of 1.1079 to 0.5506 and above. Though, rejection by 0.8135 will keep the case of medium to long term sideway consolidation open.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals