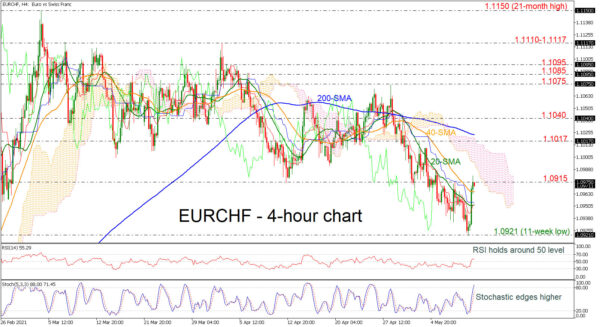

EURCHF quickly recovered yesterday’s losses after touching an eleven-week low of 1.0921. The rebound helped the currency to surpass the 20- and 40-period simple moving averages (SMAs) on the four-hour chart. The RSI jumped above the neutral threshold of 50 but it is currently pointing down, whereas the stochastic is moving towards the overbought region.

In the positive scenario, a successful close above the 1.0915 resistance could take the market towards the 1.1017 barrier and then up to the 200-period SMA at 1.1023. More increases could open the door for the 1.1040 hurdle and the 1.1075-1.1095 restrictive region.

Alternatively, a decline beneath the 40-period SMA could meet the 20-period SMA at 1.0951 ahead of the eleven-week low of 1.0921. Even lower, the bears could flirt with the 1.0890 support, taken from the inside swing high in December 2020.

To sum up, EURCHF has been in a bearish mode in the short-term timeframe. An upside tendency could develop if there is a rise above the 200-period SMA.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals