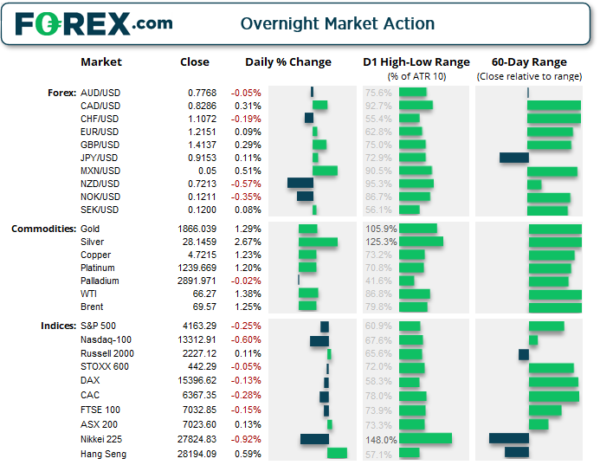

Wall Street edged lower overnight, giving back some on Friday’s strong gains, whilst yields ticked higher and the British pound was the strongest major as the UK eased lockdown restrictions.

Asian Futures:

- Australia’s ASX 200 futures are up 11 points (0.16%), the cash market is currently estimated to open at 7,034.60

- Japan’s Nikkei 225 futures are up 30 points (0.11%), the cash market is currently estimated to open at 27,854.83

- Hong Kong’s Hang Seng futures are up 43 points (0.15%), the cash market is currently estimated to open at 28,237.09

UK and Europe:

- UK’s FTSE 100 index fell -10.76 points (-0.15%) to close at 7,032.85

- Europe’s Euro STOXX 50 index fell -10.6 points (-0.26%) to close at 4,006.84

- Germany’s DAX index fell -20.02 points (-0.13%) to close at 15,396.62

- France’s CAC 40 index fell -17.79 points (-0.28%) to close at 6,367.35

Monday US Close:

- The Dow Jones Industrial fell -54.34 points (-0.16%) to close at 34,327.79

- The S&P 500 index fell -10.56 points (-0.26%) to close at 4,163.29

- The Nasdaq 100 index fell -80.207 points (-0.6%) to close at 13,312.91

US indices retrace slightly:

It was a soft start to the week on Wall Street ahead of the latest round of earnings reports, with Walmart (WMT), Home Depot (HD) and Macy’s (M) scheduled to release their reports on Tuesday. The Nasdaq 100 down -0.6%, the Russell 2000 fell 0.4%, the S&P 500 was -0.25% lower and the Dow Jones slipped -0.16%. Technology and consumer discretionary sectors were the worst hit on the S&P 500.

On the news front, Joe Biden is set to release up to 20 million vaccines, (earmarked for domestic use), overseas by the end of June. And the European Union and United States have agreed not to intensify their disputes over aluminium and US steel tariffs, which began under Trump’s watch, and instead focus on formal talks to address excess capacity with a focus on China.

The ASX200 saw a sharp, three day decline last week (between Tuesday and Thursday) and has since printed a bullish inside candle and a bearish pinbar on the daily chart. Given the 20-day eMA has capped as resistance, we now wonder if a two-day correction is now complete and whether bearish momentum is set to return. Given the monthly chart is currently trying to form a bearish pinbar and last week produced a bearish engulfing candle, during a month which is historically bearish, we feel comfortable seeking bearish setups despite its longer-term uptrend.

ASX 200 Market Internals:

ASX 200: 7023.6 (0.13%), 17 May 2021

Information Technology (1.16%) was the strongest sector and Utilities (-1.9%) was the weakest

- 7 out of the 11 sectors closed higher

- 5 out of the 11 sectors outperformed the index

- 4 out of the 11 sectors closed lower

- 5 hit a new 52-week high, 4 hit a new 52-week low

- 66% of stocks closed above their 200-day average

- 36.5% of stocks closed above their 20-day average

Outperformers:

- + 7.83% – Resolute Mining Ltd (RSG.AX)

- + 7.76% – Ramelius Resources Ltd (RMS.AX)

- + 7.04% – Viva Energy Group Ltd (VEA.AX)

Underperformers:

- -10.4% – Carsales.Com Ltd (CAR.AX)

- -9.51% – Nuix Ltd (NXL.AX)

- -4.89% – Macquarie Group Ltd (MQG.AX)

Forex: GBP firmer as lockdown restrictions eased

The British pound and Canadian dollar were the strongest currencies overnight (and remain the strongest month-to-date), whilst the New Zealand dollar and Swiss franc were the weakest yesterday.

- The pound was stronger as the UK entered its second phase of reopening, sending GBP/USD to a three-day high, and EUR/GBP printing a bearish outside day at a key resistance zone around 0.8620/30

- The US dollar index (DXY) fell to a three-day low, and just 0.16 points from retesting 09.0 support.

- CAD pairs were bolstered by stronger oil prices and closed higher against al major currencies.

- After a two-day pullback, bearish momentum returned on AUD/CAD and printed a potential swing high at 0.9431 and brings our original 0.9300/24 support zone target into focus.

- AUD/NZD failed to break beneath 1.0714 support yesterday to confirm its breakout. And now trades back above its trendline – this puts in on the backburner for us, but still one to watch for a potential break down.

Commodities: Gold breaks key resistance

Commodities were broadly higher overnight, with the Thomson Reuters CRB index rising 1.3%, led by natural gas and livestock.

- Oil prices were higher on fresh recovery hopes, with news that Biden was to send 20 million vaccines overseas and the UK reopening. Brent futures stopped just shy of breaking above 70.0 and extended gains to a three-day high in early Asian trade.

- Copper prices may have formed a corrective low on Friday with yesterday’s small bullish candle finding support at its 10-dau eMA and above the Fen 2011 high.

- Silver rose to an 11-week high and found resistance at its upper-trend channel.

Gold closed to its highest level since February, amidst its most bullish session in seven and closing above its bearish channel. Now trading around 1866, we’d expect prices to initially find resistance at the 1875 highs but yesterday’s bullish opening Marabuzo candle (elongated bullish candle with no lower wick) places support around 1844.

- Our bias remains bullish and for a break above 1785 whilst prices trade above the 1808 swing low.

- A break above 1875 brings 1900 and the 1949/59 high into focus.

- Counter-trend traders may look to fade into moves below 1875 and target 1844 (Marabuzo line).

Up Next (Times in AEST)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals