Talking Points:

- The Nucleus of the Forex Market are Trade and Capital Flows

- This article shows why trade and capital flows, driven by currency spot prices, can be so impactful to an economy and a company operating inside of that economy.

- Below, we look at a hypothetical example using real prices and actual scenarios that have impacted the Japanese economy.

At the core of the FX market, interest rates are commonly looked to as a primary driver. After all, if an investor can earn interest payments on a daily basis just for being long or short in a pair, there’s motive that can drive capital flows into that currency. And if it’s an increasing rate scenario, where an economy is continually lifting interest rates to keep inflation in-check, this can lead to a prolonged trend in which that currency is bid higher and higher by market participants looking to capture that new, higher rate of return.

Recommended by James Stanley

Download your Free Forex for Beginners Guide

But, currencies differ from stocks in that they’re not an isolated asset class: There are repercussions. And too much of a good thing can end up becoming a very bad thing, as seen by the nation of Japan and how the ‘Japanese Economic Miracle’ of post-WWII Japan morphed into the ‘lost decades’ for the Japanese economy.

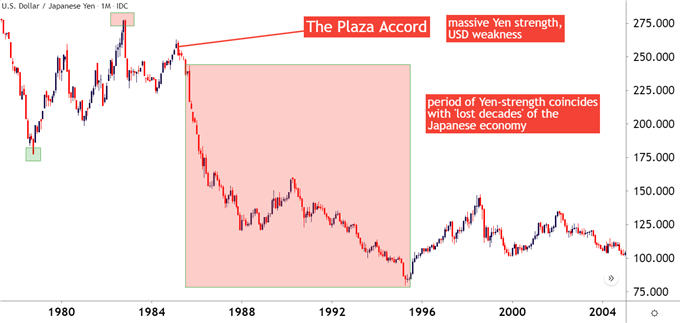

While the Japanese economy saw strong growth over a 45-year period, a strong Japanese Yen, helped along by the Plaza Accord in 1985, brought upon some significant economic erosion as the economy was mired by three decades of slowing growth and, in some cases, deflation. Below, we look at an example of how this can happen using a very rational outlay.

Why are Economic Market Cycles Important?

USD/JPY Monthly Chart: 1977-2004

Created by James Stanley

Setting the Stage with the Japanese Yen

To fully tell this story we’ve got to go through a quick history lesson with the USD/JPY pair, and the root of this story really drives back to the 70’s and stagflation.

To beat stagflation, Paul Volcker had to raise interest rates to a really high level in the US in the effort of stalling the rampant inflation that was showing at the time. These extremely high interest rates drew significant demand for the US Dollar, driven by the carry trade and rate divergence between the two pairs in the quote.

From the 1978 low to the 1982 high, USD/JPY ran by more than 56%. The pair cooled after Volcker’s policies began to show impact in the US but, from March of 1984 into February of 1985, bulls were in control again, crafting a 1985 high of 262.80 in the USD/JPY pair. And that’s around the time the Plaza Accord came into effect, which was essentially an agreement amongst the G5 to manipulate exchange rates in order to depreciate the US Dollar.

And that’s when the Yen strength really began to show.

See our study on the history of trade wars and their impact on markets!

In the example below, we’re going to look at a hypothetical model using prices from 1998 into 2008, when the USD/JPY exchange rate had depreciated considerably. But, this issue was going on far before that 1998 date for the nation of Japan.

A Real-World (but Hypothetical Example) of Exchange Rates in Action

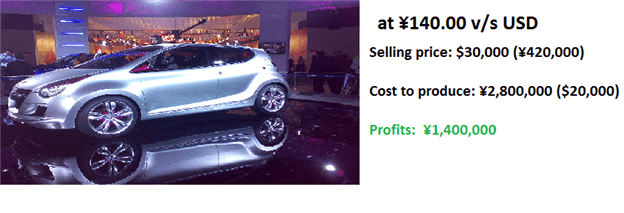

Let’s say that a Japanese auto-maker designed a car in 1998; and calculated that it cost them roughly ¥2,800,000 to produce it ($20,000). But, no problem at all – they were going to sell the car for $30,000 – which would allow a very handsome profit of $10,000 on every car sold.

The USDJPY exchange rate in 1995 was roughly ¥140.00. So, we can look at the overall cost and sale of one of these cars below:

So, remember – the value of 1 dollar in 1998 was around ¥140.00 – so it cost ¥2,800,000 to build the car. But, that’s ok – because they were selling it for $30,000, or ¥4,200,000. That left the auto-manufacturer with a nice profit of ¥1,400,000, or $10,000.

If things could stay like this forever, our auto-manufacturer would surely be happy with a 50% profit margin on each car sold.

But things didn’t stay that way. The world has changed massively since 1998.

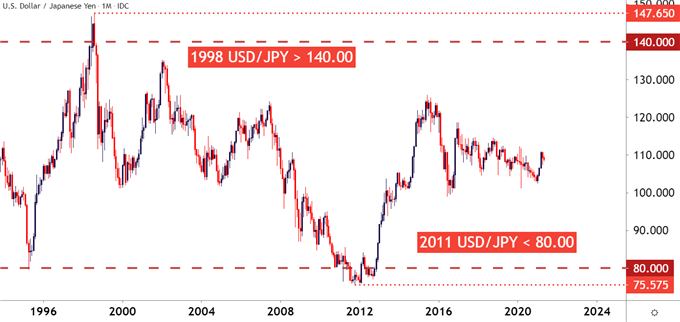

Only 13 years later, that exchange rate on USDJPY had moved below 80.

Created by James Stanley

Let’s look at how our auto-manufacturer would fare in that environment.

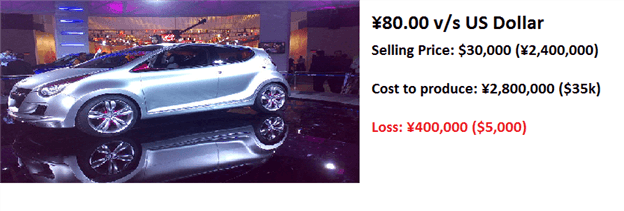

It still costs ¥2,800,000 to build the car, because they are paying workers in Japan, and buying goods in Japan (and likely paying higher wages to keep up with inflation but, for our simple example we’ll assume identical labor costs). So the change in the exchange rate doesn’t necessarily do anything to their cost structure.

It does, however, have a massive impact on their sales revenue. Remember how they were selling it at $30,000 in the US. Well, now they are only getting back ¥2,400,000 ($30,000 X ¥80.00 = 2,400,000).

They aren’t even covering their costs any longer! A 50% profit margin has just went ‘POOF’ into thin air, and this is ONLY because the ¥ has gotten stronger.

Our auto-manufacturer is now losing 400,000 yen on each and every car sold. How long do you think this will go on for? Not many businesses can continue to stay in business if they are losing money so quickly.

So, what will our auto-manufacturer do? Well, they’ll respond and none of their options are very good. They can raise the price in the US… but now they won’t be selling nearly as many cars. Customers will notice that our Japanese auto-manufacturer had raised the price more so than German, American, or Chinese auto-manufacturers; so this isn’t really a readily available option.

Often times they’ll respond by cutting costs. This means laying off workers, or at the very least hiring fewer of them. They’ll begin focusing on ‘efficiency’ of the business, and trying to find each and every way of pinching pennies so that they can at least cover their costs.

All of the actions taken by our auto-manufacturer to try to cut costs are going to be negative for the overall economy: Fewer people employed (higher unemployment), smaller or non-existent increases in pay (lower inflation), and a general sense of panic about future economic certainty given that our auto-manufacturer didn’t even necessarily do anything wrong… they just got blind-sided by a much stronger currency.

This is precisely why Japan was mired in a decades-long recession, and saw deflationary pressures throughout their economy.

| Change in | Longs | Shorts | OI |

| Daily | 22% | -7% | 9% |

| Weekly | 61% | -22% | 14% |

The Response:

So, what does Japan do, in response? They work to cheapen their own currency; because if they can succeed, they can get the opposite effect working for them.

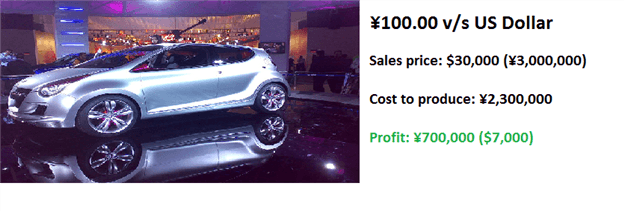

So, let’s say our auto-manufacturer has found a way to continue to exist in this expensive yen environment; and they’ve cut costs to 2,300,000 yen per car.

Surely, this isn’t a desirable scenario, because they have minimal profit margins (only 100,000 yen per car). But – they’ve found a way to survive.

But – when the Bank of Japan finally gets the yen weaker, our auto-manufacturer is in a position to massively benefit.

Let’s say that the Bank of Japan does something similar to the end of 2012, and pushed the yen lower (and USDJPY higher) to 100.00.

Well, our auto-manufacturer is lean from the hard times, and is still producing the car at 2,300,000 yen. But now that USDJPY is 100.00, they’re getting back 3,000,000 for every car sold… a profit of 700,000.

This means quite a bit… because now that profit can be re-invested in the company in equipment. Those equipment purchases are going to provide profits for manufacturers in Japan, who will then need to hire more workers. Our auto-manufacturer can now become more competitive with pricing, considering they now have a profit margin with some cushion to reduce selling prices, and they can even try to outsell their German or American counterparts by offering a lower price.

Eventually, our auto-manufacturer will need to hire more workers, and because the demand for workers has increased (since equipment and auto-manufacturers are both looking to hire), wages have to increase.

This starts that whole synergistic impact of economic growth within an economy, and all that really happened was a change in the exchange rate.

Weaker currency prices make exporting more attractive; and for export-based economies, cheaper currencies can bring considerable growth into the economy.

This is the nucleus of the forex market: Trade and Capital flows. And this is a driver that’s often hidden in plain sight as a globalized economy has seen countries so aligned that it’s difficult to imagine one major economy sneezing without the other(s) catching cold.

— Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals