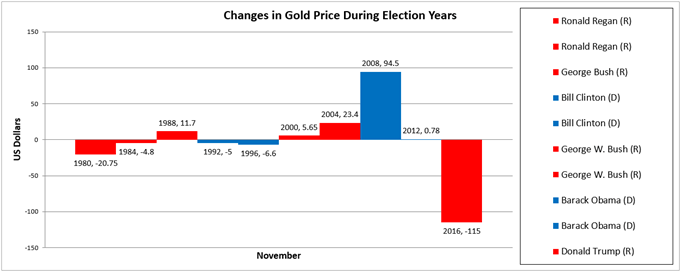

The US Presidential election has a historical tendency to influence financial markets as a change in leadership often brings a shift in fiscal policy. For the price of gold, there has been greater responsiveness to the macroeconomic landscape change since President Richard Nixon took steps to end the Bretton-Woods system starting in 1971.

However, a look at the historical impact of the US Presidential election offers little evidence of a linear relationship between the price of gold and the outcome based on party affiliation. Bullion struggled under Clinton, while the precious metal traded to a record high price in 2011 with Obama in the White House. The same could be said about Republican candidates as gold prices weakened during the Regan era, but increased during the two terms under George W. Bush.

Efforts to attribute a specific market reaction based on a candidate’s party affiliation is a practice of nuance especially when external fundamental factors like seasonality and economic cycle are taken into consideration. Many contrasting observations can be made from different regimes as financial markets have seen bubbles and crashes during various presidencies.

Nevertheless, one observation to apply to the unique situation of present conditions is that gold prices have become more volatile in the 21st century, and it remains to be seen if the trend will hold for the 2020 election as the economic shock from the COVID-19 pandemic clouds the macroeconomic outlook.

Source: Data from Bloomberg

Open a demo FX trading account with IG and trade currencies that respond to systemic trends.

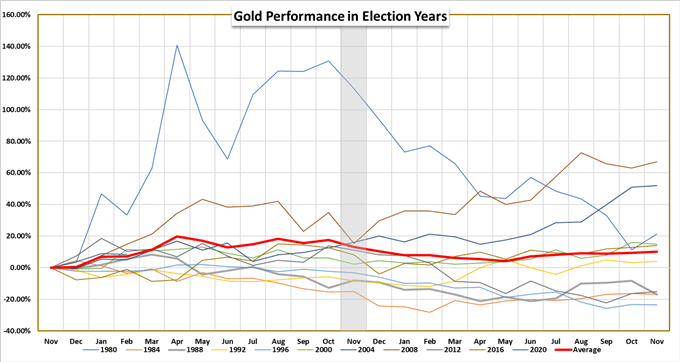

Tracking the performance of gold prices during election years may help to shed some light by looking at the average performance in the year preceding and following elections since 1980. The study reflects the precious metal (red line) rallying at the start of the year, but hitting a peak in the second-half to trend lower in November.

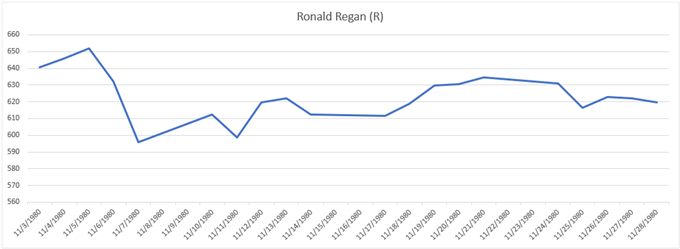

1980 – Ronald Regan (R)

Source: Data from Bloomberg

In 1980, the price of gold hit a high of $850 in January as the Federal Reserve under Chairman Paul Volcker was on course to push US interest rates towards 20% to curb inflation, but the advance from the start of the year was short-lived as the precious metal registered the 1980 low ($482) in March. Bullion recovered to trade above $600 ahead of the November 4 election, but consolidated throughout the remainder of the year to hold around $590 ahead of 1981.

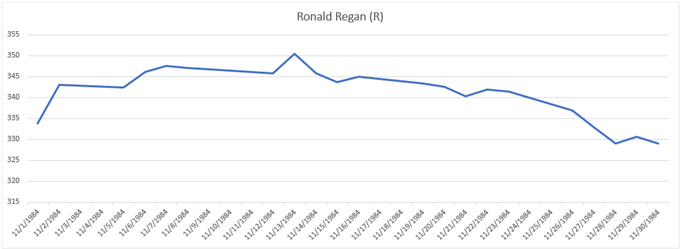

1984 – Ronald Regan (R)

Source: Data from Bloomberg

In 1984, gold prices briefly traded above $400 in March as the Federal Reserve pushed the benchmark interest rate back above 10%, with Chairman Volcker still at the helm after being nominated to serve a second term in 1983. Bullion gradually weakened over the coming months, with the November 6 election doing little to prop up the precious metal even though incumbent Ronald Regan won a second term. In turn, the price of gold continued to drift lower following the 1984 election to register the yearly low ($308) in December.

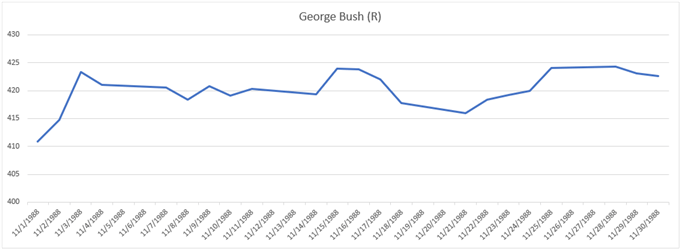

1988 – George Bush (R)

Source: Data from Bloomberg

In 1988, the price of gold registered the yearly high ($482) in January, but dipped below $400 in September as the effective Federal Funds rate increased ahead of the November 8 election, with the US central bank led by Alan Greenspan, who was nominated by Regan in 1987. The victory by Bush did little to sway gold prices, with bullion trading sideways throughout the remainder the year to end 1988 around $410.

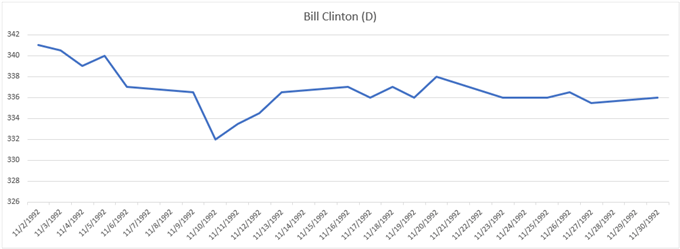

1992 – Bill Clinton (D)

Source: Data from Bloomberg

In 1992, bullion held above $350 until March, with the precious metal weakening throughout the first half of the year even though the Federal Open Market Committee (FOMC) stuck to its rate easing cycle following the recession in the early 1990’s.

Chairman Greenspan continued to cut US interest rates ahead of the November 3 election after being reappointed by Bush in 1991, but the price of gold remained under pressure after Clinton won the presidency, with the precious metal registering the yearly low ($332) just days after the election. Gold traded in a narrow range for the remainder of the year, with bullion ending 1992 around $335.

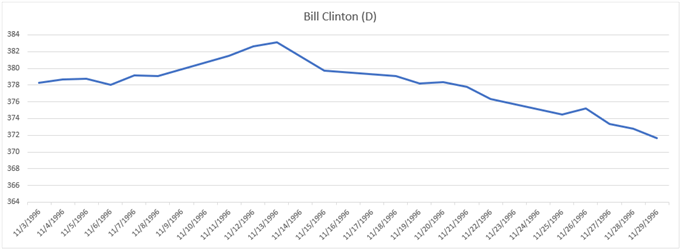

1996 – Bill Clinton (D)

Source: Data from Bloomberg

In 1996, gold climbed above $400 during the first quarter as the Federal Open Market Committee (FOMC) kept US interest rates unchanged, with Chairman Greenspan still at the helm after being reappointed for a third term earlier in the year by Clinton.

However, the price of gold held below $400 throughout the remainder of the year even though Clinton won a second term, with bullion quickly giving back the rebound following the November 5 election to close out 1996 around $368.

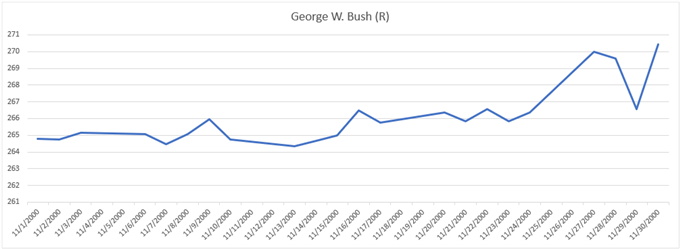

2000 – George W. Bush (R)

Source: Data from Bloomberg

In 2000, the price of gold recovered at the start of the year even though the FOMC continued to embark on its rate hiking cycle from 1999, with the precious metal trading above $300 in February.

However, the price for bullion declined in the incoming quarters even though the FOMC had implemented its last rate hike in May, with the precious metal marking the yearly low ($264) just days after the November 7 election. Gold prices nudged higher over the remainder of the year to end 2000 around $272 as Fed Chairman Greenspan, who was serving his fourth term after being reappointed by Clinton, kept US interest rates on hold.

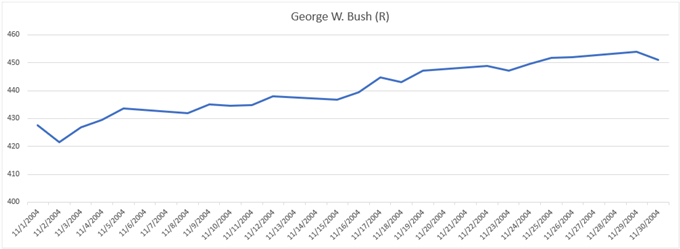

2004 – George W. Bush (R)

Source: Data from Bloomberg

In 2004, the price of gold traded as high as $426 during the first quarter as the Federal Reserve kept US interest rates at 1.00%, but slipped below $400 on numerous occasions ahead of the November 2 election as Chairman Greenspan, who was serving an unprecedented fifth term after being reappointed by George W. Bush, began hiking rates in the second half of the year. Gold prices increased after Bush won his second term, with bullion registering the yearly high ($456) in December.

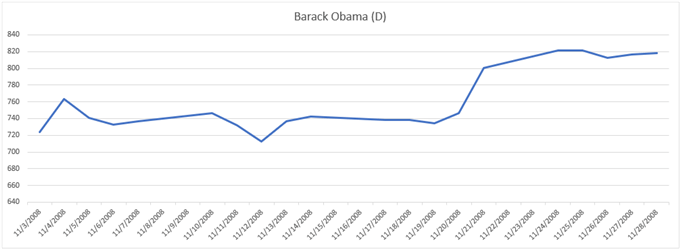

2008 – Barack Obama (D)

Source: Data from Bloomberg

November 4, 2008

In 2008, the price of gold briefly climbed above $1000 in March as the FOMC lowered US interest rates in response to the sub-prime housing crisis, but traded as low as $721 ahead of the November 4 election even as the central bank under Chairman Bernanke delivered two separate rate cuts in October. Gold registered the yearly low ($712) just days after Obama won the election, with bullion recovering throughout the remainder of the year to close out 2008 around $882.

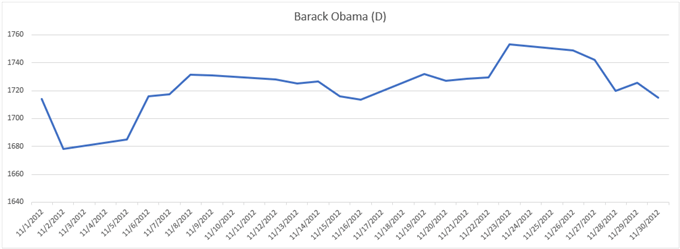

2012 – Barack Obama (D)

Source: Data from Bloomberg

November 6, 2012

In 2012, the price of gold started off the year just above $1600 and pushed as high as $1781 in February, but ended up registering the yearly low ($1540) in May even though the FOMC kept US interest rates close to zero. Gold prices recovered ahead of the November 6 election to trade back above $1700, but the rebound unraveled despite Obama winning a second term as the precious metal ended the year around $1675.

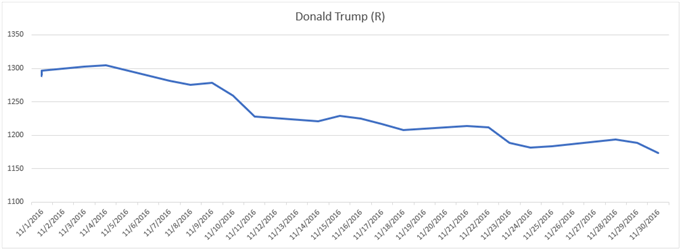

2016 – Donald Trump (R)

Source: Data from Bloomberg

November 8, 2016

In 2016, the price of gold started off the year below $1100 as the FOMC led by Chair Janet Yellen increased US interest rates at the end of 2015, but traded as high as $1366 in July as the central bank kept the Federal Funds rate in a range of 0.25% to 0.50%. However, gold prices slipped below $1300 ahead of the November 4 election, with the victory by Donald Trump doing little to shore up the precious metal as bullion closed out the year around $1148.

2020 – ?

Since the collapse of the Bretton-Woods system, various fundamental factors can be attributed to the changes in the price of gold, but a look at the timeline of the US Presidential election offers little evidence of a linear relationship between bullion and party affiliation even though the precious metal has become more responsive to the macroeconomic environment.

With that said, the study does indicate that gold prices have become more volatile in the 21st century, and it remains to be seen if the trend will hold beyond the 2020 election as the precious metal trades to fresh record highs this year.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals