Does a Relationship Exist Between the S&P 500 and the US Election Outcome?

Beyond policies and history, past data suggests that S&P 500 stock can be used to predict the winner of the US election. The S&P 500 Index has an 87% success rate when it comes to predicting the outcome of an election. As per the data, if stocks are higher three months before the election than they were at the beginning of the year, the incumbent party is likely to win.

Stock performance is a key point addressed in the analysis of each presidency. However, given the impact of COVID-19, can the S&P 500 still be used as a reliable indicator? Are we living in an unprecedented time where previous markers of success no longer apply, or has the pandemic brought issues to light that we’ve seen before?

To answer these questions, we need to look at past presidential races and analyze the factors each incumbent inherited, how they addressed them, and the impact they had on future elections. Within the following sections, we examine the conditions each President faced, how they reacted, and what changed during their time in office. This analysis, in tandem with fluctuations in the S&P 500, can provide a base for predicting the 2020 US election.

- Bush’s Presidency Punctuated by Crisis

- Obama Elected as US Society Demands Change

- Trump’s Tumultuous Ascent to Power

- How are Trump & Biden Planning to Deal with Current Crises?

Bush’s Presidency Punctuated by Crisis

George W. Bush inherited an economy on the brink of collapse when he became US President in 2001. The stock market was reeling from the dot-com bubble, and the terrorist attacks of September 11, 2001, would trigger a war that not only changed the US but the world at large.

Policies to Correct and Issues that Arose: Tax Cuts and War

President Bush made two significant fiscal moves in response to the stock market collapse in the early 2000s:

- The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA)

- The Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA)

The two policies provided relief across the board. However, some analysts have noted that there was key support to high-income households, with the top 1% receiving an effective tax cut of 5% per year.

At the same time that Bush was cutting taxes, he was also directing wars in Afghanistan and Iraq. Following the attacks of September 11, 2001, he authorized the invasion of Afghanistan and, two years later, a second military assault on Iraq. This doubled military expenditure from $300 billion to $600 billion between 2001 and 2008. This increase impacted the US economy and, thus, the S&P 500, but not as significantly as many might assume.

As noted by Leigh et al of the National Bureau of Federal Research (NBER), US markets can be “extremely sensitive to changes in the probability of war.” Following the terrorist attacks of 9/11, the S&P 500 experienced a one-day loss of 4.9%. Leigh et al also note that a 10% rise in the probability of ousting Saddam Hussein caused the S&P 500 to drop 0.5%.

Therefore, it’s possible to say that political changes can be too marginal and temporary to have a long-term effect on the index. While the threat of war does have some impact on the markets, the evidence above doesn’t show an undisputable link between Bush’s military actions and the changing value of the S&P 500. Thus, in purely economic terms, the wars may not have contributed to a decline in public support for Bush.

The Bush Administration in Summary: What Did We Learn?

Although President Bush oversaw one economic expansion, he also presided over two recessions and saw the US debt-to-GDP ratio hit 68%. For investors, it was a shift in speculative fortunes. The stock market when Bush left office was in trouble. Those that stayed the course saw S&P 500 returns drop to -40%.

In looking back over the factors that led to Bush becoming President, economics were the crucial factor. Regardless of how successful his policies were, US voters saw them as a way out of trouble at a time when a major industry – the internet – was collapsing. His response to the 9/11 terrorist attacks was tolerated but may not have been ideal economically or socially. Overall, economic factors were enough to keep Bush in power for two terms. However, by the time his tenure was up, Americans were ready for change.

Obama Elected as US Society Demands Change

Just as Bush inherited a fragile economy, President Barack Obama walked into a financial crisis in 2009. The Great Recession had rumbled on for two years, but Obama hit the campaign trail with one simple message: “Change We Can Believe In.” As well as being seen as a contrast to Bush, Obama was vying to become the first black president in US history.

Policies to Correct and Issues that Arose: A Time for Change

The lead up to Obama’s inauguration is often seen as a time of change both politically and socially. Although his presidency wouldn’t bring an end to the wars overseas, there was hope it would. The US was strained under two recessions and two wars under President Bush. The stage was set for a radical change, and voters believed Obama would bring it.

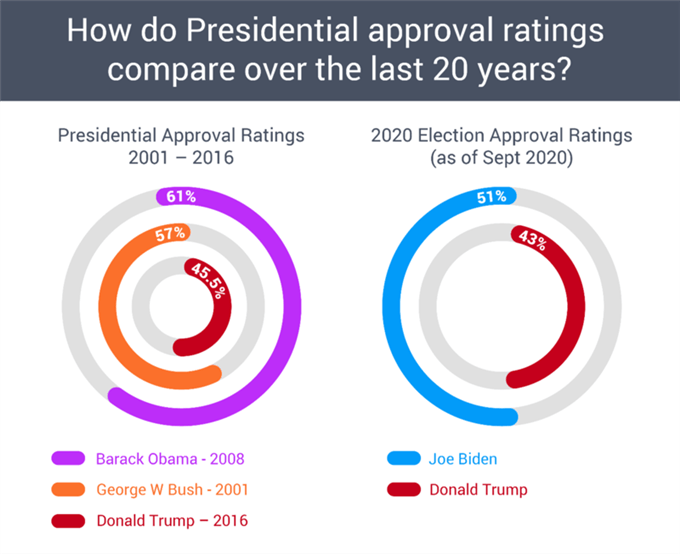

Unlike the Bush years where economics influenced public opinion, societal desires marked the Obama vs. McCain race. Both Obama and McCain were rated as two of the most liked candidates in recent history. An October 2008 Gallup poll saw Obama receive a 61% favorable rating, with McCain a few percent behind at 57%. This could suggest US voters were desperate for a President that could offer a new direction. We can contrast this with a 45.5% approval rating for Donald Trump heading into the 2016 election.

Based on this evidence, we can posit the notion that economics and the US economy were critical factors during the Bush campaign. But by the time Obama came around, public sentiment had shifted towards steadying the ship. Then, when Trump was elected, US voters were back to focusing on economics.

Consumer Confidence, Jobs, and Obama Stock Market Growth

Although Obama’s reputation and style of politics were important, the economy couldn’t be ignored. According to the US Bureau of Labor Statistics, the number of unemployed went from under 5% in December 2007 to 7.2% a year later. During the early stages of Obama’s presidency, unemployment rates rose.

However, by October 2012, just weeks before US voters went to the polls, unemployment had dropped by 8%. This broke the cycle of gains and when polled by NBC News, voters took it as a sign Obama’s economics were turning a corner. This led to a 15-point increase in support, with 42% of people surveyed believing the economy would improve under the incumbent rather than challenger Mitt Romney.

The Obama Administration in Summary: What Did We Learn?

Something we can learn from Obama’s two terms is the interplay between economics and societal factors. When he won his first term, Obama was the face of change: a figure that represented a shift in public opinion and someone that wouldn’t base his policies on hard economics alone. As he fought for a second term, the economy became a greater issue. People needed jobs and they thought of Obama as the man to deliver that.

This sets up an interesting parallel with the world today. Societal factors may not win Donald Trump a second term. However, the issue of jobs might. His America First strategy delivered economic growth up until the COVID-19 pandemic struck in Q1 2020. Now, with US jobless claims reaching record levels (over 830,000 per week in September 2020), voters may side with the candidate that can manage the employment crisis, in much the same way they did with Obama in 2009.

Trump’s Ascent to Power

Unlike his predecessors, Trump didn’t inherit a recession. However, he did walk into an economy under threat, as he saw it, from China. Previous trade deals and the entrance of China into the World Trade Organization (WTO) under Bush meant the US wasn’t the only superpower anymore.

Whether conflict was manufactured or inevitable, Trump based his campaign on reasserting US dominance by bringing businesses back home. Make America Great Again was his mantra. Although the economy was strong, many Americans were unhappy that foreign investors, namely China, had a significant hold over US imports, exports, and national debt.

In 2011, China held $1.3 trillion of US debt. China also controlled 15% of global exports. Trump made this one of the major battlegrounds. He saw China’s dominance as a problem for the economy, a problem Hilary Clinton couldn’t fix, but that he could. This, in many ways, was a major factor that influenced the election.

The Trump Administration in Summary: What Did We Learn?

Trump was elected to office and set his sights on boosting businesses and curbing the influence of China. At home, he implemented tax cuts, particularly for businesses. In 2017, President Trump proposed a corporate tax rate cut from 35% to 20% and the elimination of estate taxes. He also reduced the number of federal tax brackets for individuals from seven to three: 12%, 25%, and 35%. Finally, business income reported on a personal return was taxed at 25%.

At the time he was focused on US businesses, Trump also started his attack on China. The trade war was prompted by a desire to put “America First.” Bringing back manufacturing jobs lost to other countries, including China, was a priority for Trump. Reducing the trade deficit and reestablishing the US as a superpower was always going to sit at odds with the growth of China’s economy.

Trump’s policies were working. Unemployment at the start of 2020 was below 4% and economic growth was similar to the levels witnessed during Obama’s time in office. The S&P 500 also generated returns of more than 50% in the latter part of 2019. However, when COVID-19 struck in March 2020, things took a dive.

How Are Trump & Biden Planning to Deal with Current Crises?

The 2020 presidential candidates will have to deal with a global pandemic. Prior to the COVID-19 outbreak of 2020, President Trump was having a positive impact on the US economy and S&P 500. Up until February 2020, S&P 500 returns under Trump were sitting at 48%. Although they’ve since dipped to 43%, his time in office has been less positive for investors than Obama but more positive than Bush.

However, the Great Shutdown of 2020 has brought three years of economic growth to an end. COVID-19 has resulted in quarantine measures across the US, businesses to file for bankruptcy, and millions of people to lose their jobs. This could hurt any future Trump vs. Obama stock market debates. But, more significantly, it means the winner of the next election will not only have S&P 500 charts to worry about, but social and economic issues also.

COVID Hits All Areas of Life

Between March 21 and May 28, 40 million US citizens filed for unemployment insurance. Trump responded by signing a $2 trillion stimulus package dubbed the Coronavirus Aid, Relief, and Economic Security Act (CARES). By August 2020, real GDP was 4% lower than when Trump got into office. However, the Trump stock market swing was in full effect as indexes were 54% higher. Indeed, even though the S and P 500 fell by 34% when COVID-19 struck, it has since recovered and reached record highs.

The recovery is due, in large part, to the technology sector. Energy and financials have fallen 37% and 20%, respectively, in 2020. In contrast, the S&P’s tech sector has grown by 25%. This rise has been helped by the performance of Amazon and Apple during the lockdown. The tech surge, coupled with stimulus measures overseen by President Trump, has enabled the US economy to rebound. Although the crisis is far from over, 1.37 million jobs were added in August 2020, taking the unemployment rate from 10.2% in July to 8.4%.

The US Presidential Race is a Complex Equation

Society and economics have a history of swinging US elections. The Bush years were mainly characterized by economic issues. Although his approval rating was lower than other Presidents, there was something in his policies that brought voters back. Bush may not have solved the financial problems but there was a sense the country was emerging from them. This prompted voters to focus more on societal issues. In that climate, Obama embodied the idea of change.

When his time was up, economics once again became an issue. Trump capitalized on this. Like Obama, he was a President of change. However, his change involved aggressive policies in a bid to bolster the economy. That struck a chord with voters. Is it time for another change? Do voters lean more towards economic stability or societal stability? At a time of major issues, this is the key question. It seems the issues voters relate to more could determine who becomes the next US President.

Written by the DailyFX Research Team

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals