The forex markets are rather quiet in Asian session today. With some European markets and Canada on holiday, trading will likely remain subdued for the day ahead. Yen is trading mildly firmer, as near term consolidations are extending. Meanwhile, Australian Dollar and Canadian Dollar are the slightly softer ones.

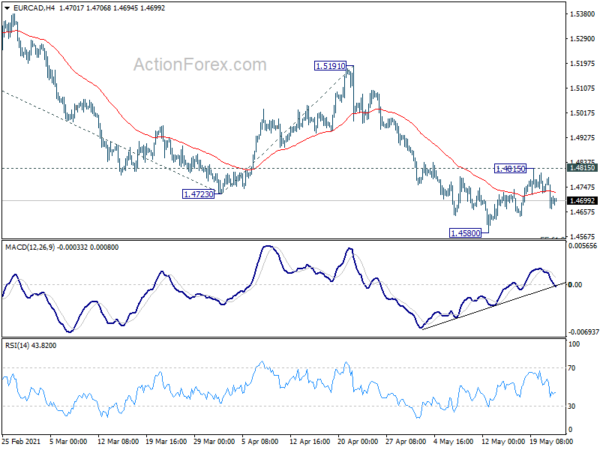

Technically, Canadian Dollar might be a focus in the next few days. Last week’s retreat in the Loonie lost momentum rather quickly, while oil price appears to have stabilized above 62 handle. EUR/CAD could try for another take on 1.4580 temporary low and break there will resume larger down trend. But that might also depend on whether USD/CAD could draw enough support from 1.2061 key long term level to stage a bullish reversal.

In Asia, at the time of writing, Nikkei is up 0.26%. Hong Kong HSI is down -0.41%. China Shanghai SSE is up 0.16%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is up 0.0010 at 0.084.

New Zealand retail sales rose 2.5% qoq in Q1

New Zealand retail sales rose 2.5% qoq in Q1, much better than expectation of -1.8% qoq. 10 of the 16 regions showed higher sales values. Ex-auto sales rose 3.2% qoq, also well above expectation of -1.0% qoq.

Electrical and electronic goods had the largest increase, up 8.4 percent followed by recreational goods, up 16 percent in the March 2021 quarter.

“Higher spending in the electrical industry coincides with falling prices for computers and phones during the first quarter of 2021,” retail business manager Sue Chapman said.

NZD/JPY and NZD/USD soften but stay above near term support

New Zealand Dollar weakens mildly today despite much stronger than expected retail sales data. While RBNZ rate decision is a focus this week, it’s unlikely to provide any market moving surprises. Kiwi is currently just following broad market developments.

NZD/JPY edged higher to 79.40 earlier this month, but quickly retreated. There is no confirmation of bearish reversal yet. But upside momentum was clearly diminishing as seen in both 4 hour and daily MACD. Sustained break of 77.68 support will also have 55 day EMA firmly taken out. That would argue that NZD/JPY is already in correction to, at least, the rise from 68.86. Deeper decline could be seen back to 75.61 support and possibly below. Nevertheless, rebound from current level would retail near term bullishness for another high above 79.40 first.

NZD/USD weakened after hitting 0.7304. Sustained break of 0.7114 support will also have 55 day EMA firmly taken out. That would suggest that recovery from 0.6942 has completed. Corrective pattern form 0.7463 should have then started the third leg. Deeper fall could then be seen through 0.6942 support to 0.6797 resistance turned support and below, to correct whole up trend from 0.5469. Nevertheless, strong rebound from current level, followed by break of 0.7304, will bring retest of 0.7463 high next.

RBNZ to stand pat, US data to take center stage in light week

RBNZ is widely expected to keep monetary settings unchanged this week. OCR will be held at 0.25%. The central bank might acknowledge mildly positive developments recently. The new “unconstrained OCR” might hint at a hike from 2023. But that’s still later than marker pricing of mid to late 2022. Also, RBNZ would likely maintain that it’s still prepared to lower the OCR if required.

The economic calendar is relatively light. US data will take center stage towards the end of the week with durable goods orders, jobless claims and PCE inflation featured. Elsewhere, German Ifo business claims will likely be mostly watched. Here are some highlights for the week:

- Monday: New Zealand retail sales.

- Tuesday: Australia goods trade balance; Germany GDP final, Ifo business climate: UK public sector net borrowing; US house price index, consumer confidence, new home sales.

- Wednesday: Japan corporate service price index; New Zealand trade balance, RBNZ rate decision; Swiss Credit Suisse economic expectations.

- Thursday: Australia private capital expenditure; Swiss trade balance; Germany Gfk consumer climate; US GDP revision, durable goods orders, jobless claims, pending home sales.

- Friday: Japan unemployment rate, Tokyo CPI core; Germany import prices; France GDP, CPI, consumer spending; Swiss KOF economic barometer; US goods trade balance; personal income and spending; Chicago PMI

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2031; (P) 1.2063; (R1) 1.2098; More…

Intraday bias in USD/CAD remains neutral at this point. We’d continue to stay cautious on strong support from 1.2048/61 cluster level to bring reversal. On the upside, break of 1.2201 resistance will indicate short term bottoming and turn bias to the upside for stronger rebound. However, sustained break of 1.2048/61 will carry larger bearish implications. Next near term target will be 161.8% projection of 1.2880 to 1.2363 from 1.2653 at 1.1816.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). We’d look for strong support from 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048 to bring rebound. Nevertheless, sustained break of 1.2363 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound. Also, sustained break of 1.2061 will pave the way to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | 2.50% | -1.80% | -2.70% | -2.60% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | 3.20% | -1.00% | -3.10% | -2.90% |

| 12:30 | USD | Chicago Fed National Activity Index Apr | 1.71 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals