So far, so good, where Tuesday’s bullish breakout on the FTSE is concerned. And equities were a touch higher overnight ahead of key US data later today.

Asian Indices:

- Australia’s ASX 200 index rose by 46.3 points (0.64%) and currently trades at 7,264.10

- Japan’s Nikkei 225 index has risen by 130.54 points (0.45%) and currently trades at 29,074.76

- Hong Kong’s Hang Seng index has fallen by -117.69 points (-0.4%) and currently trades at 29,179.93

UK and Europe:

- UK’s FTSE 100 futures are currently up 18.5 points (0.26%), the cash market is currently estimated to open at 7,126.50

- Euro STOXX 50 futures are currently up 6 points (0.15%), the cash market is currently estimated to open at 4,094.50

- Germany’s DAX futures are currently up 27 points (0.17%), the cash market is currently estimated to open at 15,629.71

US Futures:

- DJI futures are currently up 6 points (0.02%), the cash market is currently estimated to open at 34,581.31

- S&P 500 futures are currently up 14.25 points (0.1%), the cash market is currently estimated to open at 4,222.37

- Nasdaq 100 futures are currently up 2.25 points (0.05%), the cash market is currently estimated to open at 13,678.04

Equities remain cautiously optimistic

China’s services PMI expanded at a slightly slower pace of 55.1, down from 56.3% prior but this number isn’t exactly anything to be alarmed by. Traders are mostly waiting for data from the US today ad tomorrow, which includes monthly ADP national employment report alongside the weekly initial jobless claims. The ADP is often seen as a precursor to nonfarm payroll (released tomorrow) so if there is a large deviation away from forecasts today, it can move markets as though it was NFP. ISM services and Markit PMI reports are also scheduled for today.

Asian equities were cautiously higher overnight ahead of tomorrow’s nonfarm payroll report. MSCI’s APAC (ex-Japan) rose 0.3% and sits just beneath its 3-month high and Japan’s Nikkei 225 added a further 0.4%.

4069 – 7074 is pivotal for the FTSE 100

Heavyweight energy and banking stocks helped push the FTSE 100 to a three-week high yesterday and close above 7100, closing higher for a second day after breaking out of is symmetrical triangle on the daily chart. (Not quite as impressive as the FTSE 50’s record high, but it will do).

Yesterday’s intraday price action appears to be corrective, so we remain bullish with a view for it to eventually target 7200 (a measured move form its triangle breakout). We see 7069 – 7074 as a pivotal area for bulls to defend over the near-term, as a break beneath it could see some bearish follow-through. Until then low volatility retracements towards it are of interest to ‘dip’ traders and a break above yesterday’s high assumes bullish continuation. 7090 is also a level for intraday traders to monitor as it is the POC (point of control, where most of yesterday’s trading action took place).

FTSE 350: Market Internals  FTSE 350: 7108 (0.39%) 02 June 2021

FTSE 350: 7108 (0.39%) 02 June 2021

- 201 (57.26%) stocks advanced and 131 (37.32%) declined

- 38 stocks rose to a new 52-week high, 1 fell to new lows

- 85.19% of stocks closed above their 200-day average

- 26.21% of stocks closed above their 20-day average

Outperformers:

- + 4.09% – Helios Towers PLC (HTWS.L)

- + 4.04% – Hammerson PLC (HMSO.L)

- + 3.57% – C&C Group PLC (GCC.L)

Underperformers:

- -4.26% – Greencore Group PLC (GNC.L)

- -3.44% – Trainline PLC (TRNT.L)

- -3.04% – Capita PLC (CPI.L)

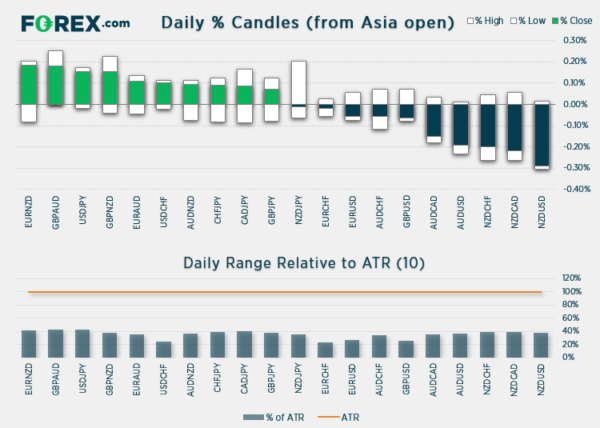

Forex: Ranges remains low ahead of key economic data

Trading ranges were tight overnight, although NZD and JPY are the weakest and USD is the strongest. The US dollar index (DXY) is just 0.08% higher, to put these overnight moves into perspective.

A second bullish pinbar formed on EUR/USD yesterday which also respected the 20-day eMA as support. We’d like to think this may signal a bullish breakout is in the pipeline but we’d need to see a breach 1.2266 first (currently around 70 pips away). So we could be in for another choppy session.

EUR/CAD continues to look like it wants to roll over. It just hasn’t done it yet. If we don’t get any real movement today perhaps will tomorrow, where the most bearish scenario for this pair would be strong employment reports for the US and Canada.

CAD/JPY is teasing its three-year high. A break above 91.20 brings the January 2018 high into focus (81.58). Should no catalyst allow such a move, we may be in for a range-trading session, in which case bears could target yesterday’s lows.

Commodities: Oil prices march higher

Oil prices edged higher with WTI currently up 0.55% and brent rising over 1%, keeping them both at their highest levels in over one year. With fundamentals and technicals supportive of its bullish trend then it a market that has favoured vanilla breakout and ‘dip’ strategies of late.

Silver printed a bullish engulfing candle yesterday after a failed attempt to break beneath its bullish channel. We really need to see prices rally (and hold) above 28.32 to regain confidence in it bullish trend, as silver has printed two reversal candles back below this key level over the past two weeks. A beneath yesterday’s low invalidates the bullish bias and a break beneath 27.20 switches us to a bearish bias.

Gold is currently 0.25% lower but downside momentum is already waning, suggesting that bulls will try and defend 1900 today.

Up Next (Times in BST)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals