Canada will announce its inflation data for the month of May at 12:30 GMT on Wednesday. Global economic activity is picking up as COVID-19 incidences decline in many nations and vaccine coverage rises. However, growth is still uneven across the country. Will the loonie move higher again after a couple of days of losses?

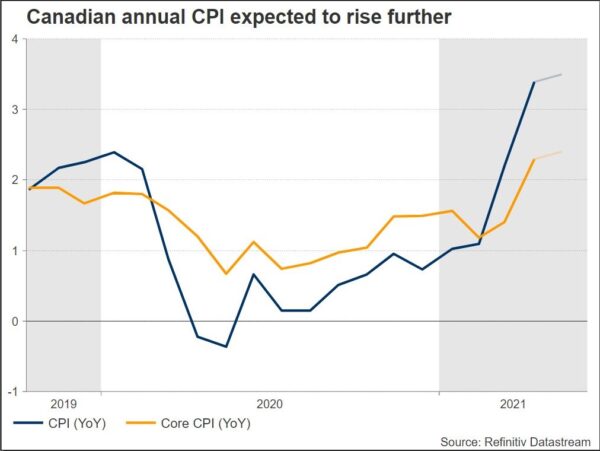

Annual CPI is forecast to tick higher

The projection for the monthly CPI is for it to fall to 0.4% in May from 0.5% in the prior month. The annual inflation rate is predicted to rise to 3.5% from 3.4% before, holding well above the 2.0% midpoint target. The previous reading was the strongest since May 2011.

Because of base-year impacts and considerably higher fuel costs, CPI inflation has climbed to roughly the top of the 1-3% inflation-control zone, as expected. Core inflation has risen as well, owing mostly to temporary reasons, albeit by a far smaller amount than CPI inflation. While CPI inflation is predicted to hover near 3% through the summer, it is forecast to moderate later in the year as base-year benefits fade and surplus capacity exert downward pressure.

Economy shows some recovery despite new variants

Economic events in Canada have mostly followed the forecast in the April Monetary Policy Report (MPR). In the second wave of the coronavirus pandemic, GDP growth in the first quarter was strong 5.6% on a yearly basis. While this was lower than the Bank had predicted, the underlying facts show increased confidence and strong demand. Household spending was higher than projected, but business spending was lower than expected. Workers in contact-sensitive industries have once again been the hardest hit, according to recent jobs data.

The Canadian economy is anticipated to significantly bounce this summer, powered by consumer spending, as immunizations progress at a faster pace and provincial control restrictions ease. Despite advancements in immunization, the emergence of novel Covid-19 variants remains a source of concern. The risks to the inflation outlook mentioned in the April MPR remain relevant in a broader sense.

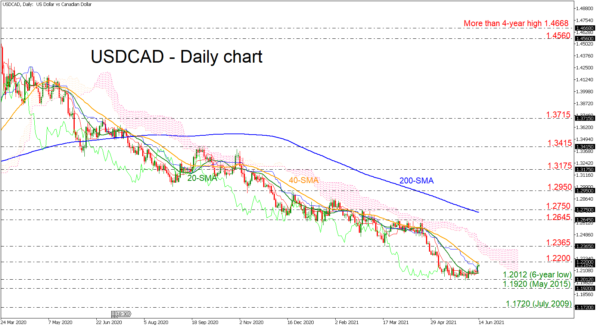

Technical View: Dollar/loonie shows some improvement

Turning to FX markets, dollar/loonie has been gaining some ground over the last couple of sessions, remaining near the six-year low of 1.2012. If the numbers beat expectations, they could strengthen the Canadian currency, pushing the dollar/loonie pair lower towards 1.2012 and the 1.1920 support, reached in May 2015.

On the flip side, disappointing CPI figures could see the pair re-challenge the resistance around the 40-day simple moving average (SMA) at 1.2200 ahead of the 1.2365 barrier. Beyond that obstacle, the way would open towards1.2645 and then up to the 200-day SMA around the 1.2750 line.

Furthermore, oil prices could help the commodity-dependent loonie gain ground as the WTI crude price is moving higher around $71.30/barrel.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals