Well, the Fed didn’t wait for the Jackson hole symposium to turn hawkish (from a very dovish base), sending equities, commodities lower and the US dollars higher.

Asian Futures:

- Australia’s ASX 200 futures are up 6 points (0.08%), the cash market is currently estimated to open at 7,392.20

- Japan’s Nikkei 225 futures are up 70 points (0.24%), the cash market is currently estimated to open at 29,361.01

- Hong Kong’s Hang Seng futures are down -162 points (-0.57%), the cash market is currently estimated to open at 28,274.84

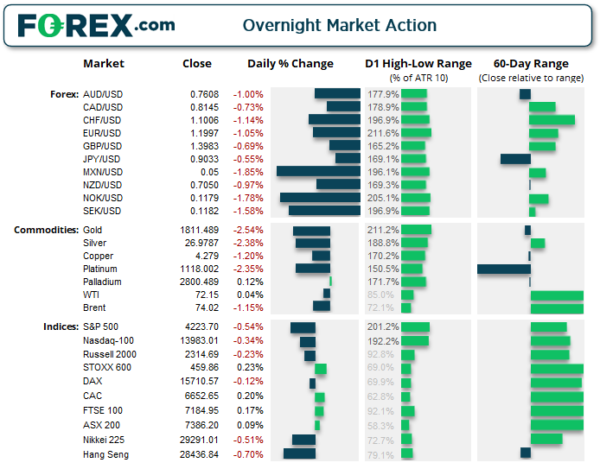

UK and Europe:

- UK’s FTSE 100 index rose 12.47 points (0.17%) to close at 7,184.95

- Europe’s Euro STOXX 50 index rose 8.24 points (0.2%) to close at 4,151.76

- Germany’s DAX index fell -18.95 points (-0.12%) to close at 15,710.57

- France’s CAC 40 index rose 13.13 points (0.2%) to close at 6,652.65

Wednesday US Close:

- The Dow Jones Industrial fell -265.66 points (-0.77%) to close at 34,033.67

- The S&P 500 index fell -22.89 points (-0.54%) to close at 4,223.70

- The Nasdaq 100 index fell -47.396 points (-0.34%) to close at 13,983.01

FOMC Recap: Hawkish dot plot flummoxes Fedwatchers

With the Fed’s dot plot now anticipating two interest rate hikes by 2023 and staff projections upgrading growth and CPI whilst lowering unemployment, it’s fair to say the market wasn’t fully expecting such a turnaround by the Fed. Powell said later in the press conference that inflation will remain elevated in the ‘coming months’ before moderating, which could be transitory or could be higher than they’d like. We’ll see.

Needless to say, Wall Street closed lower with all major indices exceeding their ATR(10). The S&P 500 fell -0.5% and the Nasdaq was down -0.34%. The Nasdaq’s housing index fell -1.3%, semiconductors shed -0.8% and biotech stocks were down -0.76%. Banking stocks however rallied 1.3% on the prospects of their profits not being eternally squeezed with low interest rates.

Still, futures markets across Europe and parts of Asia have opened slightly higher, so perhaps we’re not necessarily in for a bloodbath in Asia today, although we’d expect upside may be more limited than if the Fed had remained dovish.

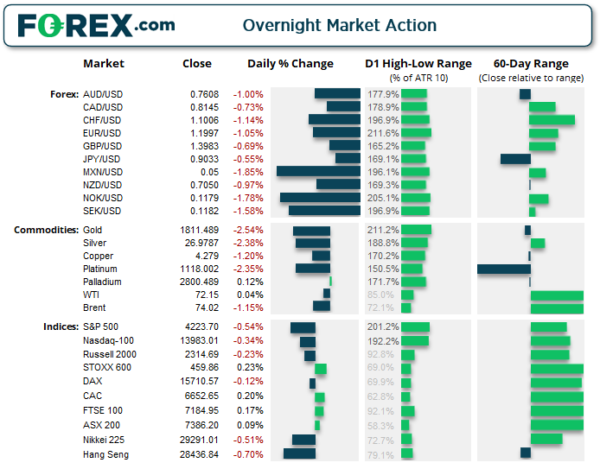

The ASX 300 metals sector fell -1.9% yesterday both gold and copper headed lower ahead of last night’s FOMC meeting. We expect this sector to remain under heavy pressure today thanks to lower gold, silver and copper prices. However, a small bearish hammer formed on the daily chart of the ASX 200 yesterday, outside the upper Keltner band to warn of exhaustion to the upside. Odds don’t favour continued gains from here and may mark a pause in trend or beginning of a retracement.

ASX 200 Intraday S/R

- R3: 7420

- R2: 7412

- R1: 7706.20

- Pivotal: 7392.6

- S1: 7386.2

- S2: 7372.4 – 7374

- S3: 7365

- S4: 7350

ASX 200 Market Internals:

ASX 200: 7386.2 (0.09%), 16 June 2021

- Healthcare (0.46%) was the strongest sector and Materials (-1.56%) was the weakest

- 8 out of the 11 sectors outperformed the index

- 9 out of the 11 sectors closed higher

- 91 (45.50%) stocks advanced, 97 (48.50%) stocks declined

- 21 hit a new 52-week high, 1 hit a new 52-week low

- 74.5% of stocks closed above their 200-day average

- 71.5% of stocks closed above their 50-day average

- 76% of stocks closed above their 20-day average

Outperformers:

- + 3.62% – Pro Medicus Ltd (PME.AX)

- + 2.87% – Ingenia Communities Group (INA.AX)

- + 2.78% – Washington H Soul Pattinson and Company Ltd (SOL.AX)

Underperformers:

- -6.69% – OZ Minerals Ltd (OZL.AX)

- -5.80% – Nuix Ltd (NXL.AX)

- -5.66% – Austal Ltd (ASB.AX)

Forex: AUD/JPY breaks lower, AU employment up next

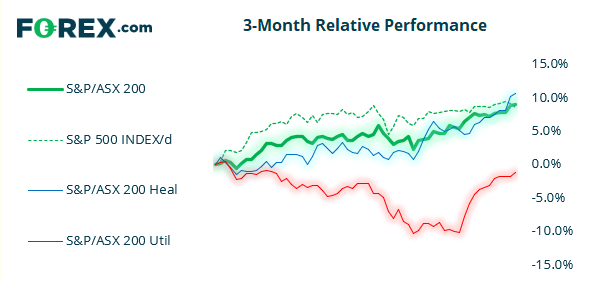

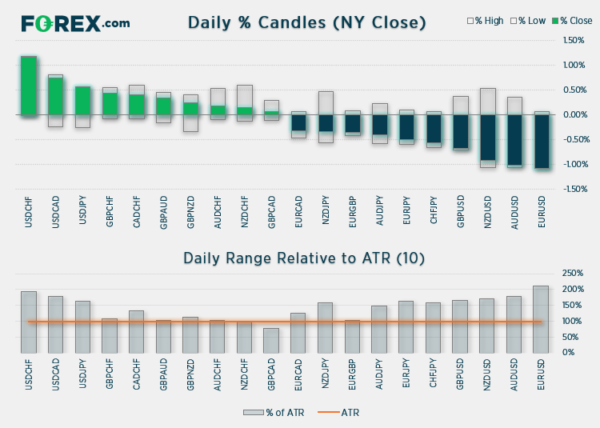

For the first time in what feels like a while, the US dollar was the strongest major currency with all major pairs exceeding their ATR (average true range) by up to two times their usual daily range.

The US dollar index rallied 0.65%, putting it on track for its most bullish week in three-months. It has closed above its 100-day and 200-month eMA and probed the 91.40 resistance level seen in yesterday’s video. It has also pared most of last month’s losses, so short covering and long initiation certainly took over yesterday.

- EUR/USD sliced through 1.2000 like butter and is just shy of probing the May low at 1.1984.

- After a minor pullback ahead of the meeting, USD/CAD exploded to a six-week high, beyond the 38.2% Fibonacci ratio and stopped just shy of the 1.2290 – 1.2300 target zone.

- USD/JPY rose over 0.5% to a two-month high.

- GBP/USD is back below 1.4000.

AUD/JPY finally made a decisive breakout (to the downside) after probing resistance around 85.00 before closing beneath trend support and the 84.30 resistance. The downside break was the original bias but admit it did begin to look like it may challenge the upside resistance zone. From here, our bias remains bearish beneath yesterday’s high, although the broken trendline and 84.30 resistance level can also be used to fine tune resistance or seek bearish entries should bearish patterns emerge around them.

AU employment is up at 11:30 AEST and a weaker-than expected report could be beneficial for the downside.

Commodities: Metals slumped in the hawkish environment

Not only did the strong dollar take its toll on metal prices but, but the prospects of stimulus potentially being removed added another blow to metals as it had been a supportive feature of its rally over the past year.

Gold endured its second most bearish session this year, falling -2.54% and falling over -$50 to a low of 1803.68. Silver also rolled over to fall -2.38% and trade briefly below 36.72 support. Copper prices fell a further -1.9% overnight (following it -4.3% yesterday) to take its losses from the May peak to -12.7%. Bearish momentum for platinum futures finally picked up to see prices at a 3-month low, stopping just shy of our initial target at 1110.

Oil prices were also lower with WTI printing a bearish Doji below 73.25 resistance, suggesting it could be entering a period of consolidation in a stronger-dollar environment.

Up Next (Times in AEST)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals