Summary

United States: The U.S. Economy Continues to Push Through Supply-Side Headwinds

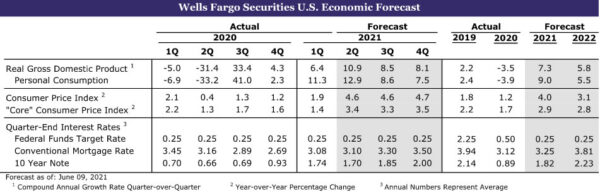

- During May, retail sales pulled back 1.3%, while industrial production rose 0.8%. Housing starts improved 3.6% in May, but the NAHB/Wells Fargo Housing Market Index slipped two points to 81 in June. The PPI for final demand advanced 0.8% in May. The FOMC made no major changes to monetary policy.

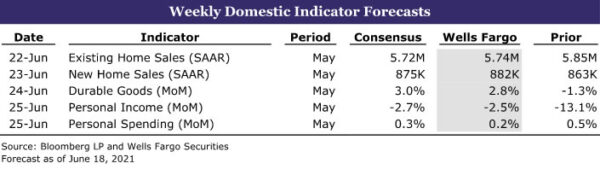

- Next week: Existing Home Sales (Tues.), Durable Goods (Thurs.), Personal Income & Spending (Fri.)

International: China’s Economy Shows Signs of a Slowdown; Brazilian Central Bank Lifts Rates Again

- This week, Chinese activity indicators revealed the economy is decelerating and the economic outperformance exhibited throughout 2020 may be starting to fade. Also, the Brazilian Central Bank raised policy rates another 75 bps and signaled additional tightening is very likely at its next meeting.

- Next week: Eurozone PMIs (Wednesday), Bank of England (Thursday), Central Bank of Mexico (Thursday)

Interest Rate Watch: The “Dot Plot” Shifts Up

- The Federal Open Market Committee (FOMC) met on June 15-16, and as widely expected, it made no substantive policy changes. But the meeting was consequential because of the signaling that the committee provided through its “dot plot.”

Topic of the Week: U.S. and E.U. End Aircraft Dispute to Form United Front Against China

- The 17-year stalemate between the United States and the European Union over aircraft subsidies finally came to an end (at least for now) on Tuesday as both parties decided to suspend related tariffs for the next five years.

U.S. Review

The U.S. Economy Continues to Push Through Supply-Side Headwinds

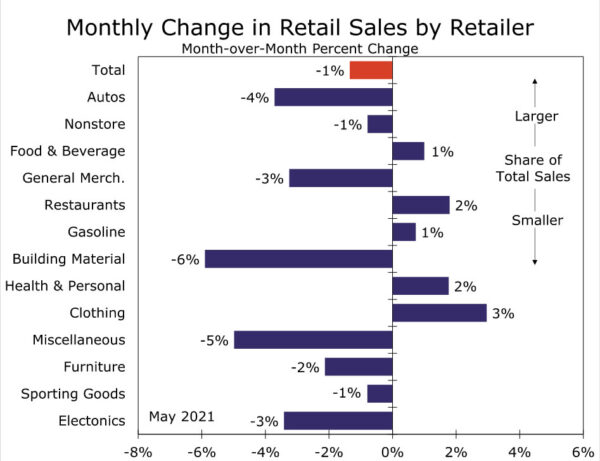

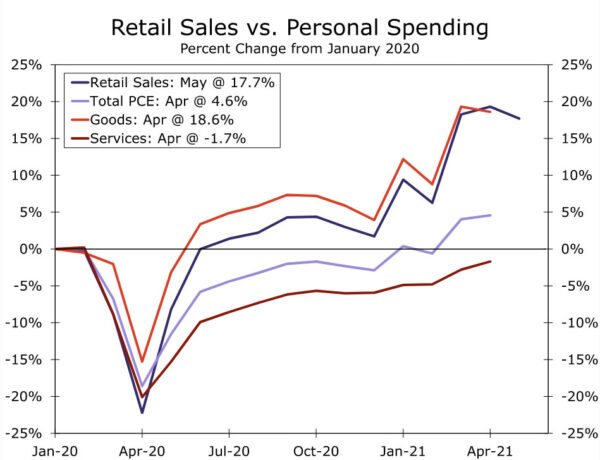

A busy week of economic data releases began with a look at retail sales during May. Retail sales fell 1.3% during the month. The magnitude of the decline in sales was a bit more than anticipated; however, positive revisions to April’s sales cushioned the blow. The dip in sales for the month is largely explained by consumers redirecting their spending away from the cars, home furnishing and other “stay-at-home” goods toward the high-contact services that have now been unlocked by vaccinations.

Put another way, retailers that generally performed the best throughout the pandemic posted the largest declines in May. For example, spending at motor vehicles & parts dealers, which represents the largest category of retail sales, posted a sharp decline, while sales at building materials & supply stores also pulled back. On the other hand, spending at restaurants, gas stations, health & personal care retailers and clothing stores all climbed higher during the month. Thus, the dip in retail sales during May is actually consistent with our view that consumers flush with cash and savings are venturing back out into the economy, which will ultimately drive consumer spending to historically strong rates of growth this year.

Elsewhere, industrial production continues to get back on track. During May, industrial production beat expectations and rose 0.8%. Mining production posted a solid improvement alongside the pickup in energy prices and oil and gas drilling activity. The outturn in overall production, however, was mostly owed to a sturdy rise in manufacturing production, which comprises about three-quarters of all industrial output. Considering the exceptionally strong consumer demand environment, industrial production would likely have been even stronger were it not for pervasive supply-chain bottlenecks, which have made procuring everything from raw materials to labor a challenge for most producers.

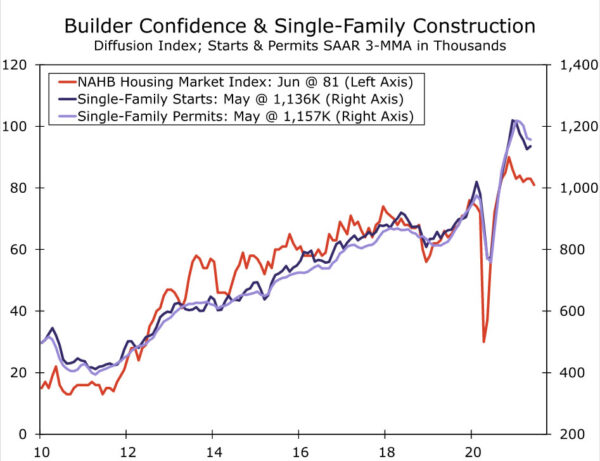

Home builders are dealing with their own set of supply-side issues. Total housing starts rose 3.6% to a 1.57 million-unit pace during May. Demand for single-family homes, townhomes, condos and apartments remains strong; however, building material pricing and availability have led to project delays and have become an obstacle for new development. Total building permits declined in May, with both single-family and multifamily permitting declining during the month. Similarly, the NAHB/Wells Fargo Housing Market Index fell two points to 81 in June. Overall, builders remain upbeat, but difficulties obtaining materials and soaring costs are clearly starting to weigh on confidence.

Meanwhile, inflationary pressures generated by these widespread supply constraints continue to heat up. The Producer Price Index (PPI) for final demand increased 0.8% in May, pushing the index up 6.6% over the past year. Higher food and energy costs pushed goods prices up, while prices in the larger service sector continued to surge higher. Prices for unprocessed goods for intermediate demand jumped during the month, which is an indication that prices further back in the pipeline are also on the rise.

Mounting inflationary pressures have not yet moved the Fed to make any major changes to monetary policy. The FOMC met this week and maintained its target range for the fed funds rate between 0.00% and 0.25%. The committee also did not alter its monthly pace of asset purchases (for more on the FOMC meeting, please see Interest Rate Watch). Rising inflation and supply-side issues notwithstanding, the U.S. economy continues to strengthen. The Leading Economic Index (LEI) rose another 1.3% in May after reaching its first post-COVID high in the prior month. Yet another improvement in the LEI is consistent with our expectation for a robust 7.3% real GDP growth rate this year, which, if realized, would be the fastest year of growth since 1951.

U.S. Outlook

Existing Home Sales • Tuesday

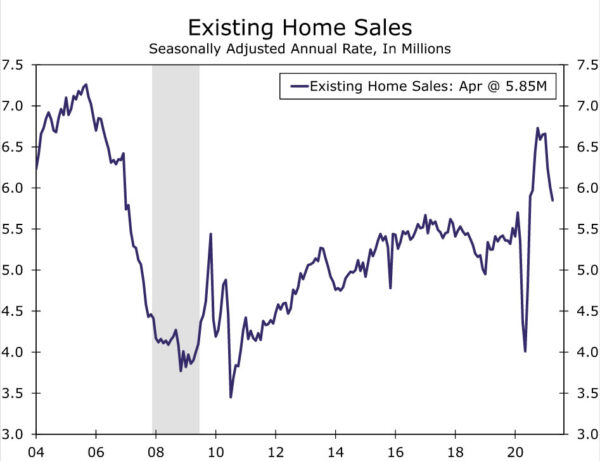

Existing home sales have slipped over the past few months, despite still seemingly strong demand, as a lack of homes for sale has limited transactions. The pipeline for new homes has thinned, as builders have been unable to secure the necessary labor and materials to move forward with projects as fast as they would like. This dearth of new homes for sale and concerns about showing one’s home during a pandemic, among other factors, have held back resales.

How much of the pandemic-induced boost to home buying and reluctance of homeowners to put their homes on the market will carry over to the spring and summer remains a big unknown for the housing market. We expect more homeowners to put their homes on the market this summer to take advantage of the one of the best seller’s markets there has even been. We do not expect to see the supply-demand imbalance to correct itself in next week’s release and forecast sales to declined roughly 2% to a 5.74 million-unit pace.

Durable Goods • Thursday

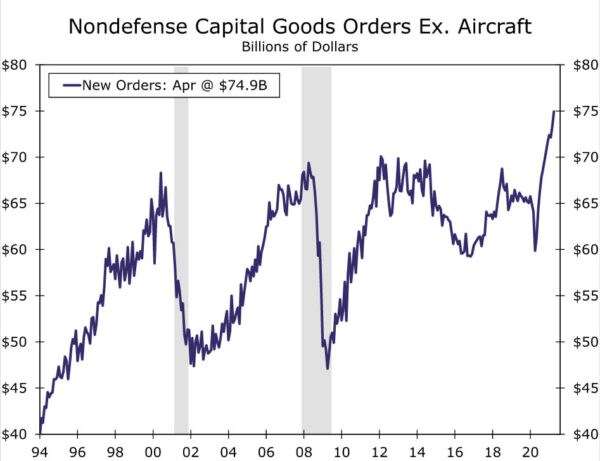

Durable goods orders fell 1.3% in April, due to ongoing issues in the auto sector and a sharp decline in defense spending. Excluding transportation, orders were up 1.0% in April, building on the prior month’s jump. We expect this pattern to reverse some in May and look for headline orders to bounce back 2.8%, with ex. transportation up a more modest 0.6%.

Beneath these headlines figures, it is clear that business investment spending remains strong. Rather than decelerating after the mechanical rebound off last year’s lows, core capital goods order growth has accelerated over the past two months, as businesses try to scale up to ease capacity constraints. Going forward, producers’ inability to fulfill these orders could restrain the pace of growth, but we continue to expect a strong year for business investment.

Personal Income & Spending • Friday

Retail sales declined 1.3% in May. While this may seem to be a bad omen for next week’s personal spending figures, it likely reflects the shifting profile of consumer spending from stay-at-home to reopening. Over the past year, consumers have largely been buying things that they can enjoy from home, while spending on services has fallen by the wayside. As the economy reopens and life trends toward normal, some retailers (e.g., health & personal and clothing) may see a pickup in sales, but the biggest winners are likely to be the service providers (e.g., gyms, transportation and recreation services). Due to this dynamic, May’s weak retail sales print has not dislodged our view that overall spending will strengthen in May and over the summer.

Next week’s personal income and spending report will also bring the latest number for what is often cited as the Fed’s preferred measure of inflation, the core PCE deflator. We expect to see another strong monthly print with both headline and core rising 0.5%, which would bring the year-over-year core PCE deflator to 3.4%. While it seems clear that inflation is here, it remains uncertain how high inflation will run and for how long. In our view, the primary factors responsible for pushing up prices, such as reopening adjustments and supply-chain bottlenecks, will ease over time, but we will be parsing May’s report for jumps in other categories that could prove more persistent. For more on how the FOMC is responding to this pickup in inflation, please see our Interest Rate Watch.

International Review

China’s Economic Outperformance Is Fading

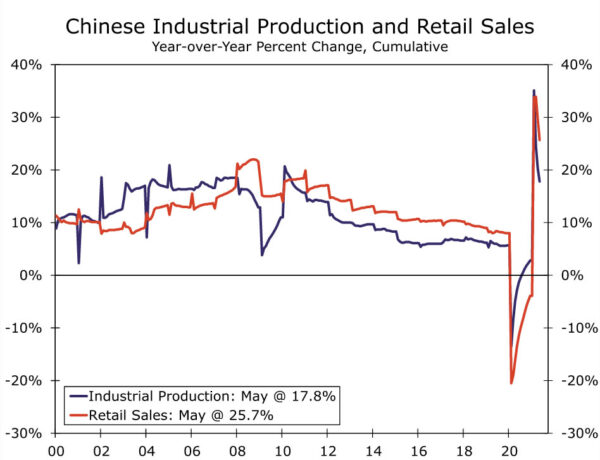

For most of the COVID crisis, China’s economy has outperformed most developed and emerging markets. Aside from being the only major economy to record positive growth in 2020, China has been able to avoid a second wave of infections and renewed lockdown restrictions that have plagued most of emerging Asia this year. Despite not experiencing any major COVID-related disruptions, China’s economy showed additional signs of decelerating this week. May industrial production and retail sales underperformed relative to consensus forecasts, while fixed asset investment and capital spending data also fell short. We have highlighted that leading indicators in China have been softening the past few months and noted risks around our 2021 GDP forecast were tilted to the downside. With additional evidence of a slowdown, it is likely we pull the trigger on a downward revision to our GDP forecast at our next update.

As of now, we forecast China’s economy to expand 9% this year. Over the next few weeks, we will be re-evaluating our forecast and could see a downward revision closer to 8.5%. Given China’s influence within the global economy, a slower growth expectation would likely contribute to a slower pace of global GDP growth as well. For now, we forecast the global economy to expand 6.3%. Even with a downward revision to China GDP, the global economy is still likely to grow at the fastest pace of global growth in decades.

Brazilian Central Bank Hikes Again

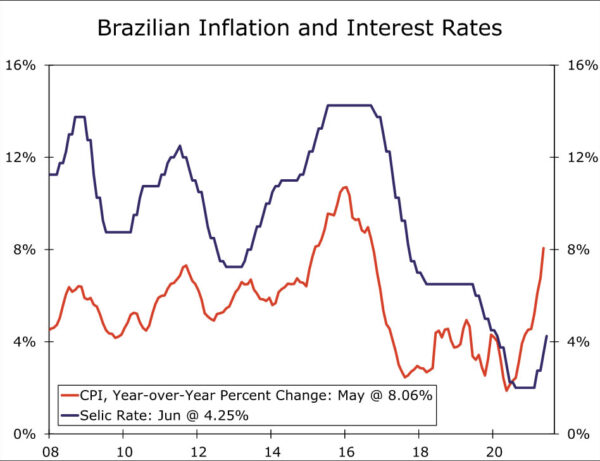

With the Fed garnering a lot of attention this week for being more hawkish than expected, the Brazilian Central Bank (BCB) also hosted a hawkish monetary policy meeting of its own. This week, the BCB raised its Selic rate another 75 bps to 4.25%, the third straight 75-bp rate hike from Brazil’s central bank. Just this year, the BCB has raised the Selic rate a cumulative 225 bps and has arguably become the most hawkish of the major central banks. Brazilian policymakers signaled monetary tightening is far from over as the BCB telegraphed at least another 75-bp rate hike at its next meeting in early August.

Elevated inflation is to blame for the BCB’s aggressive tightening cycle; however, despite sharp interest rate hikes, there may be little the BCB can do in the short term to halt price growth. Higher commodity prices, a severe drought and government fiscal stimulus were all cited by the BCB as rationale for inflation above 8% year-over-year. If these are indeed the largest contributors to inflation that is well above the central bank’s target, rate hikes may not have a significant impact in containing and changing the trajectory of inflation. Higher policy rates will do little to disrupt the path of commodity prices or solve higher prices stemming from a nationwide drought. Unless the BCB is willing to push the Brazilian economy into recession to bring down inflation, which does not seem likely, inflation in Brazil may stay elevated for at least the next few months.

International Outlook

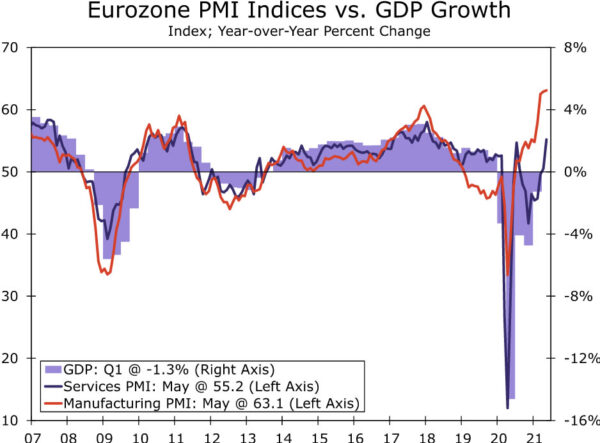

Eurozone PMIs • Wednesday

The Eurozone economy has shown improvement over the past few months as vaccinations have increased and restrictions have been gradually lifted. Just this week, the E.U. reopened travel to U.S. tourists and a host of other countries in an effort to support European economies dependent on tourism, as COVID cases continue to fall. Next week, we will get additional evidence for how the Eurozone economy is evolving when the manufacturing and services PMIs are released for June. As far as consensus forecasts, the manufacturing PMI is expected to fall modestly, but remain in expansion territory. The services PMI, however, is expected to jump to 58.0.

In our view, a rise in the services PMI makes sense as restrictions continue to get lifted off the major Eurozone economies. Consumers are likely to deploy excess savings toward services industries, such as restaurants, bars and movie theaters. Going forward, we expect the services industry to be the primary driver of the Eurozone economy and will be tracking how activity in the services sector evolves over the remainder of the year.

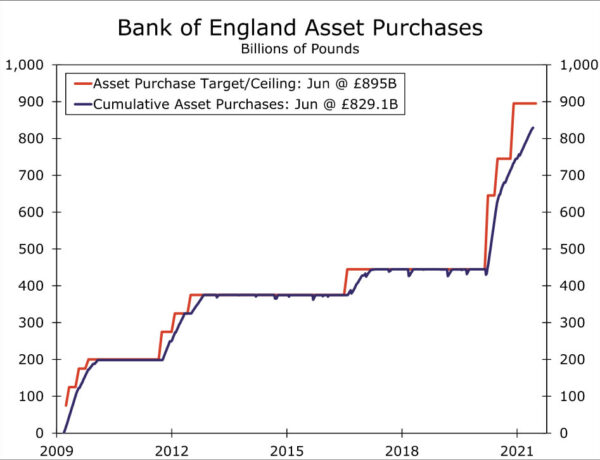

Bank of England • Thursday

Over the past few months, the Bank of England (BoE) has slowed asset purchases and hinted at additional tapering going forward. The pace of the U.K. recovery has been impressive as monthly GDP data have reflected a sharp recovery in economic activity following the gradual lifting of restrictions. This week, the U.K. economy demonstrated just how strong the recovery is as CPI inflation topped 2% for the first time in since 2019. However, COVID cases have risen as the delta variant has spread across the country at a rapid pace. In response, Boris Johnson delayed the full reopening of the economy by one month.

At the BoE’s meeting next week, we expect policymakers to provide an update on how the economy is evolving and if the renewed spread of COVID is disrupting economic activity. In addition, we expect BoE officials to provide an updated view on inflation and whether price growth is transitory or more engrained. But given the pace of the recovery, we do believe the BoE will signal a further slowdown in asset purchases is likely over the next few months. In our view, the next taper will likely occur toward the end of the summer at the BoE meeting in August.

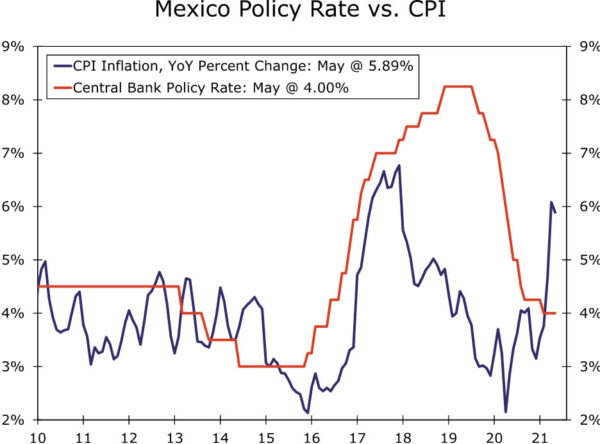

Central Bank of Mexico • Thursday

Inflation in Mexico has been on the rise for most of this year and currently sits at 5.89% year-over-year, well above the upper bound of the central bank’s inflation target. Higher commodity prices and the gradual reopening of the Mexican economy are the primary causes of elevated inflation; however, recently the central bank has commented that price growth may not be as transitory as initially expected. In our view, above-target inflation, which may not be as temporary as the central bank forecast, is likely to result in a monetary policy response in the near future. While a rate hike probably will not occur next week, we do think tighter policy will come to fruition by the end of this year.

We forecast a 25-bp rate hike around the end of this year, which would take Mexico’s policy rate to 4.25% and be the central bank’s first rate hike since 2018. In an effort not to disrupt local financial markets or the local economic recovery, it is possible the central bank will look to signal to financial markets that a rate hike is imminent.

Interest Rate Watch

The “Dot Plot” Shifts Up

The Federal Open Market Committee (FOMC) met on June 15-16, and as widely expected, it made no substantive policy changes. By unanimous vote, the committee decided to maintain its target range for the fed funds rate between 0.00% and 0.25% and to keep its monthly purchase rate of Treasury securities and mortgage-backed securities (MBS) unchanged at $80 billion and $40 billion, respectively.

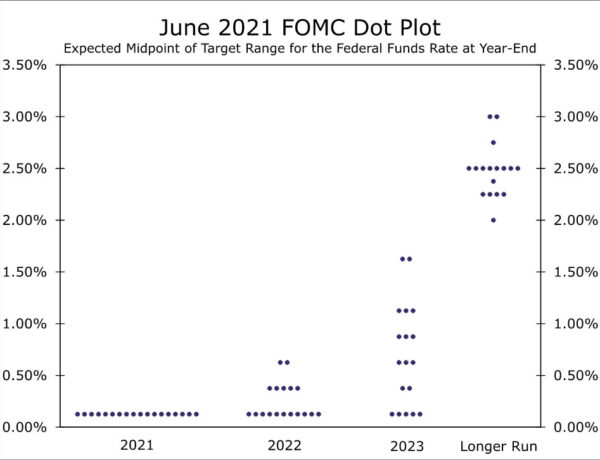

But the meeting was consequential because of the signaling that the committee provided through its “dot plot.” Specifically, seven of the 18 members of the FOMC now expect the fed funds rate to be higher at the end of next year (see chart below), which is up from four members at the March FOMC meeting. A sizable majority (13 members) look for rates to be higher at the end of 2023, up sharply from only seven members in March. Moreover, the “median” committee member thinks that the fed funds rate will be 50 bps higher at the end of 2023. In short, some Fed officials have brought forward their expected timing of policy tightening.

The move was prompted by forecasts of higher inflation. The median forecast of PCE inflation this year was revised up a full percentage point to 3.4% from 2.4% in March (see chart below). Most committee members look for inflation to drop back to 2% or so in 2022 (i.e., they continue to believe that the inflationary pressures the economy is experiencing now will prove to be “transitory”), but a majority of FOMC members see the risks to the inflation forecast as skewed to the upside.

We still feel comfortable in our view that the FOMC will refrain from raising rates through the end of 2022, but rate hikes sometime in 2023 now look increasingly likely. Although the committee re-affirmed its current pace of asset purchases, “tapering” also looks increasingly likely. That is, the Federal Reserve will eventually begin to dial back the amount of assets that it purchases. In our view, Fed policymakers likely will signal in late summer or early autumn that tapering is nearing, and we look for the actual process of reducing asset purchases to begin early next year. The upshot is that long-term interest rates likely will grind higher as market participants start to price in a reduced pace, and an eventual termination, of bond buying by the Federal Reserve.

Topic of the Week

U.S. and E.U. End Aircraft Dispute to Form United Front Against China

The 17-year stalemate between the United States and the European Union over aircraft subsidies finally came to an end (at least for now) on Tuesday as both parties decided to suspend related tariffs for the next five years. A separate but similar ceasefire also occurred with an agreement between the U.S. and the U.K. on Thursday. The U.S.-E.U. dispute started in 2004 after it was discovered that Airbus was receiving illegal subsidies via government loans from several European nations, and continued after findings that Boeing had also received unfair treatment a U.S. state through tax breaks. In late 2019, the World Trade Organization (WTO) gave permission to the U.S. to impose tariffs on $7.5 billion E.U.-produced goods per year, and late last year the E.U. was permitted to retaliate by attaching annual duties on $4.0 billion of American-made goods. The tariffs were not only levied on imports of Boeing and Airbus aircraft specifically, but also included E.U. food, wine and luxury goods as well as a variety of American goods from tractors to video games.

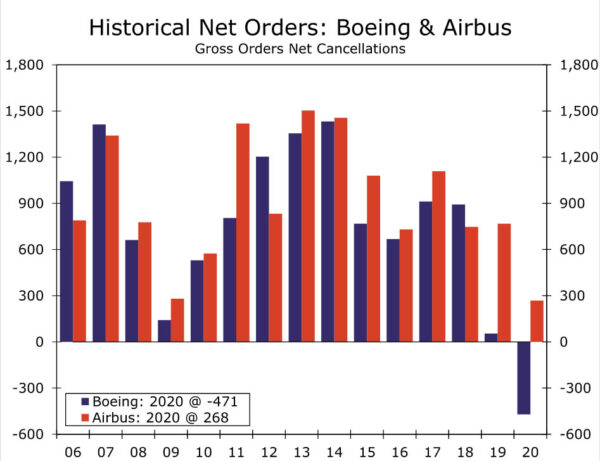

Although the U.S. and E.U previously suspended tariffs in March of this year in an effort to resolve the subsidy dispute, this more permanent resolution comes after a year of severe hardship for both aircraft companies. New orders, especially when accounting for cancellations, dropped in the wake of the pandemic as travel ceased and demand plummeted (see chart). 2020 marked the second year of disappointing sales for Boeing specifically after safety issues led to the grounding of the 737 MAX aircraft in 2019, which is now in the beginning stages of being redistributed after over two years of being grounded. In a bid to recoup revenues and not have to absorb or pass along tariffs to consumers, the agreement comes at a crucial time.

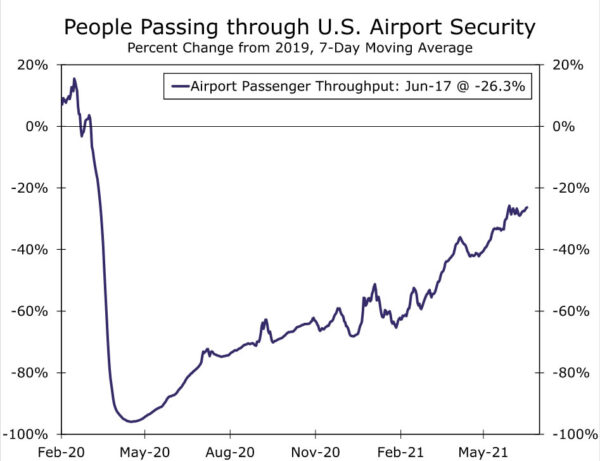

The ability to profit from the pent-up demand for travel also influences the agreement. Ending the tariffs allows both companies to again compete on an even playing field and benefit from the surge in demand in each other’s home markets. In the U.S., airport traffic has ramped up and is rapidly moving back toward its pre-pandemic level (see chart). While the E.U.’s stringent lockdown severely limited travel last year, the U.S. joined the “safe travel” list this week, suggesting restrictions are easing and demand should soon ramp up.

The longer-term concern that led to the reconciliation between the U.S. and the E.U. is the realization that increased competition from China lies ahead. Commercial Aircraft Corporation of China (Comac) has emerged as a major rival as further development of the C919 aircraft would position it to compete with Airbus’ A320neo and Boeing’s 737 MAX. To keep their market share and compete with “non-market economies” such as China, the deal also seeks to develop a working relationship to bilaterally settle disagreements and address future issues regarding China’s practices.

Ultimately, this development in trade relations demonstrates how we anticipate the Biden administration will approach trade policy. While we expect the U.S. to maintain a “hard-line” approach toward China, as President Biden has communicated the administration will likely seek a more coordinated multilateral approach against China with our allies, like the E.U.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals