Yen rises broadly today as risk aversion is dominating the overall financial markets. In particular, US 10-year yield dives through 1.4 handle in Asia, and we’d see if the weakness would persist. Though, selling focus is turning from Aussie and Kiwi to Canadian. Dollar is consolidating last week’s strong gains, but there is no sign of topping. The economic calendar is light today, but comments from Fed officials could still trigger much volatility.

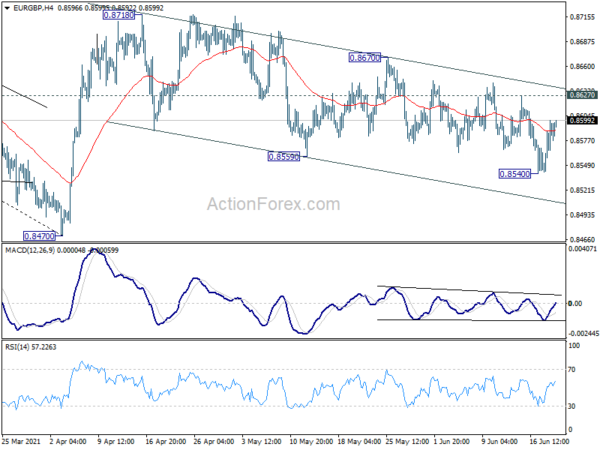

Technically, we’d pay attention to the actions in European crosses to gauge the comparative path of Euro, Sterling and Swiss Franc. EUR/GBP’s corrective-looking decline from 0.8718 extended last week but lacked follow through momentum. Indeed, break of 0.8672 resistance could suggest that EUR/GBP is ready to resume the rebound from 0.8470. EUR/CHF is also extending the rebound from 1.0863 and now sits side key resistance zone at 1.0925/1026. Firm break of this zone will indicate completion of whole choppy fall from 1.1149. The development would be interesting to watch in overwhelming moves in Dollar and Yen pairs.

In Asia, at the time of writing, Nikkei is down -3.72%. Hong Kong HSI is down -1.53%. China Shanghai SSE is down -0.18%. Singapore Strait Times is down -1.39%. Japan 10-year JGB yield is down -0.0106 at 0.050.

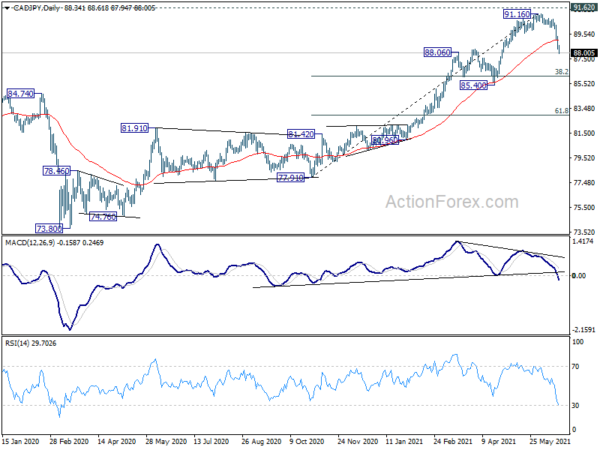

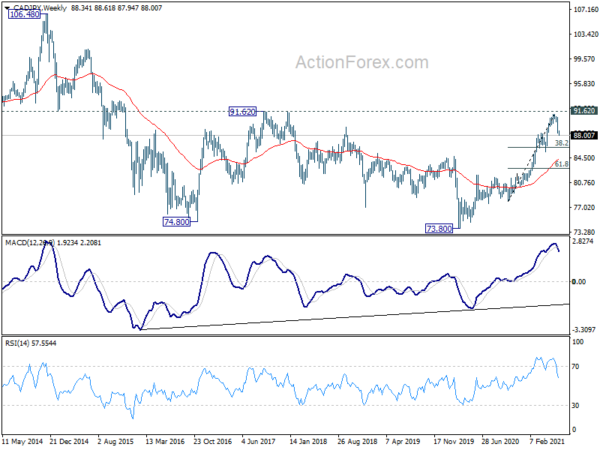

CAD/JPY in downward correction, to draw support from 85/86 zone

Yen crosses take another dive today as Asian markets are under broad based selling pressure, following the poor close in US last week. In particular, commodity currencies are clearly the weakest ones.

CAD/JPY’s sharp fall is in line with the developments in both AUD/JPY and NZD/JPY. At this point, we’re viewing the fall from 91.16 short term top as correcting the rise from 77.91 to 91.16 only. Hence, we’d expect strong support between 85.40 support and 38.2% retracement at 86.09 to contain downside and bring rebound.

However, it should also be noted that CAD/JPY was just rejected by 91.62 long term resistance (2017 high). Sustained break of 85.40 will argue that it’s at least correcting the whole up trend from 73.80. More importantly, that would raise the chance that the whole pattern from 74.80 has completed with three waves to 91.16. The implication would be rather bearish, even though the odds for such case is rather low for now.

Australia retail sales rose only 0.1% mom in May, dragged by Victoria lockdown

Australia retail sales rose 0.1% mom in May, well below expectation of 0.7% mom. Comparing to a year ago, sales rose 7.4% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “There were mixed results across the industries and states and territories, with COVID-19 restrictions in Victoria impacting the May result. Victoria fell 1.5 per cent as the state entered its fourth lockdown on May 28 with trade restricted for physical stores.”

ECB governing council held first in-person meeting a more than a year

ECB Governing Council held the first in-person meeting in more than a year over the weekend and carried out in-depth discussion about the strategy review. The topics addressed include “the definition and measurement of price stability, the underlying analytical framework, the medium-term orientation, the role of climate change in formulating monetary policy, and the modernisation of policy communication.”

“It was good to meet again in-person and the hilly Taunus countryside was ideal to reconnect after months of only digital meetings”, ECB President, Christine Lagarde, said. “I am glad we were able to have in-depth discussions and we made good progress in shaping the concrete features of our future monetary policy strategy at our retreat.”

BoE to stand pat, global PMIs watched

BoE monetary policy decision is a major focus this week, and it’s widely expected to keep policy unchanged. The central bank will likely wait until August to make any decision on tapering, with updated economic projections available. Though, the statement and minutes could still reveal more information on the board’s view on inflation and recovery. BoJ minutes and ECB monthly bulletin will be among other central bank activity.

On the data front, PMIs from Australia, Japan, Eurozone, UK and US will catch much attention, on sentiments, employment and prices. Also, Canada retail sales, Germany Ifo, US durable goods orders, jobless claims and PCE inflation will be watched closely too. Here are some highlights for the week:

- Monday: Australia retail sales; German buba monthly report; Canada new housing price index.

- Tuesday: UK public sector net borrowing; Eurozone consumer confidence; US existing home sales.

- Wednesday: Australia PMIs, trade balance; BoJ minutes, Japan PMI manufacturing; Eurozone PMIs; UK PMIs; Canada retail sales; US current account, PMIs, new home sales.

- Thursday: Japan corporate service price index; Germany Ifo business climate; ECB monthly bulletin; BoE rate decision; US Q1 GDP final, durable goods orders, trade balance, jobless claims.

- Friday: New Zealand trade balance; Japan Tokyo CPI core; UK Gfk consumer confidence; Eurozone M3 money supply; US persona income and spending.

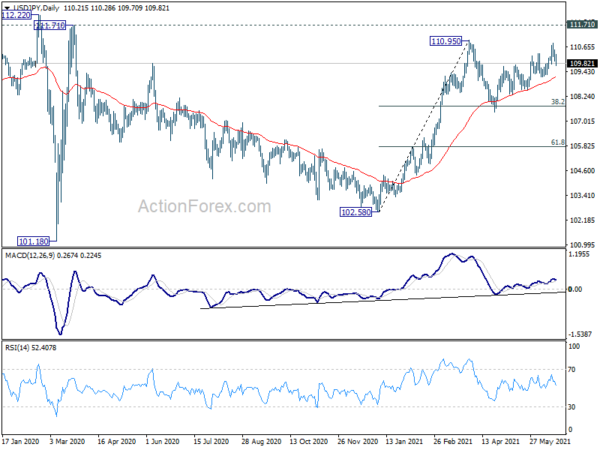

USD/JPY Daily Outlook

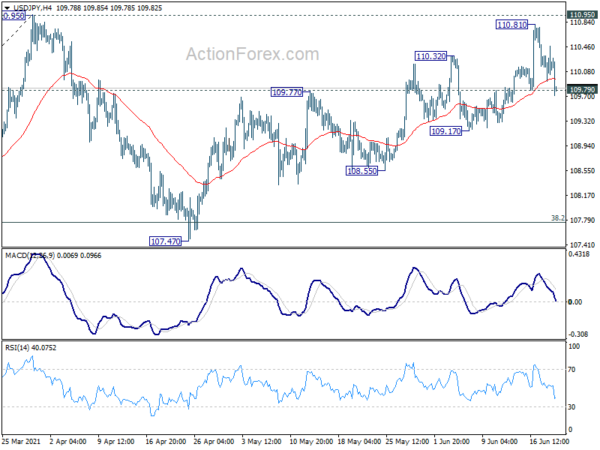

Daily Pivots: (S1) 109.95; (P) 110.21; (R1) 110.49; More…

USD/JPY’s break of 109.79 support suggests that rise from 107.47 has completed at 110.81, after rejection by 110.95 resistance. Consolidation pattern from 110.95 could have started the third leg already. Intraday bias is back on the downside for 109.17 support first. Break there will confirm and target 107.47 again. For now, risk will stay on the downside as long as 110.81 holds, in case of recovery.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. On the upside, decisive break of 111.71/112.22 resistance will suggest medium term bullish reversal. Rise from 101.18 could then target 118.65 resistance (Dec 2016) and above. However, sustained break of 107.47 support would revive some medium term bearishness, and open up deep fall to 61.8% retracement of 102.58 to 110.95 at 105.77 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Jun | 0.80% | 1.80% | ||

| 1:30 | AUD | Retail Sales M/M May P | 0.10% | 0.70% | 1.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals