We’re amidst another busy week for the Fed with 16 public appearances scheduled overall, with Powell, Mester and Daly hitting the wires overnight.

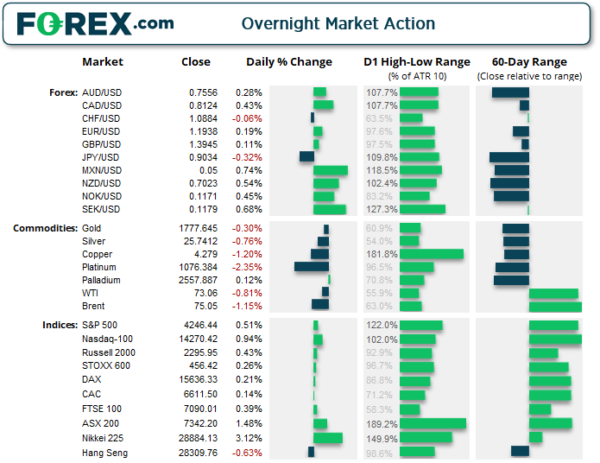

Asian Futures:

- Australia’s ASX 200 futures are down -15 points (-0.21%), the cash market is currently estimated to open at 7,327.20

- Japan’s Nikkei 225 futures are up 40 points (0.14%), the cash market is currently estimated to open at 28,924.13

- Hong Kong’s Hang Seng futures are up 131 points (0.46%), the cash market is currently estimated to open at 28,440.76

UK and Europe:

- UK’s FTSE 100 index rose 27.72 points (0.39%) to close at 7,090.01

- Europe’s Euro STOXX 50 index rose 10.8 points (0.26%) to close at 4,123.13

- Germany’s DAX index rose 33.09 points (0.21%) to close at 15,636.33

- France’s CAC 40 index rose 8.96 points (0.14%) to close at 6,611.50

Tuesday US Close:

- The Dow Jones Industrial rose 68.61 points (0.2%) to close at 33,945.58

- The S&P 500 index rose 21.65 points (0.52%) to close at 4,246.44

- The Nasdaq 100 index rose 133.186 points (0.94%) to close at 14,270.42

Equities higher as the Fed push strong economy with transient inflation narrative

San Francisco’s Federal Reserve President Mary Daly told reports she was “bullish on the recovery”, “substantial” progress had been made towards the Fed’s 2% inflation target and full employment goals. But, perhaps more importantly, she thinks the Fed may be in a position to begin tapering this year. This last point alone was enough to topple equities when James Bullard effectively read from the same script on Friday, yet Jerome Powell soothed any negative response from markets with his persistent view that inflation will be transitory, when he testified to congress separately.

Bond yields were lower across the curve the US 10-year yield falling -2.2 bps below 1.5% and the 2-year was down -2.6 bps to a two-day low of 0.23%. On the economy, Powell said labour demand is very strong and expects strong job creation in autumn. Lorretta Mester is also in the ‘transient’ camp and expects inflation to rise to around 3% to 3.5% this year before falling back to % in 2022, adding she expects employment to fall below 4% by next year.

The message of a ‘strong, but not too strong’ recovery was music to Wall Street’s ears, technology stocks took the lead with the Nasdaq 100 closing to a record high and the Nasdaq’s biotech index now up 5.6% month-to-date. The S&P 500 stopping just short of its own record high with eleven S&P 500 sectors closed in the green.

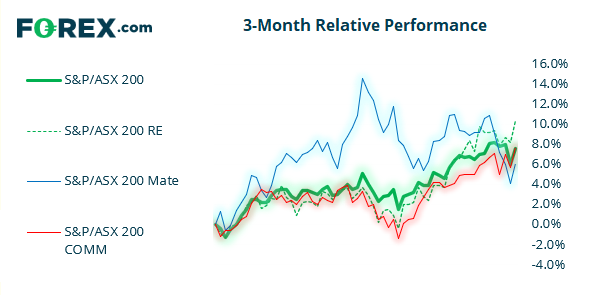

The ASX200 recouped most of Monday’s losses during its best session in three-months yesterday, to close with a large bullish inside day. Information technology sector is the best performer month-to-date, although with an RSI (2) reading of 99.52 it is at high risk of over-extension over the near-term. At the other end of the scale, the ASX Allords gold miners index is currently down -10.7% over the same period as they tracked gold prices lower.

ASX 200 Market Internals:

ASX 200: 7342.2 (1.48%), 21 June 2021

- Real Estate (1.98%) was the strongest sector and Healthcare (-0.63%) was the weakest

- 11 out of the 11 sectors closed higher

- 6 out of the 11 sectors outperformed the index

- 162 (81.00%) stocks advanced, 30 (15.00%) stocks declined

- 14 hit a new 52-week high, 1 hit a new 52-week low

- 74% of stocks closed above their 200-day average

- 68.5% of stocks closed above their 50-day average

- 67.5% of stocks closed above their 20-day average

Outperformers:

- + 7.41% – Pilbara Minerals Ltd (PLS.AX)

- + 6.96% – Chalice Mining Ltd (CHN.AX)

- + 6.75% – Redbubble Ltd (RBL.AX)

Underperformers:

- -2.16% – Nufarm Ltd (NUF.AX)

- -1.98% – Westgold Resources Ltd (WGX.AX)

- -1.79% – Appen Ltd (APX.AX)

Commodities: OPEC discuss raising oil production

Brent rose briefly above $75 for the first time in two years yet reversed earlier gains as OPEC+ discussed raising oil production. A small bearish pinbar formed on the daily chart and closed back below 74.95, although early trade in Asia has seen it return back above that level with net resistance of 78.58 in sight. WTI futures closed just beneath 73.15 after a brief spell above it and formed a small indecision candle.

Gold’s rally lost momentum and closed -0.24% lower. Its direction over the near-term is now a little unclear and the reward to risk ratio appear inadequate on the daily chart for bears. However, key levels for to monitor from here are 1756, 1760 and 1770.64 as support and 1790 and 1800 a resistance.

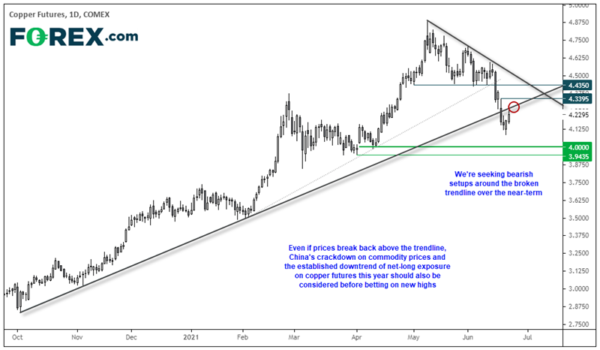

Copper probes broken trendline

Copper prices have broken two key levels of support over the past two weeks; the 4.435 level and the October trendline. We outlined a bearish case before these key levels broke based on a significant reduction of net-long exposure this year (see 1:30 in the video), and we’re not entirely convinced the -16% decline from its peak is enough considering China are continuing to curb commodity prices. So, over the near-term we are monitoring copper’s potential to form a bearish reversal at the broken trendline and make its way to the 3.943 – 4.00 lows.

That said, some noise can be allowed around a trendline break (spikes either side of it) although a clean retest and drop is always preferred. And given the established decline in net-long exposure, we’d still seek potential shorts further out below 4.435 if prices were to break back above the trendline.

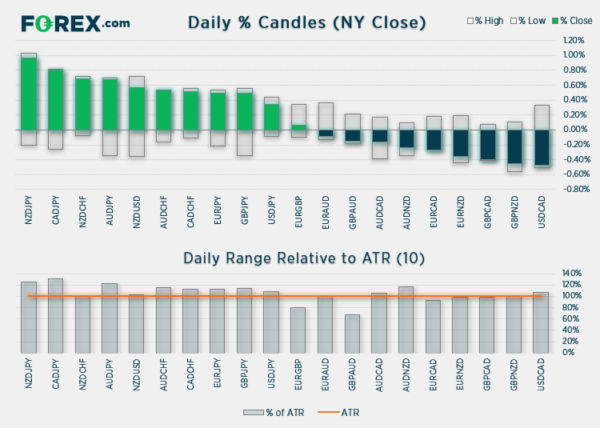

Forex: Commodity FX lead in classic risk-on session

Commodity currencies NZD, CAD and AUD were the strongest majors yesterday during a risk-on rebound. With yen being the weakest currency this naturally placed NZD/JPY and CAD/JPY at the top of the leader board. The Canadian dollar was higher on risk sentient, despite oil prices remaining flat following talk of OPEC raising oil production.

The US dollar index (DXY) fell to a three-day low, although volatility wasn’t overly bearish. Next support sits at 91.43 to if volatility remains low towards this level then it may be one for ‘dip buyers’ to consider. For now, we remain neutral on this index.

USD/JPY rallied to a three-day high in line with our bias outlined in yesterday’s Asian open report and shows the potential to break higher from here.

GBP/JPY hit our upper target of 154.51 overnight and continues to remain strong structurally, so we’ll revise the analysis for your European open report later today.

EUR/NZD has been removed from the watchlist despite holding above 1.6974 support, given its two bearish candles came close to probing that low. We would prefer to see volatility subside above or around its 200-day eMA before reconsidering longs.

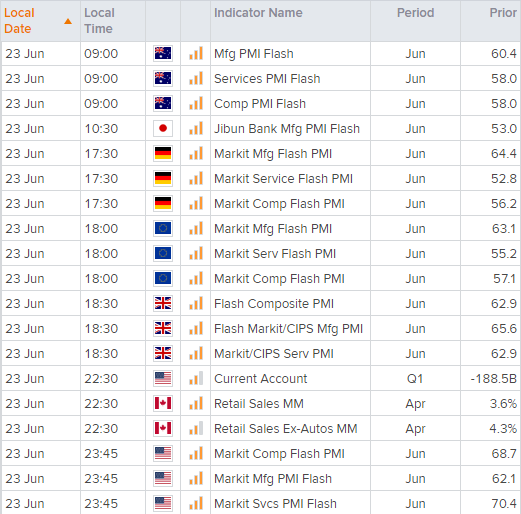

Up Next (Times in AEST)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals