‘Shocking’ inflation numbers will fall back to earth and hurt reopening trades, economist David Rosenberg predicts

Economist David Rosenberg believes the bond market is getting inflation right and yields shouldn’t trade at higher levels. His reasoning: Inflation is a temporary phenomenon caused by enormous pent-up demand and supply chain issues connected to the coronavirus pandemic. “The...

Auto insurance rates rise, but insurers could still qet squeezed by higher costs ahead

An employee at a used auto dealership treads water as he checks on vehicles they are moving out of the rising waters from two days of heavy rain in Lexington, Miss., Thursday, June 10, 2021. Rogelio V. Solis | AP...

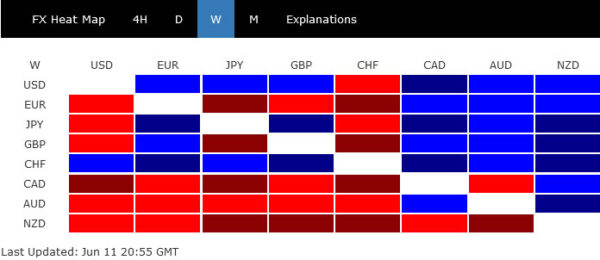

Swiss Franc, Dollar, and Yen Jumped on Falling Global Benchmark Yields

The intra-week rebound in global benchmark treasury yields was rather short-lived. Yields in Germany, US and Japan then turned south after ECB’s decision on PEPP purchases. That came even though CPI jumped to 13-year high. It remains to be seen...

Tax refunds and stimulus checks delayed by identity fraud crossfire

Samuel Corum/Bloomberg via Getty Images Jeff Lavigne plans to use a tax refund this year for long-delayed medical help. Yet his refund, almost $2,700, has been in limbo since mid-March, when Lavigne filed his tax return, records show. The IRS...

Weekly Economic & Financial Commentary: Growth Comes with a Price

Summary United States: Growth Comes with a Price Whether it is businesses struggling to get their hands on the physical inputs needed to complete production or the labor to facilitate operations, supply continues to have difficulty meeting the robust pace...

The Weekly Bottom Line: Higher Inflation On The Horizon

U.S. Highlights Consumer price inflation accelerated to 5.0% year-on-year (y/y) in May, once again coming in ahead of expectations. Soaring prices for used cars and trucks (up 30% y/y) were a major factor in higher inflation in the month. Job...

Week Ahead: Is it Time for the Fed to Start Talking about Tapering?

After the BOC and the ECB provided markets with little new information regarding their bond buying programs at their respective interest rate decision meetings last week, the FOMC gets its turn this week. With higher inflation and weaker than expected...

FOMC Meeting Preview: Will the Fed Fret about Inflation?

Traders often discuss central bank “decisions” as a major event risk, but when it comes to Wednesday’s Federal Reserve meeting, there’s really no immediate decision to be made. The FOMC will almost certainly leave interest rates unchanged in the 0.00%-0.25%...

UK and Australian Jobs Reports Could Spur GBP/AUD

On June 4th, both the US and Canada released their May jobs figures. The US added 559,000 jobs to the economy vs an expectation of 650,000 and Canada lost 68,000 vs an estimate of -20,000. Both weaker than expected. This...

Stocks making the biggest moves midday: Chewy, Biogen, Snowflake and more

Signage is seen ahead of the IPO for Chewy at the New York Stock Exchange, June 14, 2019. Andrew Kelly | Reuters Check out the companies making headlines in midday trading. Snowflake – Shares of the cloud computing company dropped...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals