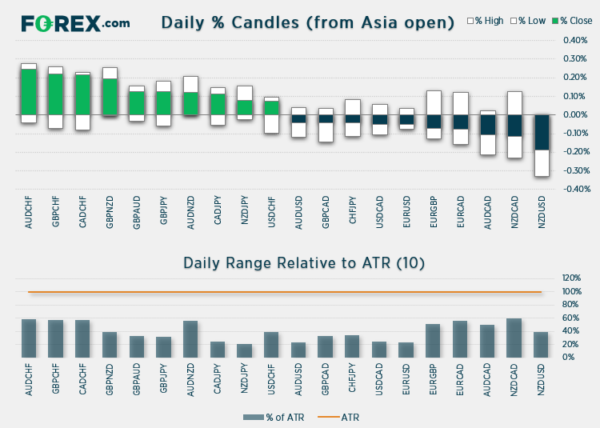

Volatility is its usual low-self ahead of today’s NFP report, which hinges around whether USD can extend its bullish moves upon an NFP beat or give back gains upon a miss.

Asian Indices:

- Australia’s ASX 200 index rose by 29.9 points (0.41%) and currently trades at 7,295.50

- Japan’s Nikkei 225 index has fallen by -294.51 points (-1.02%) and currently trades at 28,751.34

- Hong Kong’s Hang Seng index has fallen by -462.59 points (-1.6%) and currently trades at 28,365.36

UK and Europe:

- UK’s FTSE 100 futures are currently up 25.5 points (0.36%), the cash market is currently estimated to open at 7,150.66

- Euro STOXX 50 futures are currently up 14 points (0.34%), the cash market is currently estimated to open at 4,092.89

- Germany’s DAX futures are currently up 36 points (0.23%), the cash market is currently estimated to open at 15,639.81

US Futures:

- DJI futures are currently up 131.02 points (0.38%)

- S&P 500 futures are currently down -21.75 points (-0.15%)

- Nasdaq 100 futures are currently up 2.5 points (0.06%)

Indices: FTSE rallies back above its 50-day eMA (yet again)

China’s CSI 300 was the weakest major benchmark overnight, falling -2.4% the day after the CCP celebrated its centenary – all sectors are currently in the red. At the other end of the scale, Japanese equities rose to snap a four-day losing streak as a weaker yen lifted automaker and manufacturing stocks. Elsewhere, volatility remain capped and equity performance was mixed. US futures markets have opened relatively flat and European futures are a touch higher.

Once again, the 50-day eMA comes to the rescue for FTSE 100 bulls. Wednesday produce the fifth consecutive false intraday break below the 50-day eMA, only to see prices rally the next day (six if we include the Feb 26th which closed beneath it yet rallied the following day regardless). Closing to a 5-day high and rebounding above 7,000 and the 50-day eMA, the FTSE goes into this session on the front foot with support around 7090/95 (10-20 day eMA’s and yesterday’s POC). As things stand, the index is on track for a bullish pinbar week and a break above 7140 will only make it appear the more bullish for next week. A break below 7070 would quickly change our near-term bullish view over.

FTSE 350: Market Internals

Asian Indices:

- Australia’s ASX 200 index rose by 29.9 points (0.41%) and currently trades at 7,295.50

- Japan’s Nikkei 225 index has fallen by -294.51 points (-1.02%) and currently trades at 28,751.34

- Hong Kong’s Hang Seng index has fallen by -462.59 points (-1.6%) and currently trades at 28,365.36

UK and Europe:

- UK’s FTSE 100 futures are currently up 25.5 points (0.36%), the cash market is currently estimated to open at 7,150.66

- Euro STOXX 50 futures are currently up 14 points (0.34%), the cash market is currently estimated to open at 4,092.89

- Germany’s DAX futures are currently up 36 points (0.23%), the cash market is currently estimated to open at 15,639.81

US Futures:

- DJI futures are currently up 131.02 points (0.38%)

- S&P 500 futures are currently down -21.75 points (-0.15%)

- Nasdaq 100 futures are currently up 2.5 points (0.06%)

Indices: FTSE rallies back above its 50-day eMA (yet again)

China’s CSI 300 was the weakest major benchmark overnight, falling -2.4% the day after the CCP celebrated its centenary – all sectors are currently in the red. At the other end of the scale, Japanese equities rose to snap a four-day losing streak as a weaker yen lifted automaker and manufacturing stocks. Elsewhere, volatility remain capped and equity performance was mixed. US futures markets have opened relatively flat and European futures are a touch higher.

Once again, the 50-day eMA comes to the rescue for FTSE 100 bulls. Wednesday produce the fifth consecutive false intraday break below the 50-day eMA, only to see prices rally the next day (six if we include the Feb 26th which closed beneath it yet rallied the following day regardless). Closing to a 5-day high and rebounding above 7,000 and the 50-day eMA, the FTSE goes into this session on the front foot with support around 7090/95 (10-20 day eMA’s and yesterday’s POC). As things stand, the index is on track for a bullish pinbar week and a break above 7140 will only make it appear the more bullish for next week. A break below 7070 would quickly change our near-term bullish view over.

FTSE 350: Market Internals

With the trading community embroiled over Nonfarm payroll, we feel inclined to look at something relatively uncorrelated to it. Thankfully, an interesting setup appears to be forming on EUR/GBP. Price action has been trading in a corrective fashion since the April high, and the prior move into that high was a strong, bullish move. Yesterday’s bullish outside candle probed trendline resistance and tested the 50-day eMA and suggest a higher low has formed (and that the corrective low from the April high has been seen at 0.8530). Ultimately, we think EUR/GBP is trying to break high, so our bias remains bullish above yesterday’s low (0.8564) and a break above yesterday’s high (0.8615) assume bullish continuation. It would be a bonus if any low volatility retracements hold above the pivotal level of 0.8590.

Commodities:

Gold is on track for a bullish hammer this week. We’d need to see a break above 1800 before getting too bullish but, over the near-term, we see potential for further upside over the near-term. A break above 1783 brings 17900 and 1794 into focus (the latter being a swing high and weekly R1 pivot).

Copper futures produced a bearish engulfing candle yesterday. The daily chart has shows three tests of 4.340 resistance and prices remains beneath the 20 and 50-day eMA (which produced a bearish cross six days ago). Given the trend lower in net-log exposure then it is still a possibility to see another leg lower. Obviously, the US dollar plays a key part in all of this, so if ere to see a disappointing print (lower dollar) then resistance may well come under attack again.

Brent futures are holding above the April 2019 high (75.58) after yesterday’s OPEC+ meeting which suggests support resides around 75.35. It’s not impossible to see a disappointing NFP and that could weaken the dollar and support oil prices, and oil long would be preferred given the established uptrend.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals