Dollar and Yen remain generally soft in quiet Asian session today. Nikkei staged a strong 2.2% rebound but there is little reaction in the currency markets. Major pairs and crosses are generally stuck inside Friday’s range. Trading could remain subdued today with an ultra light economic calendar, without any significant release ahead. Yet volatility is certain with three central banks featured this week, with lots of data to be featured.

Technically, main focus will be on whether movements in Dollar and Yen would confirm near term bearish reversal. Levels to watch include 1.1894 resistance in EUR/USD, 0.9151 support in USD/CHF, 131.02 resistance in EUR/JPY and 153.14 resistance in GBP/JPY. Break of these levels will likely have some spillover effects to pressure Dollar and Yen elsewhere.

In Asia, Nikkei closed up 2.25%. Hong Kong HSI is up 0.54%. China Shanghai SSE is up 0.62%. Singapore Strait Times is up 0.21%. Japan 10-year JGB yield is up 0.0006 at 0.031.

ECB Lagarde expects some interesting variations and changes in Jul meeting

ECB President Christine Lagarde told Bloomberg that there will at “some interesting variations and changes” in the upcoming July 22 meeting. “It’s going to be an important meeting,” she added. “Given the persistence that we need to demonstrate to deliver on our commitment, forward guidance will certainly be revisited.”

The immediate task for the Governing Council to align the statement and forward guidance with the result of the strategic review. “We’re going to look at the circumstances, we’re going to look at what forward guidance we need to revisit, we’re going to look at the calibration of all the tools we are using to make sure that it is aligned with our new strategy,” she said.

Regarding the PEPP program, she expected it to continue until “at least” March 2022, then followed by a “transition into a new format”, without elaboration. She emphasized, “we need to be very flexible and not start creating the anticipation that the exit is in the next few weeks, months.”

ECB Villeroy: There is no point in putting predetermined threshold or duration on inflation overshoot

ECB Governing Council member Francois Villeroy de Galhau said the new 2% symmetric inflation target is a “significant change”. But, “there is no point putting in rules with such-and-such predetermined threshold or duration” on inflation overshoot.

“In the hypothesis that we stop net purchases under the pandemic emergency purchases program next March, our monetary policy will remain very accommodative for as long as necessary, thanks to our quartet of unconventional tools. There is no doubt about that,” Villeroy added.

Yannis Stournaras said that the new strategy will leave ECB better prepared for further crisis. Ignazio Visco noted ECB is not adopting average inflation target like that Fed, which suggests a period of catch-up in inflation.

RBNZ, BoC and BoJ to meet, and lots of data to watch

Three central banks will meet this week, including RBNZ, BoC and BoJ. RBNZ will particular be a focus as market speculations on a November rate hike heated up last week. The question is whether RBNZ would try to talk down such expectations. BoC is expected to further taper bond purchases, from CAD 3B to CAD 2B a week. More importantly, the updated economic projections could reveal whether it’s still expecting a rate hike for the second half of 2022, or earlier. BoJ might downgrade the outlook in the new economic projections. But other than that, it’s likely to tell us anything new. Meanwhile, Fed will also release Beige Book economic report.

The calendar is also busy on the economic data front. US CPI and PPI, regional Fed surveys and retail sales would catch most attention. Also, UK will release CPI and PPI, and employment. Australia will release NAB business confidence and employment. China will release GDP, trade balance and a string of other data. Here are some highlights for the week:

- Monday: Japan machine orders, PPI.

- Tuesday: Australia NAB business confidence; China trade balance; Germany CPI final; Swiss PPI; US CPI.

- Wednesday: RBNZ rate decision; UK CPI, PPI; Eurozone industrial production; Canada Manufacturing sales, BoC rate decision; US PPI, Fed’s Beige Book report.

- Thursday: Australia employment; China GDP, fixed asset investment, industrial production, retail sales; Japan tertiary industry index; UK employment; US Empire state manufacturing, Philly Fed survey, jobless claims, import prices, industrial production.

- Friday: New Zealand BusinessNZ manufacturing, CPI; BoJ rate decision; Eurozone trade balance, CPI final; Canada housing starts, foreign securities purchases, wholesale sales; US retail sales, business inventories, U of Michigan consumer sentiment.

GBP/JPY Daily Outlook

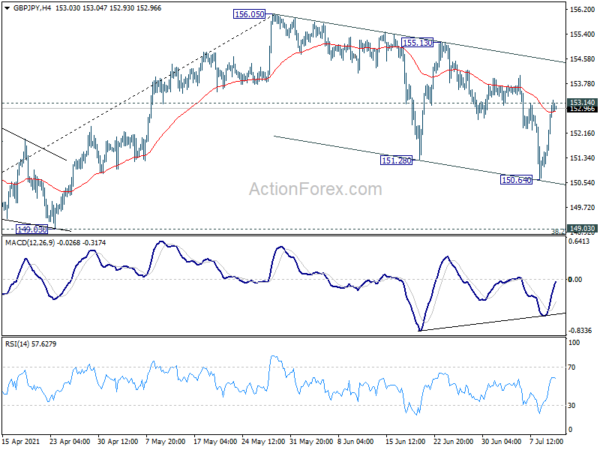

Daily Pivots: (S1) 151.79; (P) 152.43; (R1) 153.69; More…

Intraday bias in GBP/JPY remains neutral first with focus on 153.14 minor resistance. Firm break there will argue that corrective fall from 156.05 has completed with three waves down to 150.64, on bullish convergence condition in 4 hour MACD. Intraday bias will be turned back to the upside for 155.13/156.05 resistance zone. On the downside, break of 150.64 will resume the correction. But downside should be contained by 38.2% retracement of 136.96 to 156.05 at 148.75 to bring rebound.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Focus remains on 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, break of 149.03 support is needed to be the first sign of completion of the rise from 123.94. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | 5.00% | 4.70% | 4.90% | |

| 23:50 | JPY | Machinery Orders M/M May | 7.80% | 2.60% | 0.60% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jun | 96.60% | 140.70% | 141.90% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals